Whether it’s glorious holidays abroad, spending time with family, days on the golf course or leisurely lunches with friends, most of us have dreamt up a rosy picture of what our early years of retirement might look like.

Indeed, a record number of over-55s have called time on their careers early in the past few years, with close to 400,000 more than usual leaving the workplace, according to official figures.

Yet many who did retire early are now being forced to return to the workplace as they struggle to keep up with soaring costs, a bombshell survey seen by The Mail on Sunday reveals.

An exhaustive study by one of Britain’s largest workplace pension providers, The People’s Pension, found that a growing number of people in their 60s and 70s are being dragged out of retirement, amid fears their pension pots will run dry in their later years.

The research, which has involved in-depth interviews with the same sample groups of savers since 2015 and has tracked their progress through retirement, says many have rejoined the workforce this year, typically working part-time or flexible hours in low-stress roles.

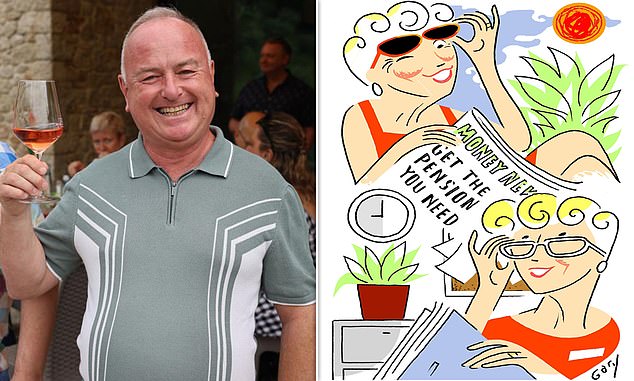

Payout: But Peter Truesdale is now heading back to work after taking early retirement in 2021

The workplace savings firm, which manages pensions on behalf of 6.5 million people, says that most pensioners fail to consider how inflation will eat away at their savings over the course of their retirement. This dangerous ‘blind spot’ means that millions could find their pensions do not stretch as far as they initially expected.

Dramatic increases in living expenses over the past 18 months, with inflation hitting a peak of 11.1 per cent in November 2022, have jolted many out of retirement already. At 61, Peter Truesdale was thrilled to take early retirement when his long-term employer offered him a two-year redundancy payoff in December 2021. Peter, now 63, had big plans to enjoy his new-found freedom and says: ‘It was a big payout so I thought I would live off that and retire, taking my pension when the funds ran out.’

But in those two years consumer prices have soared to 40-year highs, and Peter realised he was burning through the money faster than expected. He now says he cannot afford to live the retirement he hoped and must return to work.

‘I thought early retirement would be all holidays and parties with friends,’ he says. ‘I did some trips abroad and was living comfortably but things cost a lot more money than they use to and I need more income.

‘You realise that the pot you needed to retire years ago is not what you need today. Suddenly what you need doubles,’ he says.

Peter is right: a single person needs an extra £8,000 in pension income each year to fund a moderate retirement, compared to just one year ago, according to industry body the Pensions And Lifetime Savings Association. This lifestyle now costs £31,300 a year post tax, it warns.

The 63-year-old, who lives in Acton, West London, and worked at a large British bank in risk and finance for most of his life, has been volunteering at a community cinema and decided not to return to his previous career. ‘I don’t need to match the earnings I had in my previous job, I can earn less or just enough to supplement my pensions. So I want to do something I have never done before, like running a small local business or working in events management.

‘It wouldn’t make sense to go back into the banking world with all these bright young 30-year-olds.’

Peter says he is now prepared to work well beyond state pension age to ensure his pension is big enough when he decides to retire for good. ‘It was a sudden realisation that I do need to keep working. We are all living for longer so the money has to stretch further and we don’t have the generous defined benefit pensions previous generations have been able to rely on,’ he says.

The behavioural pensions research, done in conjunction with asset manager State Street Global Advisors, found that 30 per cent of those taking part in the interviews had retired and subsequently returned to the workforce.

