EUR/AUD is moving back into its longer-term downtrend, and with economic catalysts from both Australia and Europe ahead, we could see volatility and momentum pick up quickly for the pair.

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at an opportunity forming on USD/CAD ahead of Canadian GDP, so be sure to check that out to see if there is still a potential play!

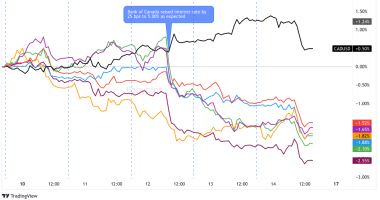

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 14012.82 +1.64% FTSE: 6588.53 +1.62% S&P 500: 3901.82 +2.38% NASDAQ: 13588.83 +3.01% |

US 10-YR: 1.419% -0.037 Bund 10-YR: -0.333% +0.003 UK 10-YR: 0.748% -0.011 JPN 10-YR: 0.151% -0.016 |

Oil: 60.28 -1.98% Gold: 1,722.90 -0.34% Bitcoin: 48,837.25 +5.55% Ethereum: 1,544.08 +7.03% |

Fresh Market Headlines & Economic Data:

Canada GDP Bests Expectations With 9.6% Climb in 4Q

German retail sales tumble in January as lockdown bites

The German unemployment rate rose by 0.4% points in January to 6.3%

IMF warns Europe’s firms need equity to save 15M jobs

ECB slows bond-buying despite strong warnings on yields

Upcoming Potential Catalysts on the Economic Calendar

Australia Services PMI at 10:00 pm GMT

Australia GDP, RBA Chart Pack at 12:30 am GMT (Mar. 3)

Japan Services PMI at 12:30 am GMT (Mar. 3)

Bank of Japan Kataoka speech at 1:30 am GMT (Mar. 3)

China Services PMI at 1:45 am GMT (Mar. 3)

Euro area Services PMI at 9:00 am GMT (Mar. 3)

U.K. Services PMI at 9:30 am GMT (Mar. 3)

Euro Area PPI at 10:00 am GMT (Mar. 3)

What to Watch: EUR/AUD

EUR/AUD traders have been on a roller coaster ride as of late, first rocketing higher last week as risk sentiment soured on rising bond yields, then slowly coming back to earth this week as the bond yield rally slowed a bit.

That pretty much brings the pair back into its longer-term downtrend, which could be enough price confirmation to draw in longer-term players back into the move lower.

But we do have potential catalysts ahead that could shake up the market’s bias, or drive the move lower even faster. The likely main driver will be the PMI updates from Europe, which does tend to be a mover for the euro in past releases.

Expectations are for contractionary conditions to continue (understandable given the slow progress in covid vaccinations), so if the data doesn’t improve, we could see a fresh move lower in the euro.

We also have updates from Australia to potentially get the Aussie moving, and if we see that data come in better-than-expected, Aussie dominance over the euro is likely to continue.

Levels to watch are the 1.5500 major psychological level and the 1.5370 level. Both were areas of strong interest in the past, and reversal patterns there could draw in momentum moves in the short-term.

If Australia data improves while euro data disappoints, the 1.5500 level is definitely one to watch for a potential short setup, especially if broad risk sentiment continues to ride the recovery narrative / potential further stimulus from the U.S. narrative.