THOUSANDS of people could be hit with huge tax bills after interest charged for late tax payments is hiked again.

HM Revenue & Customs (HMRC) charges interest on unpaid taxes and the rate is linked to the Bank of England base rate.

The central bank has recently increased rates by 0.5 percentage points from 4.5% to 5%.

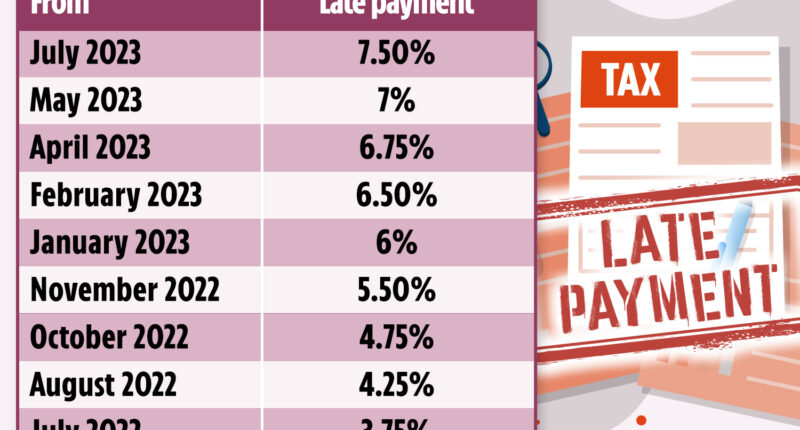

This means that customers who don’t pay their taxes on time will now face a 7.5% late payment fee, up from the current rate of 7%.

HMRC said: “The late payment interest rate encourages prompt payment.

“It ensures fairness for those who pay their tax on time.”

This will affect late payments for the majority of personal taxes and will affect the millions of people who have to file their own tax return.

Taxes include income tax, national insurance contributions, capital gains tax, stamp duty and inheritance tax.

The increased rate will come into effect on July 3.

You’ll be liable for late payment charges from the date the payment was due until the date at which HMRC receives the payment.

Most read in Money

How is the late payment interest rate calculated?

HMRC links its interest rates on late payment charges with the Bank of England’s base rate.

Late payment interest is set at the base rate plus 2.5%.

The Bank of England increased interest rates to their highest level since 2008 this week.

It is the thirteenth time in a row that rates have been raised since December 2021 when they were at historic lows.

How to avoid the high fee

The best thing you can do to avoid the new late repayment fee is to make sure your taxes are paid up on their set due date.

You’ll only be charged the repayment interest rate if you pay up on time which will be 3.5% points lower than the late repayment fee.

How do you know if you need to submit a tax return?

Self-assessment is a system HMRC uses to collect income tax.

Tax is usually deducted automatically from wages, pensions and savings, but people and businesses with other incomes must report it in a tax return.

This applies to the following:

- Earned more than £2,500 from renting out property

- You or your partner received high income child benefits and either of you had an annual income of more than £50,000

- Received more than £2,500 in other untaxed income, for example from tips or commission

- Are self-employed sole traders

- Are limited company directors

- Are shareholders

- Are employees claiming expenses in excess of £2,500

- Have an annual income over £100,000

Before you can complete and submit your tax return, you’ll need to have a so-called unique taxpayer reference (UTR) and activation code from HMRC.

This can take a while to receive, so if it’s the first time you’re completing self-assessment, make sure you register online immediately and ask HMRC for advice.

To sign in or register visit the “Self Assessment tax return” section of HMRC’s website.

If you’ve already signed up for self-assessment, you can find your UTR on relevant letters and emails from HMRC.

HMRC accepts your payment on the date you make it, not the date it reaches its account – including on weekends.

If you need to change your tax return after you’ve filed it, you can do so within 12 months of the original deadline or you can write to HMRC for any changes after that.

Filling in your tax return can seem daunting, but with our step-by-step guide you’ll have it sorted in no time.

What to do if you can’t pay right now

You should get in touch with HMRC and let them know you’re having issues. They may allow you to spread your payments.

Citizens Advice recommends that you ask to talk about a “time to pay agreement”.

An agreement will give you either more time to pay, or a schedule to pay your tax in instalments.

It’s a good idea to do this rather than bury your head in the sand.

You can contact HMRC online or by phone on 0300 200 3300.

You can also write to them at:

Pay As You Earn and Self Assessment

HM Revenue and Customs

BX9 1AS

United Kingdom