With a relatively quiet forex calendar coming up, EUR/NZD has a few different price action setups that may draw in technical traders in what may be relatively quiet sessions ahead.

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at an opportunity forming on EUR/USD ahead of U.S. employment updates, so be sure to check that out to see if there is still a potential play!

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 14012.82 +1.64% FTSE: 6588.53 +1.62% S&P 500: 3901.82 +2.38% NASDAQ: 13588.83 +3.01% |

US 10-YR: 1.419% -0.037 Bund 10-YR: -0.333% +0.003 UK 10-YR: 0.748% -0.011 JPN 10-YR: 0.151% -0.016 |

Oil: 60.28 -1.98% Gold: 1,722.90 -0.34% Bitcoin: 48,837.25 +5.55% Ethereum: 1,544.08 +7.03% |

Fresh Market Headlines & Economic Data:

U.S. private payrolls growth well short of expectations for February, ADP says

U.S. mortgage rates jump by most in nearly a year: MBA

Steepest expansion in U.S. business activity since July 2014, but costs rise at record rate

Fed’s Evans, ‘optimistic’ on recovery, sees no need to adjust QE

Strong Eurozone manufacturing growth fails to offset services contraction

German service sector activity fell in February

Sharpest contraction in French services activity for three months

U.K. Service sector output and employment fall at much slower pace in February

Upcoming Potential Catalysts on the Economic Calendar

Fed Kaplan speech at 11:05 pm GMT

Australia Trade Balance, Retail Sales at 12:30 am (Mar. 4)

Japan Consumer confidence at 5:00 am (Mar. 4)

Euro Area Construction PMI at 8:30 am (Mar. 4)

U.K. Construction PMI at 9:00 am (Mar. 4)

Euro Area Retail Sales, Unemployment Rate at 10:00 am (Mar. 4)

What to Watch: EUR/NZD

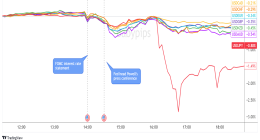

EUR/NZD is currently in choppy mode after its recent rally from swing lows 1.6350. The range has formed around a broken support level and a Fibonacci retracement area of the recent swing move to the downside.

With low tier events on the calendar, odds are that the choppiness may continue, but if we see big surprises with the round of upcoming economic updates from Europe, price action could jump in the short-term.

For the bears out there on EUR/NZD, watch out for weaker-than-expected Euro area updates and/or a broad shift in risk sentiment towards negative. That may get market out of its sideways funk and bring in higher-term traders to get back into the longer-term trend lower.

For the bulls out there, positive surprises from the Euro area or a continuation of today’s risk-off sentiment may get traders buying up the euro against the Kiwi. We’ve also got the 100 SMA moving above the 200 SMA that may draw in systematic traders to take the long side.