Positive global risk sentiment and better-than-expected consumer inflation data from New Zealand were the likely drivers for the bullish move in the Kiwi this week.

New Zealand Headlines and Economic data

Monday:

Net move lower to start the week for NZD, and with no catalysts from New Zealand, it might have been influenced by broad risk sentiment. It’s arguable that the news of President Joe Biden planning to cancel the Keystone XL pipeline project was enough to put traders in a sour mood with no other news headlines to drive the markets in the early week.

Tuesday:

New Zealand business confidence improves further in Q4: NZIER survey – A net 6 per cent of firms surveyed expected general business conditions to deteriorate compared with 40 per cent expecting a slowdown in the previous quarter, the New Zealand Institute of Economic Research’s (NZIER) quarterly survey of business opinion (QSBO) showed.

Global Dairy Prices up 4.8% from the last auction on Jan. 5

Wednesday:

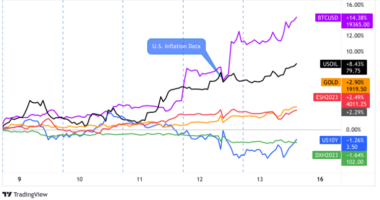

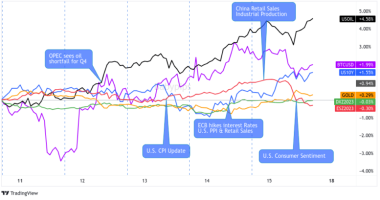

With no major catalysts from New Zealand on the session, it’s likely the broad turn higher in the Kiwi was off of the shift in broad risk sentiment. Traders seemed to have leaned further into positive risk vibes after Janet Yellen’s call for bigger spending from the U.S. government.

Thursday:

New Zealand visitor arrivals rebound 0.8% after earlier 8.1% slump

“Overseas visitor arrivals were down by 367,000 to 5,100 in November 2020, compared with November 2019.”

“The number of New Zealand residents returning from an overseas trip in November 2020 was down by 500 to 2,500, compared with October 2020.”

Westpac OCR forecast: We now expect that the OCR will remain on hold at 0.25% for the foreseeable future. Previously, we were forecasting two cuts of 25bps in May and August this year, which would have taken the OCR to -0.25%.

Friday:

NZ’s business PMI – “The seasonally adjusted PMI for December was 48.7 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was down 6.0 points from November, and the lowest level of activity since May.”

NZ’s stronger-than-expected inflation signals interest rates to be left steady – CPI rose 0.5% in the quarter ending December from 0.7% in the previous period.