Central bank headlines and commentary dominated headlines this week, followed closely by fresh data showing economic weakness rising, especially in Europe and China.

It looked like another Dollar dominant week in the beginning, but the tide turned on the weakening outlook on economic conditions/central bank aggressiveness, especially on some signs that the extreme inflation environment may have peaked.

Notable News & Economic Updates:

China Caixin services PMI for August 55.0 (expected 54.0)

Euro area services business sentiment was contractionary for the second month in a row as demand fell as a quicker pace and job growth slowed

Central bank moves this week:

- The Reserve Bank of Australia raised the official cash rate by 50 bps to 2.35%

- Chile’s central bank raises interest rate to 10.75%; In its quarterly monetary policy report, the Chilean central bank boosted its inflation forecast from 10.8% to 11.4% on Wednesday.

- The central bank of Denmark raised its benchmark to 0.65% from -0.10%

- The European Central Bank raised interest rates by 75 bps to 0.75% as expected

- The Bank of Canada raised interest rates to 3.25% from 2.50%

China’s exports (7.1% y/y in August) was below expectations in August as growing inflation hampered global demand and additional COVID controls and heatwaves hindered output

Fed Chair Powell reaffirmed that the central bank will take whatever steps are necessary to combat inflation during a Q&A session at the Cato Institute.

China’s National Health Commission announced Thursday new measures to tackle a virus that shows little sign of diminishing.

Chinese CPI fell from 2.7% to 2.5% y/y in August vs. 2.8% consensus; Chinese PPI slowed from 4.2% to 2.3% in August vs. 3.2% estimate

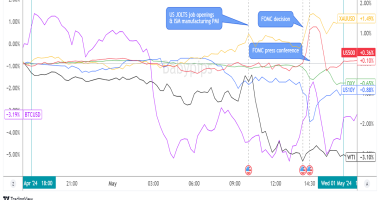

Intermarket Weekly Recap

Did inflation peak? That seems to be the question that drove the markets this week, as traders had to digest lots of central bank action and economic/sentiment survey updates from around the world.

On the central bank front, we saw five central banks hike interest rates by 50 basis points or more, including three from the major currencies: the Reserve Bank of Australia, the Bank of Canada and the European Central Bank. This is all to fight the extreme inflation conditions we’ve seen all throughout 2022 by trying to reduce the demand side of the price equation.

And by some measures, it just might be working. In the latest round of PMI’s, businesses around the world are starting to see price pressures easing, along with consumer demand. The outlier in consumer demand continues to be the United States, which has had relatively strong job growth and likely why the Dollar has dominated handily for a lot of the year.

But we saw a break in that market behavior, starting around Wednesday, possibly on the combination of economic weakness in Europe (rising risk of recession due to high energy costs) and China (a rise in COVID cases has the government implementing lockdowns again, weakening trade data), which traders may have taken as a sign that monetary policy tightening could slow in order to avoid a severe global recession.

But it wasn’t until Friday that we saw strong moves across the broad markets, specifically a big dip in the U.S. dollar possibly catalyzed by the surprise dip in China’s inflation rate. The possible argument could be that the market may have seen this as another sign of peak inflation and pared back expectations central banks need to stay aggressive with monetary policy tightening efforts.

The pullback in the U.S. dollar may have also been some reaction to intermarket developments, including an increasingly hawkish ECB and higher interest rates, jawboning from Japanese officials on the yen, or possibly it was also a technical move as the Greenback has had a heck of a bullish run since mid-August.

In FX, the main story, aside from the strong dollar moves, seems to be the rapid depreciation of the yen against the major currencies. Again, there’s a huge policy divergence between the Bank of Japan (who sees high inflation as transitory and wants to keep monetary policy easy) and the rest of the majors who are in all-out rate hike mode, so it’s no surprise the yen was once again the biggest loser of the week. This is despite a lot of jawboning from Japanese officials this week. The biggest winner of the week was the Swiss franc, likely benefiting from the rebound in the euro and possibly taking away some additional “safe haven” flows from the Japanese yen.

USD Pairs

Overlay of USD Pairs: 1-Hour Forex Chart

ISM Services PMI for August: 56.9 vs. 56.7; New Orders & Employment growing; inventories are contracting at a slow pace. Prices are increasing at a slower pace.

S&P U.S. Services PMI for August: 43.7 vs. 47.3 in July, below flash estimate of 44.1

Richmond Fed President Thomas Barkin argued on Tuesday that interest rates must remain elevated until inflation moderates.

The U.S. Labor Department said on Thursday that the number of first-time claims for state unemployment benefits dropped by 6,000 to 222,000 for the week ending September 3.

After rising 1.8% m/m in June, U.S. wholesale inventories gained 0.6% m/m in July. Economists predicted a 0.8% rise in wholesale inventories.

GBP Pairs

Overlay of GBP Pairs: 1-Hour Forex Chart

Liz Truss to replace Boris Johnson as the next Prime Minister of the U.K.

