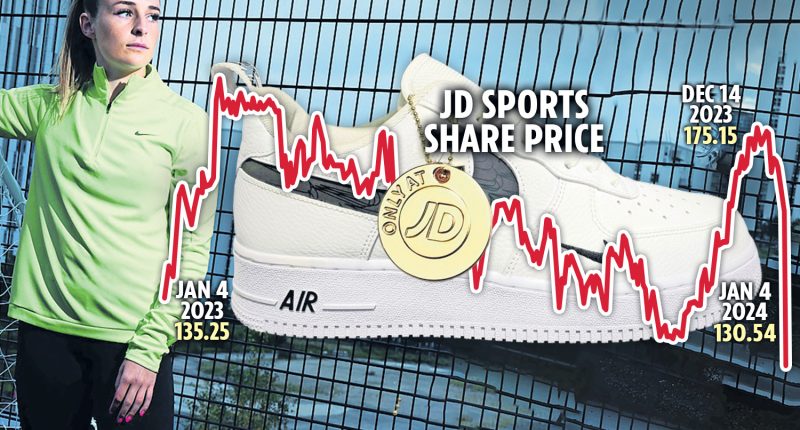

“KING of Trainers” JD SPORTS saw its crown slip yesterday as shares tanked after a shock profit warning.

The sportswear chain has been one of the UK’s strongest retail names but almost £1.7billion was wiped off after its shares crashed 23 per cent to 119.7p, valuing the firm at £6.2billion.

Before Christmas, and with its ad starring footie Lioness Ella Toone, boss Regis Schultz was confident, telling The Sun young customers had no bills so had spare cash for trainers.

However, JD Sports yesterday blamed “more cautious consumer spending” and mild autumn weather for dampening demand.

JD Sports’ total sales had grown by 6 per cent while like-for-like sales rose by just 1.8 per cent in the 22 weeks to December 30.

It expects profits to be between £915million and £935million, 10 per cent lower than past guidance.

READ MORE BUSINESS STORIES

Next to nothing

NEXT brought cheer to investors and shoppers yesterday by boosting profit forecasts again and ruling out further price rises.

The fashion chain, which also now owns Joules, FatFace and Reiss, said there would be “zero inflation” in its shops this year because factory costs had fallen substantially.

Next said it would be the first time in three years that input prices have been stable, having faced huge cost pressures during the pandemic and energy crisis.

Boss Lord Wolfson said shoppers would have benefited from falling prices had the Government not hiked staffing costs by increasing the living wage.

Most read in Business

Next said the pay increase had cost the business £60million, which would have otherwise been funnelled into lowering prices.

Retailers are nervously watching developments in the Red Sea, where Houthi rebels have forced container ships to divert on longer routes to avoid being attacked. Lord Wolfson said that at the moment it was “an inconvenience, not a crisis” — but the extra costs would begin to rise the longer it went on, and it could impact autumn and winter stock.

Next said it would now make profits of £905million, £20million more than thought in its fifth upgrade in eight months.

Full-priced sales rose 9.1 per cent in the last three months of 2023. Online sales were strong compared with 2022, when postal strikes and delivery disruptions caused shoppers to be wary about orders arriving before Christmas.

The share price jumped 5 per cent yesterday to an all-time high of £85.32, valuing the FTSE 100 retailer at £10.8billion.

It’s grid up north for cars

A SHORTAGE of public charging points in the North is hampering Brits from switching to electric cars, car industry bosses have said.

Last year 1.9million new cars hit the road, 18 per cent more than the year before, as supply issues eased, the Society of Motor Manufacturers and Traders said.

The number of battery electric vehicles released reached a record high as more businesses made their van fleets go green.

The Ford Puma was the overall top-selling car of 2023 and an electric version will be released this year.

SMMT boss Mike Hawes called on the Government to halve the VAT on electric vehicles for three years to encourage more drivers to switch.

He acknowledged that there was a shortage of charging points in the North, adding: “A national roll-out needs to be mandated.”

Boots on the table

The owner of Boots has said “everything’s on the table” for a potential stock listing.

The beauty and health firm yesterday toasted a 9.8 per cent rise in sales in the run-up to Christmas, helped by record Black Friday sales.

Owner Walgreens Boots Alliance wants to focus on its US market and is exploring a £7billion flotation of Boots.

Boss Tim Wentworth said the company was “evaluating all strategic options”.

All guns blazing for BAE

BRITISH defence firm BAE has signed a £39million contract with the US Army to restart production of its M777 guns.

BAE said it came on the back of the effective use of the towed howitzers by Ukraine against Russia.

The contract will initially focus on producing parts to refurbish guns used by Ukrainian forces, which were donated by Western allies, before resuming production for new orders.

BAE said: “This restart of production of the major structures for the US Army’s M777s comes at a critical time, with howitzers deployed on operations in Ukraine.

“We understand that they are performing well and we are very proud of our role in supporting our allies.”

SAINSBURY’S has bumped up pay for 120,000 staff by £2,000 a year. From March, workers will receive £12 an hour (up from £11) and £13.15 in London. The supermarket said the 9 per cent pay rise would cost it £200million.

Rate war by home lenders

HOPES that the Bank of England will cut interest rates this spring are triggering cheaper mortgages.

Home loan approvals picked up in November, with 50,067 processed in a welcome sign of a housing market rally, according to Bank figures.

Economists have predicted that inflation could fall to 2 per cent by May, which traders are betting should persuade the Bank to start cutting rates.

Growing confidence that rates will fall has led to a price war between lenders such as Halifax and HSBC. NatWest yesterday cut its two-year fixed rate to 4.81 per cent.

Read more on The Sun

Rachel Lummis, broker at Xpress Mortgages, said mortgage rates were falling so quickly a client had managed to save £157 per month — or £3,746 over two years of the loan — since starting the application process.

Homeowners remortgaging will typically still have to pay £200 more than they did in 2021.

SHARES

- BARCLAYS up 2.46 to 155.58

- BP up 1.50 to 473.45

- CENTRICA up 1.60 to 147.35

- HSBC up 7.10 to 632.50

- LLOYDS up 0.11 to 47.57

- M&S up 1.50 to 284.00

- NATWEST up 1.30 to 220.10

- ROYAL MAIL down 0.30 to 267.60

- SAINSBURY’S up 4.90 to 308.20

- SHELL up 1.50 to 2,594.50

- TESCO up 4.60 to 302.40