Sterling volatility picks up on Brexit developments, making GBP/JPY one to watch for potential intraday and short-term moves.

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 13256.48 -0.32% FTSE: 6562.96 +0.19% S&P 500: 3695.98 -0.08% NASDAQ: 12521.17 +0.46% |

US 10-YR: 0.934% -0.035 Bund 10-YR: -0.583% -0.042 UK 10-YR: 0.289% -0.001 JPN 10-YR: +0.029% -0.001 |

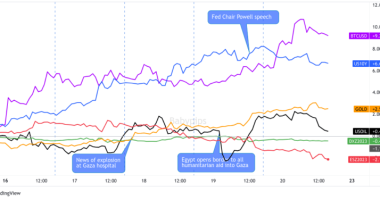

Oil: 45.67 -1.28% Gold: 1,864.8 +1.34% Bitcoin: 19,225.25 -0.71% Ethereum: 594.48 -0.87% |

Fresh Market Headlines & Economic Data:

Dow and S&P 500 slip from record highs to start the week amid jumping coronavirus cases

Oil falls on surging virus cases and U.S.-China tensions

Canada Ivey PMI dips to 52.7 in November from 54.5 in October

Sentix investor confidence index improves to -2.7 in December vs. -10.0 in November

Michel Barnier offers downbeat take on Brexit talks to diplomats and MEPs

Michel Barnier says Brexit talks will not go beyond Wednesday

German Industrial Production Rose for Sixth Month in October

U.K. Says Talks Could Collapse in Next Few Hours

UK house prices show biggest annual rise since 2016 – Halifax

Australia ANZ job ads climb as Victoria state reopens

China suspends beef imports from sixth Australian beef supplier

BOJ becomes biggest Japan stock owner with ¥45.1 trillion hoard

China Foreign Reserves at Highest Since 2016 as Trade Booms

Upcoming Potential Catalysts on the Economic Calendar

U.S. Consumer Credit Change at 8:00 pm GMT

Japan Tankan Index at 11:00 pm GMT

Japan Household spending, Average Case Earnings at 11:30 pm GMT

Japan GDP, Current Account at 11:50 pm GMT

Australia Business Confidence, House Price Index, Building Permits at 12:30 am GMT (Dec. 8)

Japan Eco Watchers Survey at 5:00 am GMT (Dec. 8)

What to Watch: GBP/JPY

Sterling dropped on the session as the failure for a Brexit deal this past weekend and today’s headlines are raising the odds of a no-deal Brexit. This is not likely to end today, which means more volatility could be ahead for the British pound for the rest of the week.

And the Japanese yen is finding a bid on the session as traders move towards safe havens as rising coronavirus cases finally spark fear into trader’s minds. And the volatility for the yen may not stop here as we will see economic updates from Japan in the upcoming Asia trading session.

In terms of price action, Forex Gump pointed out a rising wedge pattern at the start of the week, which was broken during today’s London trading session. This break may attract more bears, especially if Brexit headlines continue to disappoint the bulls. But the pair seems to have found support at at minor support area around the previous swing low (around 138.50).

If you’re bearish on the pair, watch out for a break there before considering a short position, or if you are more conservative, look out for a bounce up to the minor broken-support area around 139.00. A retest there and bearish reversal patterns is a higher probability trade if the fundamentals continue to support a bearish outlook on Sterling and risk sentiment.

If you think a Brexit deal is right around the corner, then today’s support around 138.50 may be a could starting point in building a position for a medium to longer-term trade. With a daily ATR of around 120 pips, considering scaling into a long position down to the next major handle (138.00), or be patient as see if the pair does move lower before considering building a longer-term long position.