U.K. Services PMI for August: 50.9 vs. 52.6

U.K. Construction PMI for August: 49.2 vs. 48.9 in July; construction firms noted signs of weakening demand

Halifax reported that its measure of U.K. property prices grew 0.4% last month, following a 0.1% decline the previous month, bringing the average cost of a home to a new high of £294,260.

BOE Governor Andrew Bailey expressed concerns on Wednesday that little could be done to prevent the UK from experiencing a recession this year due to the ongoing conflict in Ukraine.

Bank of England policy maker Silvana Tenreyro said on Wednesday that she will think about more votes to raise interest rates until the data shows that they are having an effect on inflation.

UK PM Truss announced a guarantee for energy bills in the U.K.

EUR Pairs

Overlay of EUR Pairs: 1-Hour Forex Chart

Eurozone retail sales ticked up by 0.3% in July but the downward trend remains

Germany Services PMI in August: 47.7 vs. 49.7 in July

Eurozone Services Index for August: 49.8 vs. 51.2 in July

Germany’s factory orders fell -1.1% m/m in July, more than the previously reported -0.3% m/m drop in June, according to Destatis.

Germany July industrial orders -1.1% vs -0.5% m/m forecast

German industrial production dipped by 0.3% vs. projected 0.5% decline

GDP was up by 0.8% q/q and employment was up by 0.4% in the euro area

The European Central Bank raised the deposit rate to 0.75% from 0.00% as forecasted

France trade Balance deficit increased to -€14.5B in July from €13.08B in June

To allow for a period of grief following the passing of Queen Elizabeth II, the Bank of England postponed its next interest-rate announcement by one week to September 22.

CHF Pairs

Overlay of CHF Pairs: 1-Hour Forex Chart

Switzerland GDP rose +0.3% q/q in Q2 2022 vs. +0.5% q/q previous

Switzerland August unemployment rate 2.0% vs 2.0% expected

Speaking at the Finanz and Wirtschaft financial conference, Thomas Jordan (the president of the Swiss National Bank), said that the uncertainty on inflation is higher than usual and that it is too soon to declare that prices have peaked.

CAD Pairs

Overlay of CAD Pairs: 1-Hour Forex Chart

The Bank of Canada raised interest rates to their highest level in 14 years at 3.25% from 2.50%, and left the door open for further rate hikes.

According to figures released by Statistics Canada on Wednesday, the country’s trade surplus shrunk to C$4.05B in July, primarily as a result of fewer exports of consumer products.

Canada’s Ivey August PMI jumps to 60.9, above July’s 49.6

Canada unemployment rate jumped to 5.4% in August and saw a net jobs loss of 39K

NZD Pairs

Overlay of NZD Pairs: 1-Hour Forex Chart

New Zealand ANZ commodity prices fell 3.3% after previous 2.2% drop

Global Dairy Prices rose by +4.9% to an average price of $4.007, the first price rise since Jun. 7

NZ manufacturing sales in Q2 2022 was down by -3.8% q/q vs. 0.9% q/q uptick in Q1 2022

New Zealand – Card Spending for August – Retail +0.9% m/m (prior -0.3%); +26.9% y/y vs. -0.7% y/y in July

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

Australia’s MI inflation gauge down 0.5% after earlier 1.2% gain

Australian retail sales rose another 1.3% m/m as expected in July, inline with June’s growth rate

The Reserve Bank of Australia raised the official cash rate by 50 bps to 2.35% amid inflation fears; the RBA anticipates that inflation will peak in 2022 and fall back towards the 2% – 3% range

Australia current account surplus increased to A$18.3B ($12.50B), up from A$2.8B in the previous quarter and just below projections of A$20.8B

Australia’s AIG services index up from 51.7 to 53.3

Australian economy expanded by 0.9% in Q2 2022 as expected, Q1 2022 GDP downgraded

RBA Gov. Lowe said on Thursday that “the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises”

The Australian Bureau of Statistics released data on Thursday that showed the surplus on goods and services went down to A$8.7B ($5.66B) from A$17.1B in June. less than $14.5B forecast

JPY Pairs

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

Japan Services PMI for August: 49.5 vs. 50.3 in July

Japan’s July real wages continue to slide (1.8% from 2.0%) as rising consumer prices weigh

Japan household spending rose 3.4% y/y in August vs. -1.4% in July

Japanese leading indicators fell from 100.9% to 96.6% in July

Japanese finance minister Suzuki says gov’t will not tolerate “one-sided” FX moves; Japan’s chief cabinet secretary Matsuno also said they are ready to take action on JPY if needed

Japan increased its daily entry threshold to 50,000 in an effort to bolster the flagging tourism industry.

Japan GDP grew by 3.5% on an annualized basis in the second quarter. This was better than the initial estimate of 2.2% growth on an annualized basis.

Early numbers from Japan’s Finance Ministry showed that July’s current account surplus was 229B yen (-86.6% y/y)

Japanese Finance Minister Suzuki says they’re not ruling out any options on FX, ready to act against the swift moves in the yen.