The Reserve Bank of Australia (RBA) will kick off the list of central bank decisions this week!

Will the event propel AUD/JPY higher in the next trading sessions?

Before moving on, ICYMI, I’ve listed the potential economic catalysts that you need to watch out for this week. Check them out before you place your first trades today!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

China’s manufacturing PMI slowed down from 50.3 to 50.1 in Jan

China’s services PMI weakened from 52.7 to 51.1 in Jan thanks to COVID restrictions

Caixin’s manufacturing PMI dipped to contraction territory and 23-month low at 49.1 (from 50.9) in Jan

Japan’s industrial production fell by 1.0% in Dec after record output increase in Nov

Japan’s retail sales up by another 1.4% from a year ago in Dec

Oil benchmarks hover near 7-year highs over OPEC+ policy prospects, geopolitical concerns

Asia stocks make tentative gains ahead of this week’s major central bank decisions

Eurozone’s flash GDP at 10:00 am GMT

U.S. Chicago PMI at 2:45 pm GMT

Australia’s AIG manufacturing index at 9:30 pm GMT

New Zealand’s trade balance at 9:45 pm GMT

Japan’s unemployment rate at 11:30 pm GMT

China’s markets out on Spring Festival holiday (Feb 1)

Australia’s retail sales at 12:30 am GMT (Feb 1)

RBA’s policy decision at 3:30 am GMT (Feb 1)

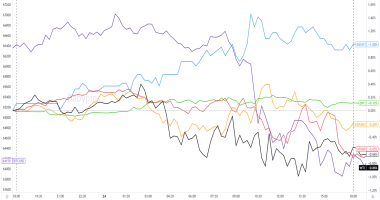

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! ? ?️

What to Watch: AUD/JPY

Aussie bulls and bears are in for a battle as the RBA publishes its monetary policy decision in the next trading sessions.

While not a lot of traders expect a rate hike or any policy change from the central bank, word around is that we’ll start to see hints that Governor Lowe and his team are readying for policy normalization.

And why not? Australia’s inflation is high, the labor market is getting tighter, and all the cool kids are doing it.

Expectations and the pricing in of a hawkish RBA could extend AUD/JPY’s upswing from its 80.45 lows all the way to the 82.00 psychological handle and the top of a descending channel.

But the RBA’s event may also turn out to be a dud. Or market players could extend last week’s concerns about high inflation, high interest rates, and low global growth.

In that case, AUD/JPY could find resistance at the mid-channel level near the 100 SMA and 50% Fibonacci retracement of the last downswing.