Start your trading prep with an overview of catalysts coming up. I’ve got some chart setups to keep tabs on, too!

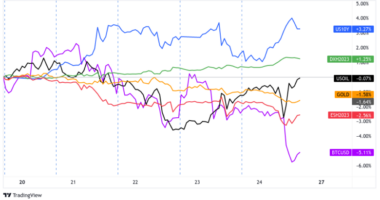

Take a look at how the majors performed recently and the upcoming catalysts to watch out for:

Major FX Pairs Overview

USD

It could shape up to be an exciting trading week for the scrilla, as the FOMC will be releasing the minutes of its latest policy meeting prior to the December NFP report being printed. Read more

CAD

Canada’s employment report is due later in the week, but volatility could pick up earlier since the OPEC-JMMC meetings would likely impact crude oil price action. Read more

EUR & CHF

A handful of mid-tier reports are lined up from the eurozone’s top economies, and the flash inflation reports are also on the docket. Meanwhile, the franc might take cues from overall market sentiment. Read more

GBP

Sterling is now dealing with the post-Brexit world and a fresh set of lockdown measures in several parts of the U.K., so traders could turn to BOE head Bailey’s speech for more clues on what the central bank is up to. Read more

JPY

There are no major reports due from the Japanese economy, which leaves the yen extra sensitive to risk flows throughout the week. Read more

AUD

The coast is clear in terms of economic reports from the Land Down Under, so Aussie pairs might react to counter currency action or overall market sentiment. Read more

NZD

There are also no major reports due from New Zealand throughout the week, which means that risk appetite could be the main driving factor for Kiwi pairs. Read more

Forex Charts to Watch:

AUD/USD: 1-hour

First up is this break-and-retest setup on the short-term chart of AUD/USD

The pair has formed higher lows connected by a rising trend line since mid-December last year, and it looks like another bounce off the support area is in order.

The Fibonacci retracement tool shows that the 61.8% level lines up with the trend line and the 200 SMA dynamic inflection point where several buyers might be waiting.

Stochastic is already turning higher, though, suggesting that bulls are ready to charge. In that case, the 38.2% Fib at .7670 or the 50% level at the .7650 minor psychological mark could be enough to keep losses in check.

NZD/JPY: 1-hour

Here’s another trend setup for y’all!

NZD/JPY is also cruising higher after recently busting through the resistance at the 74.00 major psychological level.

A break-and-retest situation could be unfolding as price retreats to this area of interest, which coincides with the 38.2% Fib. Technical indicators confirm that support is more likely to hold than to break, with the 100 SMA above the 200 SMA and Stochastic already heading north.

EUR/AUD: 1-hour

Fancy a channel setup? Here’s a neat one on EUR/AUD.

The pair is moving inside a descending channel on its 1-hour chart and is currently testing support. A bounce could take it back to the top of the channel where bears are likely hanging out.

Stochastic is starting to turn lower to suggest that sellers are eager to return, possibly allowing the mid-channel area of interest to keep gains in check.

A larger pullback could reach the 61.8% Fib around the broken support at 1.6050, which happens to be near the dynamic resistance at the moving averages.