The Hut Group’s shares jumped nearly 50 per cent as it became the latest British firm to be targeted by private equity predators.

The online retailer – now known as THG and owner of websites Lookfantastic and Myprotein – said it has received a ‘highly preliminary and non-binding indicative proposal’ from Apollo Global Management.

The move came as takeover fever gripped the City with oilfield services firm John Wood Group and payments provider Network International – both FTSE 250 companies – also in the crosshairs yesterday.

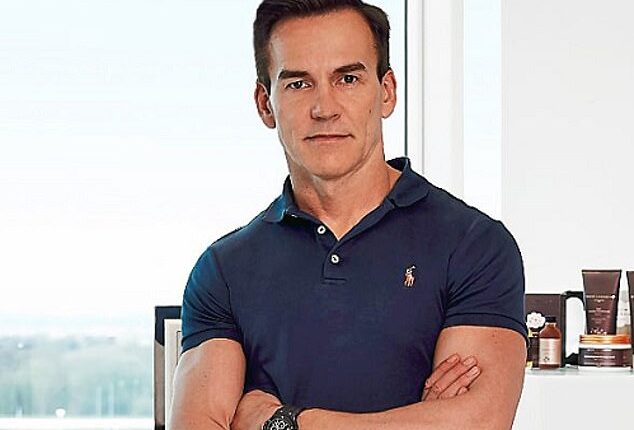

The swoop on THG from one of the world’s biggest buyout groups follows a torrid time for the company and its founder Matt Moulding since its float on the stock market in London in September 2020.

Private equity swoop: THG – founded by Matt Moulding (pictured) – said it has received a ‘highly preliminary and non-binding indicative proposal’ from Apollo Global Management

Its shares listed at 500p valuing it at £5.4billion, and peaked close to 800p in early 2021. But they were changing hands for little more than 30p last year and having closed up 44.9 per cent, or 29.66p, yesterday following Apollo’s approach were still worth just 95.76p.

That gave THG – which publishes annual results today – a value of £1.2billion.

Moulding (pictured), who pocketed £830million in the THG float, has made no secret of his feelings since listing on the stock market, saying the experience has ‘just sucked from start to finish’.

He claims to have rejected ‘numerous’ takeover approaches in the past amid speculation he wants to buy back the company he co-founded and has run since 2004.

Under City takeover rules, New York-based Apollo must make a firm offer for the embattled online retailer by May 15 or walk away.

Apollo is also pursuing oil services group John Wood Group and having seen four offers rejected has been given until next month to thrash out a deal.

Other London-listed firms such as Dignity, Hyve and Dechra Pharmaceuticals have been gripped in talks about potential takeovers in recent weeks.

The flurry of activity – which follows a wave of ‘pandemic plundering’ after Covid – has sparked fears British companies are being bought on the cheap.

Danni Hewson, head of financial analysis at investment platform AJ Bell, said: ‘UK equities are a tempting target for private equity looking to bag a bargain.

‘But the trick for intended targets is to make sure they play the game well enough to ensure British jewels aren’t being sold on the cheap.

‘Playing the game isn’t likely to be high on the agenda in the boardroom at THG. The ecommerce retailer hasn’t exactly enjoyed its time as a public company, so news of a takeover bid is likely to have been welcomed with open arms.

‘Moulding has been incredibly vocal about his unhappiness with life on the London Stock Exchange, so potential suitor Apollo is likely to find him receptive to a fair offer.’

Activist investor Kelso, which snapped up a small stake in THG in January, said it would ‘monitor this situation closely’.

‘The gap between the intrinsic value and the actual listed value is large,’ Kelso chief executive John Goold said, when asked if THG should be taken private last week, adding he ‘would be extremely disappointed if the uplift in the narrowing of the value gap was not enjoyed by public market investors as THG gets back on track in 2023’.

Analysts at Liberum hiked their rating on the stock to ‘buy’ yesterday, highlighting ‘just how cheap the shares are’.

It gave THG shares a target price of 220p, well above current levels but less than half its value when it listed.

…And that won’t be the end of Apollo’s spree

By LEAH MONTEBELLO

One of the world’s biggest private equity companies, Apollo has made its intentions in Britain clear.

On a day when it emerged that Apollo was chasing both The Hut Group and John Wood Group, the New York-based buyout firm revealed it is bringing together staff from two sites in London to a new headquarters in the capital for its European operations.

Chief executive and co-founder Marc Rowan said: ‘London has always been our European hub and continues to be.

Bargain Britain: UK-listed firms have been targeted by foreign investors thanks to their cheap valuations

‘It is an important global financial centre with a great ecosystem built around it.’ The move suggested Apollo – whose former boss and co-founder Leon Black left in 2021 over his connections to convicted paedophile Jeffery Epstein – has further plans in Britain beyond its swoop on THG and Wood.

UK-listed firms have been targeted by foreign investors thanks to their cheap valuations.

Shares in oil services firm Wood jumped 6.7 per cent yesterday after it said there could be merit in the final takeover proposal from Apollo, valuing it at £1.7billion.

The Aberdeen-based group told shareholders it will open up its books and ‘engage’ with the US suitor to firm up a fifth and final 240p per share offer.

Last year, Apollo failed to scoop up educational publisher Pearson in a £6.7billion deal.

It also lost a bidding war for supermarket Morrisons in 2021 and bookie William Hill in 2020.

Former chief executive Black left the group over his long association with Epstein.

A review found that Black had paid the sex offender £128million for financial advice from 2012 through 2017.