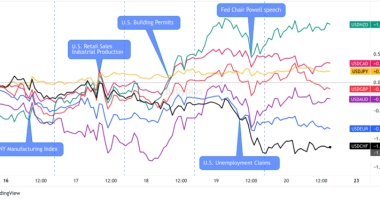

Traders didn’t waste no time getting back to work after the holidays, pushing markets around right from the jump of the new year. It was a mix of repricing monetary policy developments from major central banks and reacting to geopolitical and top tier economic events that had markets notably moving with strong biases in most cases, but a bit of unusual relative behavior. This resulted in equities and gold closing out the week in the red, while the U.S. dollar, bitcoin and oil drew in buyers and traded most of the week in the green.

This Article Is For Premium Members Only

Become a Premium member for full website access, plus get:

- Ad-free experience

- Daily actionable short-term strategies

- High-impact economic event trading guides

- Access to exclusive MarketMilk™ sections

- Plus More!