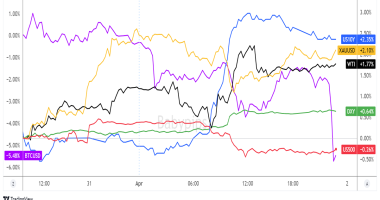

After spending most of the week in the green, the Greenback falls on Friday as risk sentiment improved on stimulus and recovery hopes, closing USD mixed for the week.

United States Headlines and Economic data

Monday:

ISM Manufacturing PMI at 58.7 in January vs. 60.5 in December

IHS Markit U.S. manufacturing PMI hits record high at 59.2

“The seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers’ Index posted 59.2 in January, up from 57.1 in December and broadly in line with the earlier released ‘flash’ figure of 59.1. The latest data signaled a substantial improvement in operating conditions among manufacturers, and the most marked since data collection began in May 2007.”

Fed officials say U.S. economy still in depths of recession, more relief needed

Fed’s Kashkari says need to keep up support for economy

“The key now is for the Federal Reserve to keep our foot on the monetary policy gas until we really have achieved maximum employment as we call it,” Kashkari said. “And I think it’s going to be important for Congress to continue to be aggressive supporting people who have been laid off, supporting small businesses until we really get the pandemic behind us and restore the economy.”

CBO sees rapid growth recovery, labor force returning to pre-pandemic level by 2022

“Importantly, the CBO said its rosier projections do not assume any new stimulus, including President Joe Biden’s $1.9 trillion plan.”

“The CBO projects the unemployment rate to fall to 5.3% in 2021 and to 4% between 2024 and 2025.”

Tuesday:

Wednesday:

U.S. private payrolls rebounded in January – ADP

“The ADP National Employment Report showed private payrolls increased by 174,000 jobs last month after dropping by 78,000 in December. Economists polled by Reuters had forecast private payrolls would rebound by 49,000 in January.”

ISM Services PMI at 58.7 for January, above December’s read of 57.7

Sharp upturn in business activity amid stronger client demand – IHS Markit

“The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 58.3 in January, up from 54.8 in December and higher than the earlier released ‘flash’ estimate of 57.5. The rate of growth was the second-sharpest in almost six years, with firms linking the upturn to stronger client demand and an increase in new business.”

Thursday:

Fed’s Evans sees price spikes ahead, but policy steady

“It will be critical for monetary policymakers to look through temporary price increases and not even think about thinking about adjusting policy until the economic criteria we have laid out have been realized,” Evans said in remarks prepared for delivery to the Oakland University School of Business Administration, in Rochester, Michigan. “So I see us staying the course for a while.”

New U.S. jobless claims totaled 779,000 last week, the lowest since late November. – “The total of those receiving benefits fell sharply to a still-elevated 17.8 million.”

U.S. factory orders beat expectations in December

“The Commerce Department said on Thursday that factory orders increased 1.1% after surging 1.3% in November. Economists polled by Reuters had forecast factory orders gaining 0.7% in December. Orders dropped 6.6% year-on-year.”

U.S. Senate Democrats prepare to push through Biden’s $1.9 trillion COVID-19 package

U.S. productivity posts biggest drop since 1981 in fourth quarter – “Data for the third quarter was revised higher to show productivity growing at a 5.1% pace instead of the previously reported 4.6% rate. Productivity rose 2.6% in 2020 compared to 1.7% in 2019.”

January 2021 Job Cuts Report: Cuts Rise Slightly to 79,552

“January’s total is 17.4% higher than the 67,735 cuts announced in the same month last year. It is the highest January total since 2009, when 241,749 cuts were announced.”

Friday:

U.S. Payrolls barely grow to start 2021 even as the unemployment rate fell to 6.3%

“Job growth returned to the U.S. in January, with nonfarm payrolls increasing by 49,000 while the unemployment rate fell to 6.3%, the Labor Department said Friday in the first employment report of the Biden administration.”

“Economists surveyed by Dow Jones had been looking for growth of 50,000 and the unemployment to hold unchanged at 6.7%. However, many analysts on Wall Street had been looking for higher numbers; Citigroup had projected a gain of 250,000.”

U.S. Trade Plunges To Lowest Point Since 2008 Financial Crisis, A Worrying Sign For The Economy

“Exports plunged 15.7% to $2.1 trillion, while imports fell 9.5% to $2.8 trillion, signaling that both businesses and consumers have sharply pulled back.”

This post first appeared on babypips.com