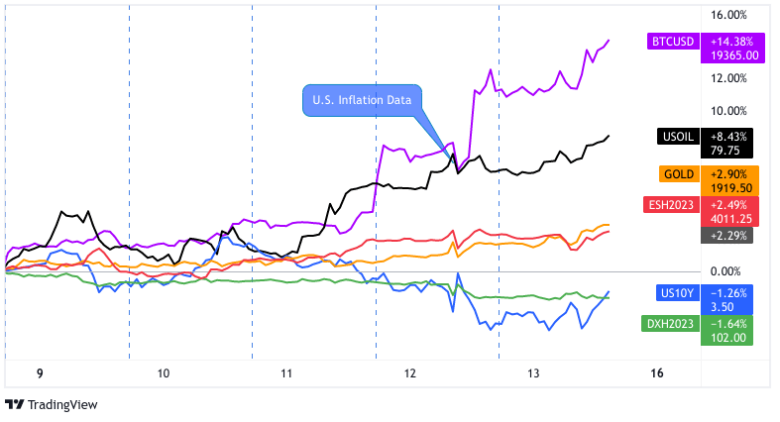

Tough week for U.S. dollar bulls as traders correctly anticipated a slowdown in U.S. inflation data and begin to price in the potential for the current aggressive interest rate hiking cycle in the U.S. to peak.

Notable News & Economic Updates:

China’s central bank will assist private firms and ease tech company crackdowns to boost the economy. State media quoted PBC Communist party leader Guo Shuqing this past weekend.

In his speech on Tuesday, Federal Reserve Chairman Jerome Powell stressed the significance of the central bank’s independence from political influence as it deals with stubbornly high inflation. He acknowledged that stabilizing prices necessitates making difficult decisions that can be politically unpalatable.

Germany industrial production rebounded by 0.2% m/m as expected in Dec. vs. -0.4% m/m in November

Sentix Investor Confidence Index improved to -17.5 In January from -21.0 in December

API reported crude oil inventory build of 14.86M barrels

U.S. CPI for December: -0.1% m/m as expected and +6.5% y/y; Core CPI was +0.3% m/m as expected and +5.7% y/y; Gas prices, which are now lower on an annual basis, were the main factor for the dramatic decline in inflation.

U.K. economy expanded by 0.1% m/m in Nov vs. projected 0.2% contraction

Several Federal officials commented this week that a slower rate of interest rate hikes may be appropriate; markets currently show a 25 bps hike in February

Genesis Global Capital, LLC and Gemini Trust Company, LLC were charged on Thursday by the SEC for the unregistered offer and sale of securities to retail investors via the Gemini Earn crypto asset loan program.

On Friday, Xinhua reported that Chinese authorities will soon announce further policies to help the rental housing industry, including a 100 billion yuan ($14.86 billion) program to support rental housing loans.

Intermarket Weekly Recap

It was a relatively low volatility start to the week, possibly due to a lack of major catalysts (data surprises, headlines), but more likely due to traders waiting for the highly anticipated U.S. CPI report on Thursday. And based on the slow and broad lean favoring risk assets (and away from the U.S. dollar), it looks like traders were expecting U.S. inflation rates to slow.

Early positive risk vibes may have also been a reaction to weekend news from China that the central bank will assist private firms and ease tech company crackdowns to boost the economy, according to PBC Communist party leader Guo Shuqing.

As expected, U.S. CPI came in lower than previous reads, with the data showing the fall in gas prices as the main driver for the slower inflation read. This of course fed the argument that the Federal Reserve will be able to hike interest rates at a slower pace at the next Federal Reserve meeting in February.

According to the CME Fed Watch tool, traders are now pricing in 94.2% probability of a 25 bps hike in February, and a 78.9% probability that the Fed will raise another 25 bps in March.

Market sentiment and volatility picked up quite quickly after the CPI event on more signs of a peak interest rate hike cycle potentially forming, continuing to favor risk-on behavior as we saw equities and crypto higher, while the U.S. dollar continued its fall through Thursday and Friday.

Bond yields also took a hit on the CPI news as well on the prospects of a slower rate hike pace ahead, evidenced by the U.S. 10-year government bond yield falling to as low as 3.43% on the session after peaking around 3.90% at the start of 2023.

On Friday, there was apparently no stopping the risk-on train as we got more news from China that more economically supportive policies are set to be announced soon, this time benefiting the rental housing industry. We also got the latest GDP news from the U.K., showing positive growth in Q4, that may have fueled some broad positive risk sentiment behavior.

Top Moves in FX

USD Pairs

Overlay of USD Pairs: 1-Hour Forex Chart

Aside from the shift in sentiment fueled by expectations of a slowing pace of inflation in the U.S. and U.S. CPI data later confirming it on Thursday, several Fed officials spoke this week on the likelihood of a slower rate hike pace ahead.

On Thursday, Federal Reserve Bank of Philadelphia President Harker said the central bank should raise interest rates in 0.25% increments “going forward.” And on Friday, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, said he is inclined to support a modest interest rate increase at the Fed’s upcoming meeting in light of Thursday’s report showing a further slowdown in inflation.

JPY Pairs

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

The euro lead the FX majors early in the week, but was quickly outpaced by the Japanese yen on Thursday. The bullish boost likely came from a news reports out of Japan that the Bank of Japan will examine the unintended consequences of its monetary stimulus at its next meeting, and may take more measures to normalize the country’s yield curve.

EUR Pairs

The strength in the euro was a bit tougher to pinpoint this week, possibly a reaction to improving investor sentiment and improving industrial production data out of Europe, and an argument can be made that a warm winter in Europe may be economically supportive as well. Broad U.S. dollar weakness may have been a contributor as well.