Not a lot of top-tier reports scheduled today but a weekly jobless claims report from the U.S. just might confirm a short-term reversal for USD/CAD.

Is USD/CAD ready for a downtrend?

Before moving on, ICYMI, yesterday’s watchlist looked at CAD/JPY’s flag formation ahead of the BOC’s decision. Be sure to check out if it’s still a valid play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Pfizer, BioNTech vaccine neutralises Omicron with three shots

BOC kept policies unchanged, hinted of rate hikes as soon as April 2022

Supply and demand imbalance in US jobs market hits record, JOLTS survey shows

EIA crude inventory data shows 241K barrel decrease last week

US House passes bill blocking imports of products produced by forced labor in China’s Xinjiang region

New Zealand manufacturing sales fall in third quarter

Big Japan firms’ sentiment up for 2nd qtr in row amid low virus cases

China’s sky-high factory inflation slows in Nov amid price crackdown

RBA governor Philip Lowe signals central bank is open to retail digital currencies

German exports up in Oct, beating forecasts and surpassing pre-pandemic levels

SECO trims Swiss 2022 growth forecast, raises inflation outlook

U.S. initial jobless claims at 1:30 pm GMT

BusinessNZ manufacturing index at 9:30 pm GMT (Dec 10)

Japan’s producer prices at 11:50 pm GMT (Dec 10)

U.K.’s manufacturing and industrial production at 7:00 am GMT (Dec 10)

If you’re not familiar with the forex market’s main trading sessions, check out our Forex Market Hours tool.

What to Watch: USD/CAD

The economic calendar is light on data releases today so risk sentiment will likely take center stage again.

If you missed the memo, know that traders are happy that the Omicron COVID-19 variant may not derail global economic recovery as much as markets had feared. Oil prices are creeping higher, central banks like the Fed and BOC are on track to exit their monetary stimulus programs, and China remains proactive in addressing market concerns.

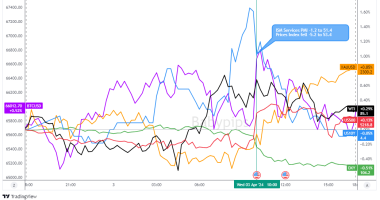

Increased oil prices and a risk-friendly environment has dragged USD/CAD to its 1.2600 lows but the pair has climbed 80 pips on a bit of profit-taking.

Will today’s market themes push USD/CAD back up to the 1.2750 zone? Odds are in favor of the Loonie heading back down to its weekly lows but ya never know when the dollar bulls strike, namsayin?

If the current upswing extends and then ends at 1.2750, then the broken trend line support will become resistance along with the 50% Fib retracement and the SMAs on the 1-hour time frame.

USD/CAD bears or reversal fans can target the 1.2600 lows or even new December lows.

If the dollar gains more ground despite the risk-friendly trading environment, however, then you should prepare for USD/CAD possibly extending its weeks-long uptrend. A return to the 1.2800 levels could lead to a trip to December’s highs.