Federal Reserve Chairman Jay Powell said Tuesday that growth in the economy is, in fact, still too robust.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell said in remarks prepared for his two appearances this week on Capitol Hill.

“We have covered a lot of ground, and the full effects of our tightening so far are yet to be felt,” Powell said of the Fed’s program of raising interest rates to slow investment and borrowing. “Even so, we have more work to do.

“There is little sign of disinflation,” he added, referring to a substantial reversal of higher prices.

Many economists now believe interest rates are going to climb so much that — as the key federal funds rate large banks use for overnight borrowing from the Federal Reserve approaches 6% — a recession is likely by the end of the year.

“We still haven’t seen the full effects of the Fed’s tightening,” said Sarah House, a senior economist at Wells Fargo. “As financing becomes more expensive, there’s going to be weaker demand for big-ticket consumer items. And as we see overall spending weaken, profits are going to be squeezed.

“Companies will then start looking at their investments and hiring practices, and that’s where a recession is likely to come from, that tighter [monetary] policy environment,” House said.

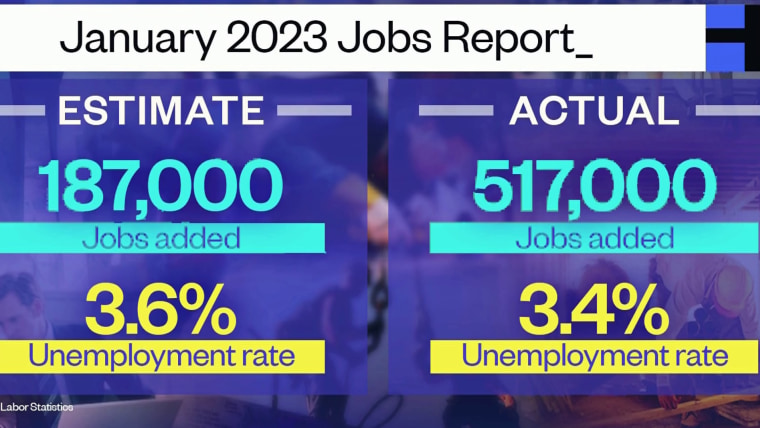

On Friday, the Bureau of Labor Statistics will release its jobs report for February. Economists expect new jobs added to come in at 225,000 — about half of January’s reading. And next Tuesday, the bureau will release the latest inflation data for the U.S. economy. If either figure comes in stronger than expected, it will confirm that the economy is still running hot, and it is likely to make the central bank’s efforts to tackle inflation even harder.

And that would mean more — and higher — interest rates would be in the offing, raising the cost of housing to car loans to credit cards.

Bottom line: If you were one of the lucky ones who hadn’t yet felt their personal finances were under pressure in the past year, it’s possible you may not feel that way for much longer.

Source: | This article originally belongs to Nbcnews.com