The key trigger was watching the value of their savings pot decrease, it says. In these cases, they did not want to increase their drawdown withdrawal amount as they were worried that the money would run out too quickly.

Almost half of working adults have changed their retirement plans because of the cost-of-living crisis, new research from the Pensions Management Institute (PMI), a trade body, shows.

One in four are set to delay retirement, while millions have reduced the amount they pay into their pensions to be able to keep up with rising costs. Phil Brown, director of policy at People’s Partnership, provider of The People’s Pension, says: ‘The fact that an increasing number of early retirees are returning to the workplace is a reminder of how important retirement planning is and that so many savers need support when it comes to how they access their pension pot.’

Alistair Byrne, head of retirement strategy at State Street Global Advisors, says: ‘The cost-of-living crisis created by high inflation and markedly higher interest rates is forcing retirees to rethink their approach.’

Three quarters of people in the UK believe that a hard-stop, where you go from working full time to being completely retired, is becoming less common, a survey commissioned by digital bank Chetwood Financial finds.

Nearly seven in ten say they envisage doing some part-time work in ‘retirement’ as the ability to fully retire is becoming a privilege that only the wealthy can afford.

Andy Mielczarek, chief executive of online savings platform SmartSave, says: ‘The research highlights that for millions of UK employees, the way they think about retirement is evolving. For many, it is no longer black and white – part-time work in later life will play a big part in how they transition into retirement, and this is not always a financial necessity – there are a lot of people who want to keep working.’

At age 86, Alice Portnoy is still busy working for her own business. Alice, who lives in London, retrained as a jeweller after she retired in 2006 from a long career in corporate marketing.

She went back to school and took a BTech degree to learn how to craft jewellery. Eight years ago, Alice launched her business and sells her handmade pieces at craft fairs and markets in London most weekends. The business, My Jewellery Wardrobe, brings in about £4,000 in profit each year, she says, which is a valuable top-up for her pension. Her items typically sell for between £50 and £150 – with her most expensive piece going for £400. ‘It is a good boost for me and I love what I do,’ she says. ‘It’s really important as you get older to have something that you enjoy doing and I will continue to do it for as long as I’m able to.’

Suzanne Noble, founder of Startup School for Seniors, a Government-funded online programme that helps the over-50s set up their own businesses, says an increasing number are looking for a second income to bolster their pension in retirement. Many are able to make money from a hobby they have enjoyed their whole lives rather than trying to fit back into their old working routine.

‘The most successful are the ones who think ahead about retiring in a couple of years and want to build the financial stability they know they are going to need once they do. Planning really helps, especially if you are in your early-60s.’

Laurence Collier, a retired London cab driver and insurance broker, says day-to-day expenses have increased enormously since he retired ten years ago. The 74-year-old worked for an insurance company by day and drove a cab at night as an extra source of income for nearly 20 years, so he knows a thing or two about money-making side gigs. A worsening visual impairment means that Laurence can no longer drive a taxi.

Though technically retired, he still makes money where he can and has been able to monetise his health problems. He works at a company that trains junior doctors who are attempting to pass tests. He allows them to run tests on his eyes ahead of their ophthalmology practical exams. The courses last six weeks and pay £60 a day, he says. ‘I get paid for doing nothing. It’s no fortune but it comes to about £1,000 a couple of times a year in cash, with no taxes because it is paid as an incentive,’ he says.

‘The cost of living is going up like crazy so it all helps. We go to Lidl, we don’t shop at Harrods or Waitrose, but you notice that everything is so expensive now.’

Laurence says the cost of his weekly shop has gone up from £80 to £120-130 a week today and he and wife Sue have reduced how much they treat themselves to eating out. ‘The cost of going out to eat is ridiculous,’ he says. ‘We used to go out nearly every Saturday night, we now go out once a month and I fear it’s just going to get worse.’

Laurence and Sue also top up their income by taking part in companies’ market research sessions. These pay around £100 per day and they take part in about two a week, as they are signed up with a dozen agencies.

‘I have rental income, annuities, I saved into a private pension as well as my workplace one so I’m in a relatively good position and yet we’re still struggling,’ says Laurence.