Will the Fed raise its rates by 50 bps next? Will the U.K. be one step closer to a technical recession?

These are questions that scheduled data releases may answer for us this week!

Before all that, ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

And now for the closely-watched potential market movers this week:

Major Economic Events:

U.S. inflation reports (Jan 12, 1:30 pm GMT) – After Friday’s jobs-related volatility, traders will be looking at Uncle Sam’s inflation numbers for clues on the Fed’s next policy decisions.

Markets expect annualized prices to slow down from 7.1% to 6.6%, the lowest since October 2021. It may mark the sixth consecutive slowdown but 6.6% is still more than thrice the Fed’s 2% target.

Meanwhile, annualized core CPI could slow down from 6.0% to 5.7%, the third consecutive slowdown and the lowest core CPI in a year.

Higher-than-expected consumer prices would support FOMC members’ hawkish speeches from last week and encourage speculations of a 50 bps rate hike in the Fed’s next meeting. CPI misses, on the other hand, could reduce expectations to “only” a 25 bps rate hike.

U.K.’s monthly GDP (Jan 13, 7:00 am GMT) – Markets see the U.K.’s economy slipping back into contraction in November after October’s figures reflected artificial bounces from the Queen’s state funeral holidays.

The economy likely dipped by 0.2% after a 0.5% uptick in October. Production, construction, and trade activities printed on the same day are also expected to show weaker readings than the previous months.

A negative reading puts the economy on track for a negative Q4 growth, which would officially put the U.K. on “recession” status that could last until late 2023.

Forex Setup of the Week: GBP/USD

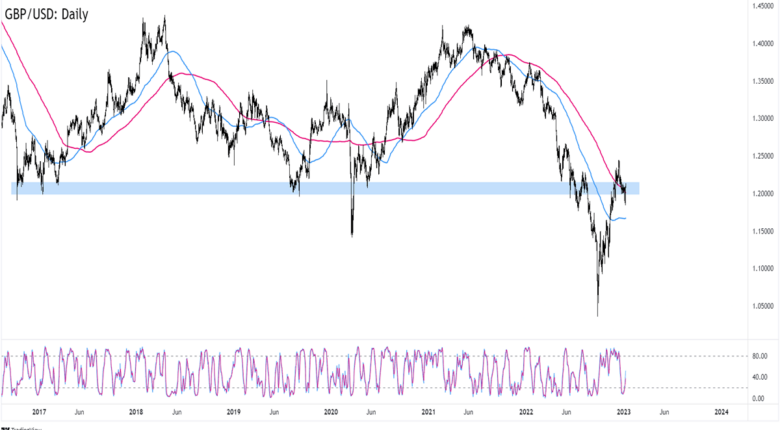

GBP/USD Daily Forex Chart by TradingView

It’s make or break week for Cable! The pair is retesting the daily chart’s 200 SMA after breaking above the dynamic resistance line in early December.

Indicators also favor more buying as the 100 and 200 SMAs turn flatter after showing bearish trends for most of 2022. Meanwhile, Stochastic has just left oversold territory and is heading for higher levels.

This week’s U.S. inflation and U.K. GDP reports could help traders find GBP/USD’s next direction.

Expectations of a less hawkish Fed could encourage risk-taking in the markets and confirm GBP/USD’s break-and-retest pattern on the daily.

The pair could 1.2450 December highs and maybe head for 1.3000 in the next few weeks.

Global growth concerns, however, could keep GBP/USD below 1.2500.

Watch GBP/USD’s next candlesticks to see if the pair is in for a longer-term uptrend!