Indian rupee registered the worst weekly decline of the financial year amid worries over surging current account deficit, capital outflows, risk-averse sentiments, and dollar demand. Let’s look at narrated factors one by one.

Trade Balance:

India’s trade balance for the month of June came at $26.18bn, the record high following higher imports of petroleum products on the back of supply worries and slower exports amid recession fears.

Capital Outflows:

So far this month, foreign institutions (FIIs) have withdrawn around a billion dollars from the equities and debt market. Surging trade deficit numbers and capital outflows will force the government to revise the deficit target for the current financial year.

Forex Reserves:

India’s forex reserves fell by $13 billion to $580.3 billion while the rupee depreciated by 1.14% to 79.88 per US dollar and the benchmark Sensex declined 1.6% to 53761, this month.

Dollar Index:

Going ahead, the direction of the rupee will be determined by how the dollar index reacts to US Federal Reserves’ monetary policy and foreign fund flows.

Technical Factors:

Looking at the technical, the spot USDINR is having psychological resistance at 80 followed by 80.90 while the support has been seen around 78.85. The medium-term trend remains bullish as long as it holds the support of 78.50.

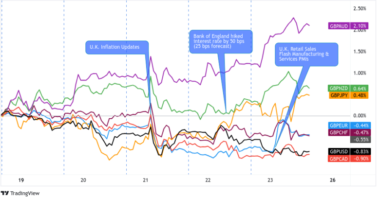

Rupee might be depreciating against dollar but is appreciating against Euro, Pound, Yen, says Sanjeev Sanyal

‘Rupee might be depreciating against the dollar but is appreciating against Euro, Pound, Yen’ says PM-EAC member Sanjeev Sanyal

Interest Rates:

From the overseas ground, the central banks are hiking interest rates, the only factor which is in their hand to bring aggregate demand back closer to where aggregate supply meets, in doing so they not only destructing demand but also pushing the growth lower or in some countries recessions.

Global Inflation:

Whether central banks will be successful in their mission to bring inflation back under control by hiking rates is in doubt as recent inflation figures didn’t confirm it but yes economies are shrinking. The markets are now pricing in recessions in the Eurozone and US for next year accordingly.

The inflation vs. growth debate that has begun to emerge in other G10 countries is already fairly advanced in the European countries. In the Eurozone, June PMI data reflected an increasing weakness in demand. The European Commission’s survey for June reported the lowest level of consumer sentiment since April 2020.

This highlights the inflation pain in terms of real purchasing power, forcing households to slow down their spending. The subsequent release of Germany’s IFO survey unexpectedly brought softness in the expectations component as energy fears constrained the outlook. All these are not at all bode well for the EUR which became in parity with US Dollar in the week gone.

ECB:

The focus will be on the ECB when they meet on 21st July for a monetary policy decision. The question remains about how they cope with the current situations by unveiling the details.

Conclusion:

Given headwinds to global growth and lower-dollar liquidity, we expect the greenback to remain relatively well supported.

We see a chance of pullback in the Euro after breaking below parity in the week gone. In the short-term EURUSD is having resistance at 1.0359 and support at 0.9950.

(The author is Research Analyst,

Securities)

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)