Are you an existing business owner looking to expand your business into Mexico?

You may be a budding entrepreneur with big dreams of owning a business in North America and one in Mexico.

If you are interested in learning what is involved in starting a business in Mexico, including the laws and culture, continue ready for everything you need to know about this exciting business venture.

Why choose to start a business in Mexico?

Deciding to open a business in another country is a big decision. So why choose Mexico to branch out into?

Conducting business in Mexico comes with many perks.

With wages being lower for skilled workers, transportation costs being less than in many places in North America and Mexico being closer to the U.S. and Canada than other countries like China or India, branching out into Mexico may be the right decision for you.

Mexico being part of The North American Free Trade Agreement (NAFTA), which includes Mexico, Canada and the United States, eliminates tariffs between these countries. There are agreements and legal processes concerning international rights for business investors.

Related: Technology Trends Making Entrepreneurs Turn to Mexico

How do you start your business in Mexico?

Now that you have decided it’s the correct business decision to open a business in Mexico, you must ensure you take the proper steps.

It is recommended to hire a Mexican law firm to help with setting up your business as they can help you navigate any red tape that you may run into and provide proper guidance in regards to:

- Zoning and building permits.

- Mexican taxes.

- Environmental regulations.

- Your immigration status.

- Mexican labor laws.

Related: Becoming an Entrepreneurial Expat | International Business | Entrepreneur.com

What are the basics of Mexican labor laws?

As Mexico has strict labor laws to help protect its employees, it is vital to have a Mexican law firm help you navigate these laws.

All conditions and expectations of employees must be written in an employment contract between the worker and the employer. In Mexico, any disagreement between the two parties may result in the employer having to prove their case.

Similar to Canada and the U.S., there are also numerous labor laws involving:

- Child labor.

- Discrimination.

- Harassment.

- Maternity leave.

- Profit sharing.

- Overtime.

- Yearly wage negotiation.

- Vacation time.

- Union regulations (where applicable).

What is Mexican business taxation like?

As Mexico is made up of 32 states, and each state is made up of different municipalities, each level can apply different taxes.

Mexico’s main taxation source is federal taxes, whereas state and municipal taxes aren’t as dominant.

The Tax Administration Service (SAT in Spanish) is the governing body in charge of collecting federal taxes as well as monitoring for compliance. Each state and municipality also have its own treasuries that help enforce its local Tax Law.

So what taxes could you be subjected to as a business owner in Mexico?

Related: Tax Basics For Business Owners | Entrepreneur

Income tax

In Mexico, the income tax (ISR in Spanish) is classified under a corporate tax rate of 30%, while individuals rates range from 1.92% to 35%.

Value added tax

The Value Added Tax (IVA in Spanish) has a standardized rate of 16% with a 0% rate on certain activities.

Related: International Payments and VAT: Facts | Entrepreneur

Special tax

In Mexico, the Special Tax on Production and Services (IEPS in Spanish) ranges from 3% up to 160% or a compound tax.

Social security

As an employer in Mexico, you are subject to social security taxes ranging from 25% to 30% of the employee’s salary.

Real estate or land tax

Mexican states have implemented a Property Acquisition Tax. This means the buyer of a house, land, building, apartment or any other is responsible for paying the tax.

While the tax rate varies from state to state, the average rate is 2%, with rates reaching 6.5% of the sale price in certain states.

Related: How to Leverage Real Estate Tax-Deferral Strategies to Grow your Business | Entrepreneur

Payroll tax

Mexican states have implemented Payroll Tax on wages and other expenses that come from an employment relationship.

The tax rate does vary from state to state but is typically between 2% and 3% of the wage paid.

Resident and non-resident status

How do you know if your business would fall under the resident or non-resident designation for tax purposes?

Continue reading for a description of who is considered a resident and non-resident of Mexico.

Mexican residents

Foreigners are individuals or entities typically taxed under another country due to nationality, address, place of residence or business.

Under Mexican Tax Law, there is a set of rules where a foreigner is considered a resident for tax purposes.

For individuals, if you have a home in Mexico, you are considered a tax resident. If you do not have a home in Mexico, but your “place of professional activities” is located in Mexico or more than 50% of your income comes from Mexico, you are classified as a resident.

In regards to legal entities, any company that is incorporated in Mexico is considered a tax resident. Foreign entities are considered residents when their main business place or corporate address is located in Mexico.

Related: Look Inside Amazon’s Influencer Retreat in Mexico | Entrepreneur

Non-taxable Mexican residents

In some cases, even non-residents may be subject to Mexican taxes.

