Along with continued speculation of future interest rates and economic growth outlooks, traders had to balance the terrible geopolitical news of terrorist attacks and war in the Middle East, prompting unusual behavior between the FX majors this week.

Missed the major forex headlines? Here’s what you need to know from this past week’s FX action:

USD Pairs

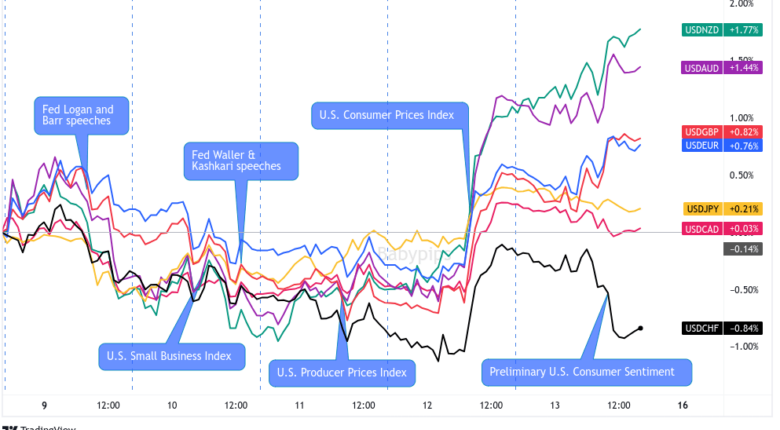

Overlay of USD vs. Major Currencies Chart by TradingView

After the initial safe haven pop to start the week due to the breakout of the Israel-Hamas war, the U.S. slowly fell lower into the red, likely due to traders further pricing in “peak rate” hike expectations, especially with Fed speak supporting that stance all week.

The tone changed, though, on Thursday after the September consumer prices data confirmed once again the sticky inflation conditions in the U.S., likely moving traders to price in higher odds of the “higher for longer” interest rate theme.

This was followed by mixed performance on Friday as traders priced in geopolitical news once again (Israel warns civilians to evacuate Gaza), prompting it to under perform against the other safe havens and CAD (oil tends to move higher during Middle East conflicts) but outperform the other major currencies.

🟢 Bullish Headline Arguments

FOMC member Christopher Waller: The Fed will “stay on the job” to achieve price stability

U.S. Producer Prices Index change for September: 0.5% m/m (0.4% m/m forecast; 0.7% m/m previous); Core PPI at 0.3% m/m (0.2% m/m forecast/previous)

U.S. CPI for September: 0.4% m/m (0.4% m/m forecast; 0.6% m/m previous); Core CPI 0.3% m/m (0.3% m/m forecast/previous)

U.S. weekly initial jobless claims for week ending Oct. 7: 209K vs. 210K previous (revised higher from 207K)

🔴 Bearish Headline Arguments

Federal Reserve Bank of Dallas President Lorie Logan said on Monday that the rise in Treasury yields may mean less need for the Fed to hike rates further

U.S. Business Optimism Index for September: 90.8 (91.2 forecast; 91.3 previous)

MBA Mortgage Applications rose by 0.6% (-6.0% previous); 30-year mortgage rate hits 7.67% vs. 7.53% previous

FOMC Meeting Minutes: will “proceed carefully” and sees risks with both over tightening or under tightening

Boston Fed President Susan Collins said on Thursday that Fed members are going to be more patient with policy as rates are likely at or near peak.

Preliminary U.S. consumer sentiment read for October: 63.0 (68.0 forecast; 68.1 previous); Expectations index falls from 66.0 to 60.7; Inflation expectations rise from 3.2% to 3.8%

Federal Reserve Bank of Philadelphia President Harker sees deflationary conditions and says that he favors holding interest rates at current levels

EUR Pairs

Overlay of EUR vs. Major Currencies Chart by TradingView

The euro spent most of the week as a net loser, likely due to a mix of weak Euro area economic updates and rhetoric from European Central Bank officials signaling that interest rates are at their peak.

The euro’s only gains were against the Kiwi and Aussie, signaling the dominance of broad risk sentiment vibes on the currency this week, and against Sterling, which ended the week with a slew of net negative economic from the U.K.

