THE value of cryptocurrency Tether has remained steady in recent days as others have crashed.

We explain all you need to know about the cryptocurrency and its price.

? Read our cryptocurrency live blog for the latest Bitcoin updates

If you’re thinking of investing, keep in mind it’s a risky business and you’re not guaranteed to make money.

You need to make sure you know the risks and can afford to lose the cash, and never invest in something you don’t understand.

Cryptocurrencies are typically also highly volatile, so your cash can go down as well as up in the blink of an eye.

What is Tether?

Tether (USDT) was originally launched as Realcoin in 2014, but has since changed its name and been updated over the years.

It’s described as a “stablecoin”, which is a type of cryptocurrency that aims to keep crypto values stable.

Tether aims to do this by pegging the price to a regular “fiat” currency, like US dollars, Euros or the Chinese yuan.

British pounds aren’t currently available, according to its website.

5 risks of crypto investments

THE Financial Conduct Authority (FCA) has warned people about the risks of investing in cryptocurrencies.

- Consumer protection: Some investments advertising high returns based on cryptoassets may not be subject to regulation beyond anti-money laundering requirements.

- Price volatility: Significant price volatility in cryptoassets, combined with the inherent difficulties of valuing cryptoassets reliably, places consumers at a high risk of losses.

- Product complexity: The complexity of some products and services relating to cryptoassets can make it hard for consumers to understand the risks. There is no guarantee that cryptoassets can be converted back into cash. Converting a cryptoasset back to cash depends on demand and supply existing in the market.

- Charges and fees: Consumers should consider the impact of fees and charges on their investment which may be more than those for regulated investment products.

- Marketing materials: Firms may overstate the returns of products or understate the risks involved.

By using blockchain technology, Tether users are said to be able to store, send and receive digital tokens mirrored against their chosen currency.

Tether claims to keep values steady by holding reserves in that currency in a bank, Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, told The Sun.

However, she added: “Tether has still witnessed spikes and sharp falls in price.

“It has also been criticised for a lack of transparency, has had to settle US lawsuits and trading in the currency is banned in the state of New York.”

Tether was founded by Brock Pierce, Reeve Collins and Craig Sellars.

What’s the value of Tether?

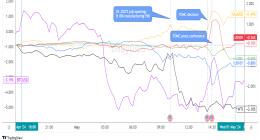

The value of Tether is currently sitting at $1, according to CoinMarketCap.

It’s remained at this level in the past 24 hours, in comparison to larger plunges in the wider cryptocurrency markets today.

Tether dropped to its lowest level ever on April 27, 2017, when it fell to a value of $0.92.

A month later, Tether then hit its record peak of $1.11 on May 27, 2017.

Its market cap is currently $57.7billion, according to CoinMarketCap.

How to spot crypto scams

CRYPTO scams are popping up all over the internet. We explain how to spot them.

- Promises of a high or guaranteed return – Does the offer look realistic? Scammers often attract money by making fake promises.

- Heavy marketing and promotional offers – If they are using marketing tricks to con customers you should beware.

- Unamed or non-existent team members – Just like any business you should be easily able to find out who is running it.

- Check the whitepaper – Every crypto firm should have a white paper. This should explain how it plans to grow and make money. If this doesn’t make sense, then it could be because the founders are trying to confuse you.

- Do your research – Check reviews online and Reddit threads to see what other people think.

Is Tether risky?

Investing in cryptocurrencies is essentially gambling and there are no guarantees that you will see what you pay in go up in value.

Cryptocurrencies are VERY high risk and a speculative investment, with limited track records and no underlying value.

There is also no guarantee that you can convert crypto assests back into cash, as it may depend on the demand and supply in the existing market.

If you’re planning to invest in newer cryptos, keep in mind these are riskier than others, such as Bitcoin, and would make you more open to fraud.

Ms Streeter said: “Investors should treat trading in cryptocurrencies with extreme caution, and dabble at the edges of their investment portfolio, only with money they can afford to lose.”

In January, the Financial Conduct Authority warned that Brits risk losing ALL of their money if they invest in cryptocurrencies.

Meanwhile, an advert for a bitcoin exchange Coinfloor was banned in March for telling savers cryptocurrencies are a safe investment.

People considering investing in Bitcoin or shares and stocks have also been warned over “risky” tips being shared on TikTok.