Start your trading prep with an overview of catalysts coming up. I’ve got some chart setups to keep tabs on, too!

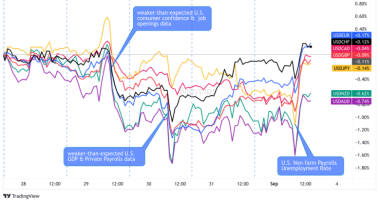

Take a look at how the majors performed recently and the upcoming catalysts to watch out for:

Major FX Pairs Overview

USD

Economic data from Uncle Sam turned out mixed, but it was the political ruckus in the U.S. Capitol that led to a rough start for the Greenback this year.

The focus could turn to the U.S. CPI and retail sales figures lined up this week, but it’s likely that sentiment and political updates would stay in play. Read more.

CAD

The Loonie was all over the place as the currency was pushed around by crude oil prices, counter currency action, risk sentiment and mostly downbeat data from Canada.

The BOC Business Outlook Survey is the only report on the docket, which leaves the Canadian currency sensitive to other market factors. Read more

EUR & CHF

The resurgence in COVID-19 cases in the region once again weighed on the shared currency, along with the implementation of stricter lockdown measures.

ECB head Lagarde is due to give a couple of testimonies early in the week while the central bank policy meeting minutes are up for release. Political troubles in Italy are back in the headlines, too. Read more

GBP

So much for a strong finish in 2020! Sterling found itself down in the dumps for the first week of 2021 as it reeled from tighter lockdown measures and downbeat PMI readings.

A couple of MPC members are due to testify this week while the U.K. economy is scheduled to print its November GDP and industrial production figures later on. Read more

JPY

Risk-taking weighed on the Japanese currency at the start of the year, as traders appear to be focused on global vaccine rollout efforts.

There are no major reports due from the Japanese economy once again, which could keep yen pairs sensitive to market sentiment. Read more

AUD

The Aussie took the top spot last week as it carried on with the positive momentum from 2020 and the pickup in risk-taking early this year.

There are no major reports due from the Land Down Under in the next few days, so another round of risk-taking could mean more gains for the higher-yielding currency. Read more

NZD

The Kiwi also soared to the top of the forex charts as it was able to benefit from stronger demand for higher-yielding currencies.

It’s another light week in terms of data from New Zealand, but it looks like the effective response to the pandemic could keep lifting their currency in the meantime. Read more

Forex Charts to Watch:

AUD/USD: 4-hour

Aha! It looks like a repeat of last week’s AUD/USD pullback setup!

If you recall, the pair already dipped to this rising trend line and made a strong bounce earlier on. Another correction is underway, and technical indicators hint that the support could hold again.

Price is already testing the 50% Fibonacci retracement level, but a deeper pullback might still be in order since Stochastic has a bit of room to fall before indicating oversold conditions.

Turning higher could confirm that buyers are ready to defend support and push AUD/USD back up to the latest highs and beyond. After all, the 100 SMA is safely above the 200 SMA to show that the uptrend is likely to carry on.

NZD/JPY: 1-hour

Here’s another trend continuation play that we’ve looked at recently. NZD/JPY is still cruising above its rising trend line and is showing another pullback opportunity.

Applying the handy-dandy Fib retracement tool reveals that the 61.8% level lines up with the trend line support, which is right around the former resistance zone at 74.50-74.75.

This is also spanned by the dynamic support levels at the moving averages, with the faster-moving 100 SMA above the 200 SMA to suggest that a bounce is likely to follow.

GBP/NZD: 1-hour

Who’s in for a break-and-retest setup? Here’s one on GBP/NZD!

The pair recently fell through support at the 1.8850 minor psychological mark then dipped to a low of 1.8625 before pulling up.

Sellers appear to be defending the 38.2% Fib level already, but a larger pullback could still reach the area of interest at the higher Fibs. Stochastic is starting to turn lower, though, which means that pound bears are returning.

The 200 SMA coincides with the 50% Fib, adding to its strength as resistance. If this is enough to keep gains in check, GBP/NZD could drop back to the latest lows or even lower!