🟢 Bullish Headline Arguments

Germany’s final CPI confirmed a 0.3% monthly inflation uptick (+4.5% y/y) for the month of September

Eurozone consumer expectations for inflation in August: 3.5% vs. 3.4% in July

During an IMF panel, ECB President Lagarde reiterates that the central bank will raise interest rates again if necessary, but will monitor the effects of prior moves

🔴 Bearish Headline Arguments

Germany Industrial Production for August: -0.2% m/m (1.0% m/m forecast; -0.6% m/m previous)

On Monday, ECB Vice-President Luis de Guindos said that he expects inflation (both core and headline) to continue their downtrends, although he remains cautious due to oil prices

Sentix Investor Confidence for October: -21.9 vs. -21.5 previous; current index fell to -27 (lowest since Nov. 2022) but expectations index rose to -16.8 vs. -21 previous

On Wednesday, ECB Governing Council member Knot said that inflation shocks are waning but the council remains ready to take action if needed

French central bank chief Villeroy commented that interest rates are at an appropriate level, and that the ECB should be patient in their fight against inflation

France’s final CPI confirmed at -0.5% m/m (+4.9% y/y) in September; decline is mainly due to lower service prices

GBP Pairs

Overlay of GBP vs. Major Currencies Chart by TradingView

The British pound started the week net negative and choppy, but turned the corner on Tuesday, likely due to a mix of fading geopolitical fears and a weaker U.S. dollar.

That lead to a positive net performance by the Thursday trade, but the bears came out in droves during the London session, correlating with an arguably net negative round of economic updates from the U.K.

This was followed by a speech from Bank of England Governor on Friday, which the markets took as net negative, likely pricing in his concerns of uninsured deposits in the banking sector and his comment that “solid progress” is being made to fight inflation (lowering the odds of further rate hikes).

🟢 Bullish Headline Arguments

On Monday, Bank of England policy committee member Catherine Mann commented that as long as inflation remains above target, central bankers will need to stay aggressive in reacting to it

BOE Financial Policy Committee (FPC) Meeting Minutes: sees the mix of persistent inflation, higher interest rates and high geopolitical tensions as likely challenging to growth expectations; banking systems remains strong even if economy worsens

🔴 Bearish Headline Arguments

U.K.’s monthly GDP came in at 0.2% in August as expected; services sector output offset weaknesses in production

The U.K.’s RICS house price balance measuring the difference between the percentage of surveyors seeing rises and falls in house prices dropped to -69 in September after August’s -68 reading

U.K.’s industrial production dropped by -0.7% in August (vs. -0.2% expected, -1.1% previous)

U.K.’s manufacturing production slipped by -0.8% (vs. -0.3% expected, -1.2% previous)

Bank of England Governor Andrew Bailey comments on Friday that uninsured deposits are a risk being watched; upcoming monetary policy decision will be “tight” despite seeing improvement in inflation conditions

CHF Pairs

Overlay of CHF vs. Major Currencies Chart by TradingView

The Swiss franc started the week in chop mode and mixed, trading mainly as a counter currency to all of the different driving themes. But with no major influences from Switzerland, a weak U.S. dollar environment and broad risk aversion sentiment due to the breakout war in Israel, traders went into full bull mode this week (ignoring the dip in Swiss PPI on Friday).

🔴 Bearish Headline Arguments

Switzerland’s producer prices dipped by -0.1% in September (vs. 0.3% expected, -0.2% previous)

AUD Pairs

Overlay of AUD vs. Major Currencies Chart by TradingView

The Aussie dollar seeing green early in the week, likely on both positive sentiment survey data from Australia, but also likely on talk that China is considering new stimulus to the tune of potentially ¥1T ($137B) of sovereign debt according to unnamed sources for Bloomberg.

Those gains were quickly lost starting on Thursday as the market shifting into a pro-USD environment on top of general risk aversion sentiment due to geopolitical risks. China also released net negative economic updates on Friday, which didn’t spark a direct bearish reaction, but also likely didn’t help the bull case for the Aussie either.

