With the Fed statement now out of the way, it looks like traders are back to taking risk and selling the Greenback. And with the latest Australian employment data up ahead to shake up the Aussie, AUD/USD hits the top of our daily watchlist for potential short-term setups.

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at an opportunity forming on NZD/USD ahead of the FOMC statement, so be sure to check that out to see if there is still a potential play!

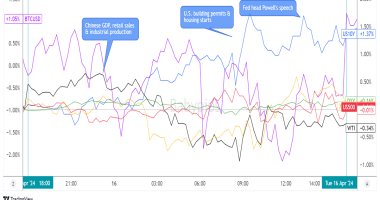

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 14596.61 +0.27% FTSE: 6762.67 -0.60% S&P 500: 3974.12 +0.29% NASDAQ: 13525.20 +0.40% |

US 10-YR: 1.646% +0.023 Bund 10-YR: -0.299% +0.038 UK 10-YR: 0.83% -0.001 JPN 10-YR: 0.09% -0.15 |

Oil: 64.55 -0.39% Gold: 1,744.50 +0.78% Bitcoin: 58,043.60 +3.02% Ethereum: 1,835.05 +2.93% |

Fresh Market Headlines & Economic Data:

Dow climbs 189 points to close above 33,000 for the first time as Fed sticks to easy policy

Fed sees stronger economy and higher inflation, but no rate hikes

Morgan Stanley becomes the first big U.S. bank to offer its wealthy clients access to bitcoin funds

Visa CEO Reveals Bitcoin and Cryptocurrency Plans

Annual inflation stable at 0.9% in the euro area; Up to 1.3% in the EU in February 2021

Canada’s annual inflation rate rose to 1.1%, from 1.0% in January

Canadian home prices gains accelerate in February

Upcoming Potential Catalysts on the Economic Calendar

New Zealand GDP at 9:45 pm GMT

Australia Employment Update, RBA Bulletin at 12:30 am GMT (Mar. 18)

Swiss Trade Balance at 7:00 am GMT (Mar. 18)

Swiss PPI at 7:30 am GMT (Mar. 18)

RBA Kent speech at 8:00 am GMT (Mar. 18)

Italy Trade Balance at 9:00 am GMT (Mar. 18)

Euro Area Trade Balance, Wage Growth at 10:00am GMT (Mar. 18)

What to Watch: AUD/USD

On the one hour chart above, we’re checking out the price action in AUD/USD, which as been snoozing in a range since the end of February. But volatility in the Dollar just popped nicely thanks to the latest monetary policy statement from the Federal Reserve, sending AUD/USD higher to retest a swing high around the 0.7800 handle.

The volatility may not stop there for AUD/USD as we’ll soon be getting the latest employment situation update from Australia in the upcoming session, and now with the Fed sending the Greenback for lower, that raises the probability of AUD/USD returning to the longer-term uptrend if Australia gives us better-than-expected numbers on jobs.

So, if that situation plays out where the net employment change comes above 30K and the unemployment rate comes in at 6.3% or lower, then the odds are pretty good that AUD/USD will break the 0.7800 handle and go higher. We’ll be looking to hop in from there or on a retest of 0.7800 after an upside break for a long position, likely short-term at first but open to a longer-term position if the market keeps the rally going.

Of course, if Australia jobs disappoints, that 0.7800 could be a short-term resistance area, but with USD likely to weaken short-term thanks to the Fed, a reversal back to the downside should only be looked at as a very short-term play for now.

In that scenario, if AUD/USD does drop all the way to the major support area around 0.7700 and we see bullish reversal patterns form there, a long play is a strong idea to consider if the market continues to play the idea we won’t see tightening action from the Fed for quite some time.