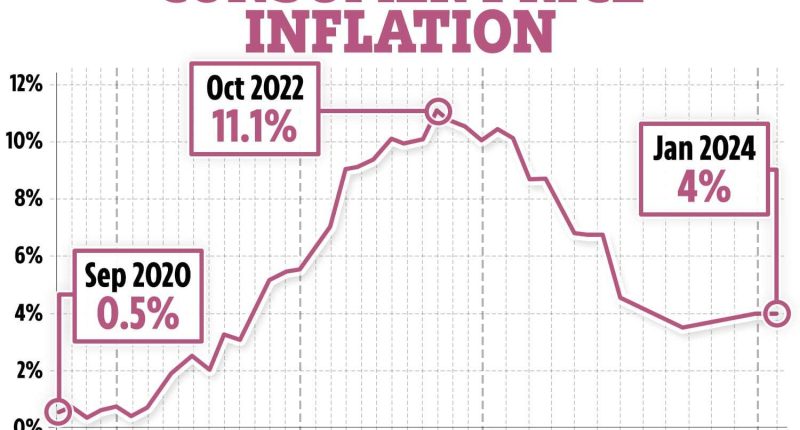

INFLATION unexpectedly held steady last month as food prices fell for the first time in almost two-and-a-half years.

The annual rate at which prices are rising stayed at 4% last month, figures from the Office for National Statistics (ONS) show.

This was lower than the 4.2% that economists had forecast in a boost for Prime Minister Rishi Sunak.

The Prime Minster said the “economy has turned the corner” at the first meeting of the Business Council in Downing Street

He said: “I absolutely believe that the economy has turned the corner and we’re now pointing in the right direction.

“Hopefully that’s something that you’re seeing in your businesses, but inflation has been more than halved from 11% down to 4%, mortgage rates are starting to come down.

READ MORE IN MONEY

“Everyone is predicting us to grow this year.”

Despite this, inflation is still double the Bank of England’s 2% target.

It comes after the rate of inflation rose unexpectedly to 4% at the end of last year.

It was the first time it had increased since February 2023 and has come as a surprise to many economists.

Most read in Money

The latest figures show prices are rising at the same rate as the month before.

Inflation is a measure of how the price of goods and services has changed over the past year.

The monthly drop in food prices, of 0.4%, was the first since September 2021, with the cost of bread and cereals, cream crackers and chocolate biscuits falling, the ONS said.

While food and non-alcoholic beverage prices are still 7% higher than a year ago, the category saw the slowest rate of increase since April 2022.

On a monthly basis, food and non-alcoholic beverage prices fell by 0.4% between December and January.

Most of this drop was down to a 1.3% decrease in bread and cereal prices – the largest in that category since May 2021.

The ONS said seven out of 11 types of food and non-alcoholic beverages it tracks put downward pressure on the inflation figure last month.

But despite the most recent fall, food and non-alcoholic beverages are around 25% more expensive than they were in January 2022. In the entire decade before that, prices only rose around 10%.

Grant Fitzner, chief economist at the ONS, said: “Inflation was unchanged in January reflecting counteracting effects within the basket of goods and services.

“The price of gas and electricity rose at a higher rate than this time last year due to the increase in the energy price cap, while the cost of second-hand cars went up for the first time in May.”

Ofgem’s energy price cap rose from £1,834 to £1,928 on January 1.

It means the average household will now see their annual bill increase by £94.

Ofgem will review its price cap again on January 23 for the period from April 1 to June 30.

Inflation eased throughout 2023, down from the eye-watering 11.1% seen in October 2022, which was driven by soaring gas and electricity prices.

It comes ahead of the Spring Budget on March 6 and there is speculation that tax cuts could be on the way.

The Budget is when the Government outlines its plans for tax hikes, cuts and things like changes to Universal Credit and the minimum wage

Suren Thiru, economics director at ICAEW, told The Telegraph that large tax cuts could “risk pushing the Bank of England to keep policy tighter for longer by refuelling concerns over inflation”.

Chancellor Jeremy Hunt said: “Inflation never falls in a perfect straight line, but the plan is working.

“We have made huge progress in bringing inflation down from 11%, and the Bank of England forecast that it will fall to around 2% in a matter of months.”

Economists’ thoughts immediately turned to what this could mean for the Bank of England’s decisions in the months ahead.

The Bank hikes interest rates in a bid to control inflation, pushing up borrowing costs for millions of homeowners.

In January it kept interest rates unchanged at 5.25% following the recent drop in the inflation rate.

It had forecast that inflation would be 4.1% last month, so it might conclude that its measures to combat inflation are working better than previously thought.

Interest rates are currently at their highest levels in 16 years in order to keep a lid on runaway inflation.

What it means for your money

High inflation means the cost of everyday essentials, like food and energy are rising, meaning your money doesn’t go as far.

Flat inflation will come as a blow for mortgage holders and prospective buyers waiting on tenterhooks for interest rate cuts to soften the blow from high mortgage rates.

Alice Haine, personal finance analyst at Bestinvest said: “Many households will have started 2024 feeling financially squeezed with pandemic savings used up and significantly higher living costs compared to just a few years ago.

“Once again, the uncertain economic climate signals that spending should remain constrained and emergency funds kept topped up to ensure households survive any further financial shocks.”

Alice added that a small fall in food inflation will come as a small relief to struggling households.

She said: “Food inflation continued to retreat – edging down to 6.9% from 8% in December – a reflection of supermarket price wars as major players ramp up loyalty scheme discounts to win market share.”

Meanwhile, the latest figure may also be a blow for mortgage holders and prospective buyers desperately hoping for interest rate cuts.

READ MORE SUN STORIES

Mortgage rate cuts were being cut at the beginning of the year when lenders battled it out for business.

But the market is more mixed now with some lenders upping mortgage rates over the past week as they react to the turbulent swap rate market, which can determine fixed-rate pricing.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories.