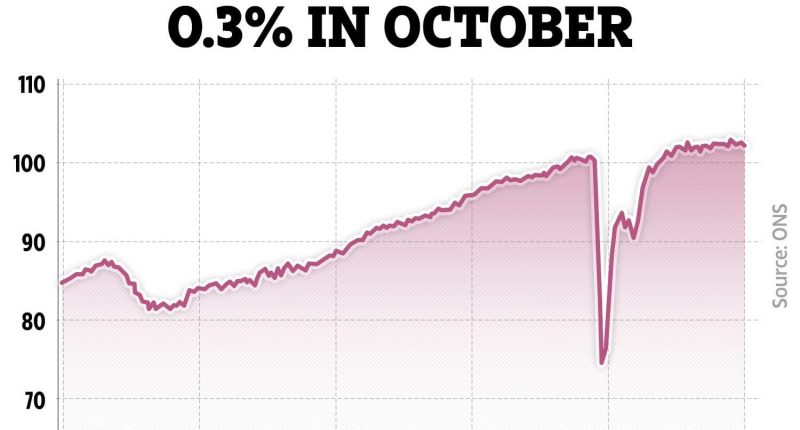

THE UK economy shrank in October, latest figures from the Office for National Statistics (ONS) show.

Gross domestic product (GDP) fell by 0.3% in October, down from 0.2% growth in September, the ONS said.

It came as all three of the main sectors that the ONS tracks fell into negative territory for the first time since July.

Economists had expected GDP to contract by just 0.1%.

The figures may reignite concerns that the UK economy is heading for recession.

If GDP drops for two consecutive quarters it is defined as a recession, which leads to job losses and wages stalling.

Read more on money

The UK last went into recession in 2020 after the coronavirus pandemic hit, shutting down large parts of the economy.

ONS director of economic statistics Darren Morgan said: “Our initial estimates suggest that GDP growth was flat across the last three months.

“Increases in services led by engineering, film production and education – which recovered from the impact of summer strikes – were offset by falls in both manufacturing and housebuilding.

“October, however, saw contractions across all three main sectors.

Most read in Money

“Services were the biggest driver of the fall with drops in IT, legal firms and film production – which fell back after a couple of strong months.

“These were also compounded by widespread falls in manufacturing and construction, which fell partly due to the poor weather.”

It comes after the UK economy showed no growth between July and August.

The numbers were more positive towards the end of the summer, when GDP increased by 0.3% in the three months to August.

GDP measures the value of goods and services produced in the UK.

It also estimates the size and growth of the economy.

Lindsay James, investment strategist at Quilter Investors said today’s figures could put pressure on the Bank of England ahead of tomorrow’s interest rate decision.

She said: “While no rate cuts are expected tomorrow, or for some time, it will be crucial to see how the BoE is monitoring economic growth going forward and what that might mean for the path of interest rates.

“Calls for rate cuts are likely to grow stronger should this sort of economic data persist.”

The Bank of England’s Monetary Policy Committee (MPC) opted to hold the current base rate at 5.25% in November.

The BoE base rate is often used by high street banks to set the rates they offer to customers on things like loans, savings and mortgages.

So higher interest rates are painful for British households, companies and the government because it makes debt repayments and mortgage bills more expensive.

What does it mean for my money?

A healthy economy is one that is growing and not in recession.

Recession occurs if there are two consecutive quarters of GDP falling, the year is split into four three-month quarters.

The economy flatlined in the three months to September, which means a recession was avoided.

Recessions are bad news because it usually means jobs will be lost and wages will stall.

Alice Haine, Personal Finance Analyst at Bestinvest, said: “A recession can have dire consequences for people’s finances as a weaker economy can cause earnings to stagnate or drop and redundancies to ramp up as companies focus on reducing costs rather than investing in expansion and new hires.

“The potential of a downturn, set against a backdrop of still high borrowing and living costs, which eat into disposable incomes and leave people with little money to spare for the luxuries in life, would deliver yet another blow to household finances already battered by a barrage of rising bills.”

It can cause businesses to go into administration or bust too.

This, in turn, means the government gets less tax, which could mean cuts to public services and benefits such as Universal Credit. Tax rates might go up too.

How to protect your finances

If you’re worried about your finances, there are steps you can take to try and keep your cash safe.

Having an emergency savings pot is helpful in times of high inflation, to help cover any outgoings that might have increased unexpectedly.

You might consider asking for a pay rise at work, but there are no guarantees your company is in a position to offer one.

Be sure to make savings where you can – shop around for better deals on your car and home insurance, as well as broadband and mobile phone.

Save money by going to a cheaper supermarket, shopping for own-brand rather than premium products, and looking out for yellow-sticker bargains.

Make a budget and check your bank statements for any forgotten subscriptions you might be wasting money on.

Making extra cash in your spare time can help too, picking up a side hustle or selling your old clothes could give you a boost.

When money is tight, it can be tempting to ignore debts – but this will only make your financial situation worse.

Stay on top of what you owe and always repay priority debts.

There are also plenty of organisations where you can seek debt advice for free.

These include:

- National Debtline – 0808 808 4000

- Step Change – 0800 138 1111

- Citizens Advice – 0808 800 9060

You should also check what benefits you are eligible for.

Entitledto’s free calculator works out whether you qualify for various benefits, tax credits and Universal Credit.

There is also emergency funding available for struggling households, which is dished out by local councils.

Read more on The Sun

The Household Support Fund is designed to help those in most need with payments towards the rising cost of food, energy, and water bills.

You could also get similar help from your council under the welfare assistance scheme.

You can also join our new Sun Money Facebook group to share stories and tips and engage with the consumer team and other group members.