For example, if a foreign individual or entity has a permanent establishment in Mexico or receives an income from any source located in Mexico, they are then subject to Mexican taxes.

Related: Mexico: A Willing Partner Next Door

Mexican income tax

Depending on whether or not you are considered a resident or non-resident of Mexico, specific income tax rules can apply to some or all of your income.

Your entire income can be subject to income tax if you are classified as a resident.

For non-residents with a permanent establishment in Mexico, the income connected to that permanent establishment may be subject to income tax.

Related: 4 Effective Strategies to Reduce Your Income Taxes | Entrepreneur

Individual income tax

For individuals that are tax residents, they are subject to income tax with a rate of 1.92% to 35% of their annual income, including income from:

- Employment (wages).

- Business and professional activities.

- Real estate income.

- Selling real estate.

- Interest and dividends.

- Lottery prizes.

Business income tax

Businesses that are residents or foreign entities that have a permanent establishment in Mexico pay income tax based on 30% of the profit they made that year.

It is important to note that dividends are subject to a withholding tax in Mexico and the tax rate for shareholders may be more than 40%.

Income tax incentives

Mexican Income Tax Laws provide some incentives, such as a tax credit of 30% or being able to defer the payment date.

If a business includes any of the following, they may be entitled to a tax incentive:

- Hiring employees with special needs.

- National film production investment.

- Theatre production investment.

- Edition and publication of literary work.

- Visual arts.

- Research and development of technology.

- High-performance sports.

- Real estate developments.

- Installation of power equipment regarding electric vehicles.

Related: 5 Legal Deductions for Entrepreneurs With the New Tax Law’s ‘Consumption’ Approach

Mexican business culture

Mexican business culture prides itself on building strong personal relationships.

Other predominant characteristics of the Mexican business culture include loyalty, a strong hierarchy and a consciousness of status.

The personal relationships that are built play a major role in Mexican business. Mexican business owners tend to spend a lot of time and effort building relationships with those they do business with.

Communication

While English is widely spoken in Mexico, it isn’t a good idea to assume that every business associate you deal with will be fluent. It is recommended to check before a meeting to see if a translator may be necessary.

Mexican culture places a high priority on communication, including body language. Mexican body language is typically different than North American body language as people tend to stand closer to each other and keep eye contact more than in other cultures.

It is important to embrace this, as a lack of eye contact or standing too far away can be a sign of untrustworthiness.

Related: What I Learned From the Hispanic Community About Entrepreneurship | Entrepreneur

Dress code

As Mexicans are typically very conscious of their social status, business professionals are expected to look the part.

How you dress is extremely important, as it is imperative to be well-dressed in both business and social settings.

Business meetings

As with many cultures, entertaining is a big part of the business world.

In Mexico, many business meetings take place while having breakfast or lunch and can last up to two hours or more.

Related: Why Mexico Needs to Be on the Radar for Tech Companies | Entrepreneur

Family

Family is essential in Mexican culture. Extended families tend to gather together most Sundays and on special occasions.

As a Mexican business owner, it is important to be aware of this and provide accommodations to your colleagues, employees and business contacts when necessary.

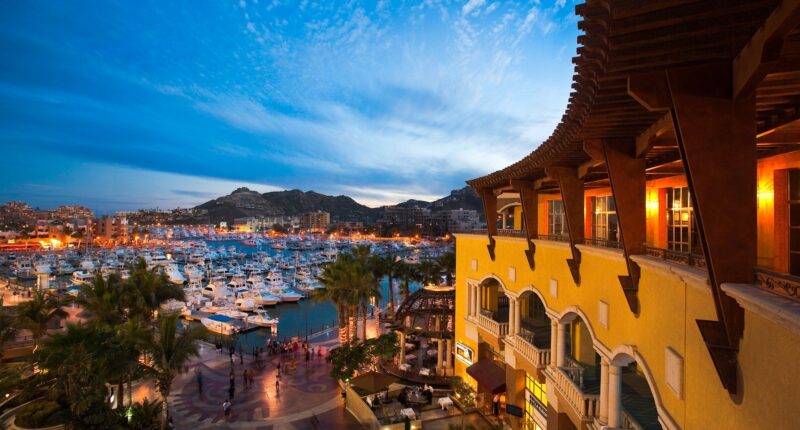

Embrace all that Mexico has to offer

By expanding your business into Mexico, you not only stand to gain a profitable business\ in a beautiful country, but you have the opportunity to build lasting work and personal relationships with those you do business with.

Mexico boasts a culture that puts family first, known for its strong work ethic and personable business approach. Branching out into Mexico might be the business opportunity you have been looking for.

Check out Entrepreneur’s other guides and articles for more information about this topic.