Buying a home in an area where property taxes are high can add a substantial amount to your monthly outlay. Unfortunately, taxes aren’t going away, but remember, they’re often the largest source of funding for schools, roads and infrastructure, garbage collection, law enforcement and other services we expect.

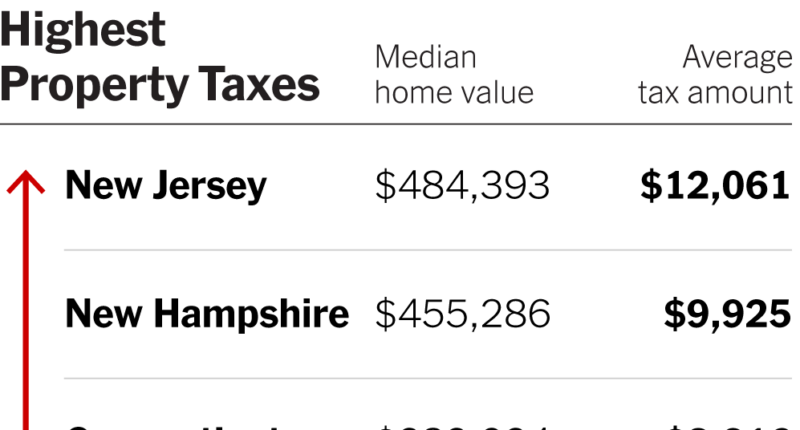

So where can we live to minimize this necessary cost? A recent study by Bankrate, which provides information and tools for home buyers, gathered property tax rates, tax amounts paid, and home values in each of the 50 U.S. States and the District of Columbia. It found that the lowest taxes in the country were in West Virginia — just $812 a year on a median-value home costing $140,027. Other Southern states followed: Alabama, Arkansas, Louisiana and Mississippi. At the high end was New Jersey, where the median home value of $484,393 was found to generate an average annual tax bill of $12,061.

California’s property taxes were 10th highest, at an average of $6,025 a year, yet the state has a much higher median home value of $792,787. What gives? Proposition 13 could have something to do with it. The law, passed in 1978, keeps property tax increases at a minimum until homes are resold. Even then, Californians over the age of 55 have Proposition 19, which allows them to carry forward a lower tax bill from a previous property and intergenerational property transfers with no tax increases.

Local laws in other states also provide tax savings for some — seniors, veterans and the disabled among them. But taxes don’t exist in a vacuum; you get what you pay for. A lower property tax bill might mean public schools are underfunded, requiring costly private school enrollment. Or maybe your low-tax house is so far from work that any savings will be eroded by the cost of gasoline, tolls and car maintenance.

This week’s chart shows the 10 locales where taxes on a median-value home were highest and the 10 where they were lowest, according to Bankrate, as well as the median home value in each.

For weekly email updates on residential real estate news, sign up here.

Source: | This article originally belongs to Nytimes.com