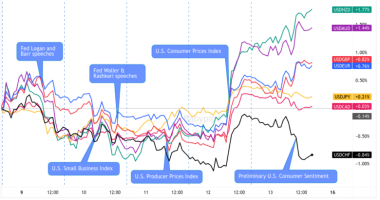

It’s been a hot minute since we’ve seen U.S. CPI data steal the show, yet here we are again with another set!

This week is all about inflation data, so the market might be in for a lot of action.

Before all that, ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

And now for the closely-watched potential market movers this week:

Major Economic Events:

New Zealand quarterly inflation expectations (Nov. 8, 2:00 am GMT) – I know this ain’t official inflation data, but expectations do tend to have self-fulfilling powers!

Now this survey tracks how business managers see price levels rising over the next couple of years, so it could shape how rising costs are passed on to consumers. The previous reading dipped from 3.29% to 3.07%, but another pickup in inflation expectations might lift RBNZ rate hike hopes and the Kiwi.

Chinese CPI and PPI (Nov. 9, 1:30 am GMT) – Next up we’ve got actual consumer and producer inflation figures from China, and number crunchers are predicting a slowdown in price pressures.

The October headline CPI is slated to dip from 2.8% to 2.4% on a year-over-year basis while the PPI probably tumbled by 1.6%, erasing the earlier 0.9% uptick.

Weaker than expected results could stoke expectations of stimulus efforts from the government and PBOC, particularly when it comes to adjusting the yuan exchange rate and easing up on their zero COVID policy.

U.S. CPI (Nov. 10, 1:30 pm GMT) – Are we about to see another hot inflation figure from the U.S. economy?

A slight pickup in price pressures is eyed, as the headline CPI probably accelerated from a 0.4% monthly gain in September to a 0.6% rise in October. However, the year-over-year figure is projected to have slowed from 8.2% to 8.0%. Core inflation likely dipped from 0.6% to 0.5% month-over-month.

Note that market watchers are trying to weight the odds of *finally* seeing a Fed pivot by December, as Powell hinted that a 0.50% hike (down from their usual 0.75%) would be up for discussion.

U.K. quarterly GDP (Nov. 11, 7:00 am GMT) – After getting a positive revision to 0.2% growth in its Q2 growth figure, the U.K. economy is slated to report a 0.5% contraction for Q3.

In their monetary policy meeting last week, the BOE already warned of a 0.3% reduction in output for the latest quarter. A smaller than expected contraction or a surprise uptick might bring some relief for the pound.

Forex Setup of the Week: USD/CHF

Here’s a setup I’m watching closely ahead of the U.S. CPI release this week!

USD/CHF has been cruising inside a rising channel with its higher highs and higher lows since last month. Another test of support seems to be in the works, and inflation data could make or break the trend.

Moving averages are pointing to a continuation of the climb, as the 100 SMA is still above the 200 SMA. Plus, the 200 SMA dynamic support lines up with the channel bottom to add to its strength as a floor.

Meanwhile, Stochastic has some room to head lower, so price could follow suit. However, the oscillator is closing in on the oversold region to signal exhaustion among sellers soon.

If support holds, USD/CHF could set its sights back on the nearby resistance levels at the channel top and mid-channel area of interest. A break lower, on the other hand, could set off a reversal from the climb.