🟢 Bullish Headline Arguments

Australia Business Confidence Index for September: 1.0 (-2.0 forecast; 1.0 previous)

Westpac Consumer Confidence Index for September: 82.0 (79.1 forecast; 79.7 previous)

Australia Building Permits: 7.0% m/m (7.0% m/m forecast; -7.4% m/m previous)

RBA Assistant Governor Chris Kent says the central bank is in its “third phase” of monetary policy tightening where there’s “an opportunity to see how the economy and how the data is evolving”

Melbourne Institute: Inflation expectations rose from 4.6% to 4.8% from September to October; there’s “mild reversal” from the downtrend in annual trimmed-mean inflation

🔴 Bearish Headline Arguments

China’s consumer prices were flat in September (vs. 0.2% uptick expected, 0.1% increase in August)

China’s producer prices fell by -2.5% y/y in September (vs. -2.4% expected, -3.0% previous)

China’s trade surplus widened from $68.4B to $77.7B in September even as both exports (-6.2% y/y) and imports (-6.2% y/y) slowed down their declines

China New Loans for September: ¥2.1T ($564B), below ¥2.5T forecast; M2 money supply growth rate fell to 10.3% y/y vs. 10.6% y/y forecast/previous

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TradingView

The Loonie saw lots of green this week even with risk aversion sentiment dominating across many markets this week.

Canadian economic updates and headlines was light, but net positive, especially the hawkish comments from Bank of Canada governor Macklem on Friday.

But it’s likely oil’s bullish week was the main driver for the Loonie to outperform against the major currencies, with exception to the Swiss franc who benefited the most due to its “safe haven” status.

🟢 Bullish Headline Arguments

Canada Building Permits change for August: +3.4% m/m (0.4% m/m forecast; -3.8% m/m previous)

On Friday, Bank of Canada Governor Tiff Macklem said that inflation is still too high and broad, but notes that recent rate hikes is lowering demand

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TradingView

The Kiwi had a great start to the week despite geopolitical risks hitting the markets at the open.

But starting on Wednesday, New Zealand released nothing but bearish headlines, and with geopolitically induced risk aversion vibes across the broad markets and weak Chinese economic updates on Friday, it’s no wonder NZD dropped like a rock into last place among the major currencies!

🔴 Bearish Headline Arguments

New Zealand’s visitor arrivals decreased by 4.1% m/m in August after a 1.8% uptick in July

New Zealand’s food price inflation fell by 0.4% m/m and 8.0% y/y in September and marked its lowest annual growth since July 2022

BusinessNZ manufacturing index shrank from 46.1 to 45.3 in September and marked the lowest non-COVID-affected month since May 2009

New Zealand electronic card retail sales: -0.8% m/m (0.5% m/m forecast; 0.6% m/m previous)

JPY Pairs

Overlay of JPY vs. Major Currencies Chart by TradingView

The Japanese yen was on a roller coaster ride this week, first jumping higher due to its status as a “safe haven” and the broad risk averse environment ignited by the war between Israel and Hamas. But as fears settled down a bit on Tuesday, traders were back to selling yen, likely pricing in weaker current account data and the economy watchers survey data.

Yen buyers came back to play on Thursday and Friday, first being a reaction to sticky U.S. CPI data moving traders to lighten up on risk assets (pricing in a ‘higher for longer’ interest rate outlook), and then on rising geopolitical risk aversion vibes after Israel warned civilians to evacuate the northern Gaza area.

🟢 Bullish Headline Arguments

According to sources, the BOJ may raise their inflation outlook for the current business year to 3% from 2.5%, likely due to rising oil prices and depreciating yen.

Japan Current Account for August: ¥2.28T (¥2.9T forecast; ¥2.78T previous)

BOJ Board Member Asahi Noguchi: “The biggest focus now is whether this (wage growth) momentum will be maintained or not”

🔴 Bearish Headline Arguments

Japan Economy Watchers Survey Index for September: 49.9 vs. 53.6 previous

Japan’s preliminary machine tool orders declined by another 11.2% y/y in September after a 17.6% drop in August; domestic demand declined at a faster rate

Japan’s core machinery orders fell for a second straight month in August, down by 0.5% (vs. 0.7% expected, -1.1% previous)

Japan’s producer prices rose by another 2.0% y/y in September (vs. 2.4% expected, 3.3% previous); showed slower growth for a ninth month in a row

Japan M2 Money Stock for September: 2.4% vs. 2.5% previous