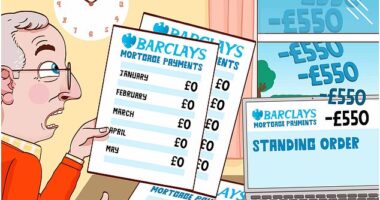

The pre-Budget rumour milling has delivered a new plan to solve Britain’s dysfunctional housing market – 1 per cent deposit mortgages.

As first-time buyers struggle to clamber onto the bottom rung of the housing ladder, the concept of government-backed mortgages for 99 per cent of a property’s value has been floated.

On this episode of Lunch Money, Helen Crane and Simon Lambert discuss the tiny deposit mortgage idea.

Is this the answer for prospective homeowners stuck in the rental market? If it’s such a good idea, why don’t banks offer these already? And how can you protect yourself if you buy with a small deposit?

In other news, the leading US stock market index, the S&P 500 has shrugged off an early New Year wobble to hit another record high.

Richard Hunter, of interactive investor, joins the show to explain why and discuss whether Primark owner AB Foods had a good Christmas.

And finally, there’s been a little bit of good news for our bills. Analysts have forecast the energy price cap will drop in April. The team look at how much this could save you – and how much more expensive they will remain than before the energy crisis.