MILLIONS of workers will be worse off due to a tax change confirmed in today’s Spring Budget.

Budget documents confirm a freeze on income tax and National Insurance thresholds until 2028 will go ahead.

Jeremy Hunt first announced the move during last November’s Autumn Statement.

The freeze was meant to come to an end in 2026, but extending this will drag millions more into paying a higher rate of tax.

That’s because inflation and rising wages will mean more workers will go over the thresholds for paying tax at 40%.

Thresholds usually increase regularly to take both of those things into account.

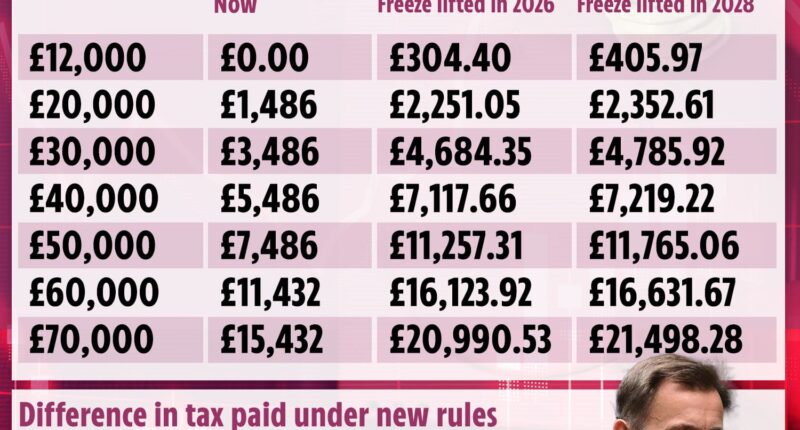

The extended freeze means someone on the average UK salary of £33,000 will be paying almost £2,557 more income tax between now and 2028.

The basic rate of income tax currently kicks in on earnings over £12,571, and the higher rate of 40% at £50,271.

It comes:

Spring Budget at a glance

National Insurance is a separate tax on your earnings and is deducted from your wages each month.

Most read in Money

You pay National Insurance if you’re 16 or over and either:

- an employee earning above £242 a week

- self-employed and making a profit of £6,725 or more a year

Although these rates are no rising, a freeze until 2028 is a stealth tax and is expected to bring in £30billion a year for the taxman by 2026.

A stealth tax is a form a tax collected in a way that isn’t obvious.

While the government doesn’t change the headline rate, you end up paying more money.

When Mr Hunt first made the announcement last year he said: “I am maintaining at current levels the income tax personal allowance, higher rate threshold, main national insurance thresholds and the inheritance tax thresholds for a further two years taking us to April 2028.”

How will the income tax freeze affect me?

Essentially, inflation and pay increases will mean more people being dragged into higher bands.

The UK’s rate of inflation in January fell to 10.1%, while regular pay in rose by 6.5% from November 2022 to January.

Put simply, this means that with wages steadily climbing, more people will become higher rate taxpayers and see a portion of their pay disappear.

Someone with the average UK salary of £33,000 will be paying almost £2,600 more income tax due to the freeze – a 10% increase – according to AJ Bell.

Those earning £50,000, and so hovering just under the current higher-rate threshold, will be hit the hardest.

It is estimated that they will be paying £6,570 more in income tax over the entire period of the tax freeze.

That represents a 17% increase in their income tax bill over that period.

As part of today’s Spring Budget Mr Hunt has extended the current £2,500 Energy Price Guarantee until July.

He has also confirmed two Universal Credit changes for working parents which will see them save hundreds of pounds a year.

For live updates on the Spring Budget follow our blog.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]