USD has got monthly jobs report ahead and with more sentiment updates coming from the Eurozone, EUR/USD looks to be a busy market this week.

Will we see the recent bounce continue or will bears retake a previous resistance area?

Short-term Reversal Ahead on EUR/USD?

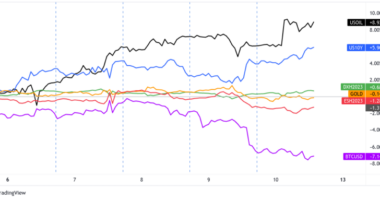

Last week I covered EUR/USD, and discussed a potential scenario where the market could bounce all the way back up to 1.1800. That seems to be the scenario playing out with the help from Fed Chair Powell on Friday, who kept rate hike expectations low and continued to be unclear on when bond buying tapering would exactly start. The Greenback immediately sold off after the event, and seems to have a little bit more follow through in this early start to the week.

Looking forward, volatility may continue with the pair as we’ll get important economic updates from both the Eurozone (business sentiment updates) and the U.S. (monthly employment updates). The more notable and likely event to spark volatility will be the U.S. Non-Farm Payrolls report as that would likely influence broad Fed monetary policy speculation, but we gotta pay attention to the Eurozone manufacturing PMI data on Wednesday as it does tend to influence the euro in the short-term.

Given that EUR/USD is in a longer-term downtrend and that the market is back to 1.1800 where we saw sellers strongly take back control in mid-August, we’ll be on the look out for bearish reversal patterns if Eurozone PMI data disappoints.

If that scenario plays out, EUR/USD could resume the downtrend there, with the odds rising if Wednesday’s ADP Non-farm employment data and ISM manufacturing PMI data points to a potentially strong Non-farm payroll report on Friday. Right now, the expectation is that the Friday jobs report will disappoint, so a positive surprise would highly likely get USD in rally mode.

If Wednesday’s ADP Non-farm employment data and ISM manufacturing PMI data point to a pullback in the U.S. employment sector, EUR/USD could break break 1.1800 and make a run for 1.1850 within the session. If so, we’ll stay watch mode until after Friday’s U.S. NFP report.

What do you guys think? Will the bears take back control of EUR/USD at previous resistance? Will this week’s U.S. employment updates disappoint Dollar bulls?

Let me know in the comments below, and as always, remember to never risk more than 1% of a trading account on any single trade. Adjust position sizes accordingly. Create your own ideas and don’t simply follow what I do.