A SAVINGS account is “making a comeback” after offering the best interest rates in 10 years.

Cash ISAs are the “comeback kings of 2023”, according to Sarah Coles, Hargreaves Lansdown’s personal finance expert.

Each year, everyone over the age of 16 gets an ISA allowance, which lets them save their cash tax-free.

This means that they can earn interest on their savings in a bank, building society or another financial provider, without paying tax.

The maximum amount you can put away for the 2022/23 tax year is £20,000.

Unlike stocks and shares ISAs, cash ISAs give you a fixed rate of return so you know what you will get back at the end of the deal.

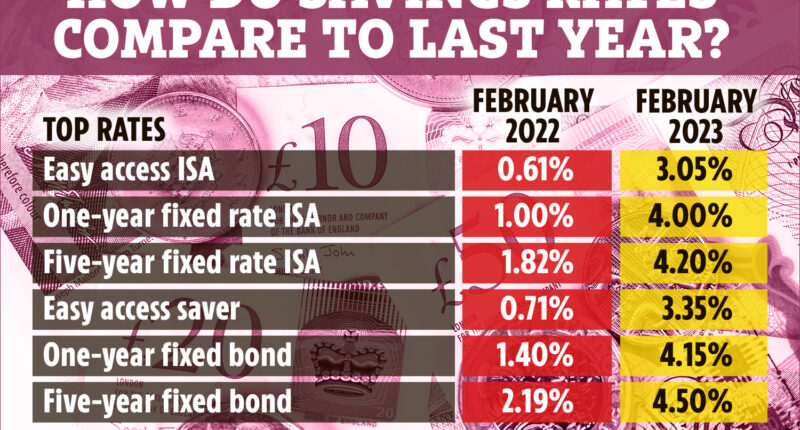

Top cash ISA rates have risen considerably over the past 12 months, across easy access, one-year and five-year fixed terms, according to MoneyFacts.

In February last year, the top rate easy access ISA paid savers 0.61% in interest but the best rate available right now pays five times more at 3.05% with a minimum deposit of £1.

Those who locked into the top one-year fixed rate ISA a year ago will find the equivalent top deal now pays more than four times the amount of interest.

In February last year, the top rate one-year fixed ISA paid savers 1% in interest but the best rate available right now pays four times more at 4% with a minimum deposit of £1.

Most read in Money

The best five-year fixed cash ISA pays savers over two times more compared to last year at 4.20% with a minimum deposit of £1,000.

Unlike with regular savings accounts cash kept in an ISA will continue to earn interest tax-free.

With a regular savings account, basic rate taxpayers have to pay tax on their savings if they earn more than £1,000 in interest annually.

Higher rate taxpayers have to pay tax on savings as soon as they earn more than £500 in interest annually.

This is what’s known as the personal savings allowance which was first introduced in 2016.

Saving rates across the board are on the up after the Bank of England’s consecutive hikes to the base rate.

In February 2022 the key rate stood at 0.5% but it’s now at 4%.

Banks and building societies often use this to work out the interest rates it offers to customers on loans, mortgages and savings accounts.

This is a good thing for savers because banks will typically raise the amount of interest paid on their savings accounts.

But high-interest rates mean that more people will be liable to pay tax on regular savings – making cash ISAs more appealing.

Cash ISAs aren’t right for everyone

Even though cash ISA rates are at the top of their game it’s still important to evaluate if they’re right for you.

Sarah Coles said: “A basic rate taxpayer with £30,000 of savings is better off with a top fixed rate ISA for a year than the equivalent savings account because while the rate is slightly lower, the tax saving makes up for it.”

So if you’re only planning on saving between £1,000 and £10,000 you’ll be better off with a normal savings account.

These accounts pay a smidgen more in interest right now and if you’re saving an amount that doesn’t take you over the personal savings allowance they’re a better option.

Rachel Springall, finance expert at MoneyFacts, said: “It is still possible that savers may forgo using their ISA allowance due to the top returns available outside of an ISA wrapper, as many savers will find their earned interest is protected under the personal savings allowance.”

Martin Lewis has previously warned that many savers should ditch their cash ISA in favour of normal savings accounts.

The MoneySaving Expert said that most would need to save at least £29,000 before they become start being taxed.

In February last year, the top rate easy access account paid savers 0.71% in interest but the best rate available right now is 3.35% with a minimum deposit of £1.

The top rate one-year fixed ISA paid savers 1% in interest a year ago, but the best rate available right now pays 4.15% with a minimum deposit of £50.

And the top rate five-year fixed ISA paid savers 2.19% in interest a year ago, but the best rate available right now pays 4.5% with a minimum deposit of £1,000.

Be aware that is you save into a normal fixed bond or fixed cash ISA you’ll usually be charged a fee to withdraw your cash before the end of the term.

Sarah Coles said: “As a rough rule of thumb, you should be aiming for enough cash to cover 3-6 months’ worth of essential expenses in an easy access account (1-3 years’ worth in retirement).”

How can I find the best savings rates?

With your current rates in mind, don’t waste time looking at individual banking sites to compare rates – it’ll take you an eternity.

Research websites like MoneyFacts and price comparison websites such as Compare the Market, Go Compare and MoneySupermarket will help save you time and show you the best rates available.

These sites let you tailor your searches to an account type that suits you.

There are five main types of savings accounts, and understanding the differences can help you narrow down the options.

- Easy-access savings accounts – usually allow unlimited cash withdrawals. However, this perk means they tend to come with lower interest returns.

- Regular savings accounts – generate decent returns but only on the basis that you pay in a set amount each month.

- Notice accounts – offer slightly higher rates than easy-access accounts but you’ll need to give advance notice to your bank (up to 95 days) before you can make a withdrawal or you’ll forfeit the interest.

- Fixed rate bonds – these offer some of the highest interest rates. However, if interest rates increase during your term you can’t move your money and switch to a better account.

- Individual savings accounts (ISAs) – these can pay high interest but come with high withdrawal fees. But, Lifetime Isas are great for anyone aged 18-39 hoping to buy a house or save for retirement.