We heard from several central bankers last week and now it’s time to turn back to economic data for clues on the major economies’ growth and their central banks’ policy courses.

Which data events can affect the major currencies in the next few days?

Before all that, ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

And now for the closely-watched economic indicators on the calendar this week:

Eurozone inflation numbers

We know from last week’s PMI reports that business growth in the Eurozone is shaky at best. This week, we’ll see if inflation has taken enough chill pill to allow the ECB to save its bullets and keep its interest rates steady.

Headline inflation in Germany (Sept 28, 12:00 pm GMT) is expected to plummet from 6.1% y/y to 4.9% y/y in September though the monthly reading could speed up from 0.3% to 0.6%. France’s preliminary CPI (Sept 29, 6:45 am GMT) could see a 0.6% decline after a 1.0% m/m increase in August but also maintain its 4.9% annual reading.

And then there’s the Eurozone CPI (Sept 29, 9:00 am GMT), which could slow down from 5.2% y/y to 4.7% y/y but speed up its monthly reading from 0.5% to 0.7%.

U.S. core PCE price index

On Friday at 12:30 pm GMT, the Fed’s preferred inflation gauge is expected to maintain its 0.2% monthly growth in August.

Annual growth is seen at 3.8%, lower than July’s 4.2% uptick but still higher than the 3.3% pace that the September FOMC projections saw for 2023.

Oh, and don’t sleep on personal income and spending part of the report that could show weaker real spending after higher gasoline prices are taken into account!

FOMC member speeches

Friday’s core PCE report too far for ya? You can also anticipate possible volatility spikes when a couple of FOMC members share their two cents.

The members include Neel Kashkari (Sept 25, 10:00 pm GMT), Michelle Bowman (Sept 26, 5:30 pm GMT), Austan Goolsbee (Sept 28, 1:00 pm GMT), Lisa Cook (Sept 28, 5:00 pm GMT), and John Williams (Sept 29, 4:45 pm GMT).

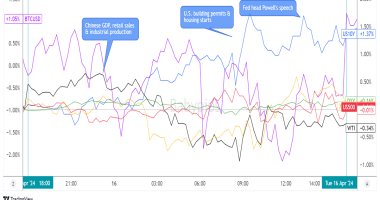

Fed Chairman Powell himself will speak at a town hall event in D.C. on Sept 28 at 8:00 pm GMT! Confirmation of the Fed’s “higher for longer” plan can extend the U.S. dollar’s rallies, so y’all better watch your newswires closely when Fed members are under the spotlight!

This post first appeared on babypips.com