A key deadline for the $464 million civil fraud judgment against Donald Trump and his co-defendants is fast approaching, and it appears it’s one he might not be able to meet.

Unless an appeals court intervenes or the former president can post a bond for the full amount of the judgment by Monday, New York Attorney General Letitia James can start collecting on the judgment she secured last month.

In a court filing Monday, Trump’s attorneys said getting a bond large enough to cover the amount is a “practical impossibility.” Trump’s other options are dwindling and could include taking out a large loan, selling off some of his properties — or declaring bankruptcy.

Here’s a look at where things stand and what might happen next.

How much money does Trump owe?

After a months-long trial, Judge Arthur Engoron hit Trump and his co-defendants — his companies and past and current executives — with a judgment of over $350 million after finding they’d committed “persistent” fraud over years. That amount ballooned to $464 million with pre-judgment interest. Of that amount on the date the judgment was entered, Trump is liable for the vast majority, about $454 million. Such judgments in New York also carry an annual interest rate of 9 percent until they’re paid, so the amount Trump owes is increasing daily by more than $111,000.

What is the deadline Trump is facing?

Engoron’s ruling was automatically stayed for 30 days after he entered the judgment. That stay expires on Monday, meaning Trump owes the money even with an appeal pending.

If Trump wants a stay while he appeals, courts in New York require the person or company to guarantee the entire amount, and because of the 9 percent interest, extra cash or security as well — generally a total of 120 percent of the award. This is done to ensure the person doesn’t spend all their money while appealing and then contend they can’t pay if they lose.

The person can either post that amount in cash if they have it on hand — which is what Trump did last year when he filed his appeal of a $5 million defamation award to writer E. Jean Carroll — or post a bond obtained from a bond company. That’s what Trump did earlier this year when he was hit with an $83 million verdict in a separate defamation case brought by Carroll.

In the current case, Trump’s attorneys said they would need to put up a bond or securities totaling over $550 million.

Can the courts help him?

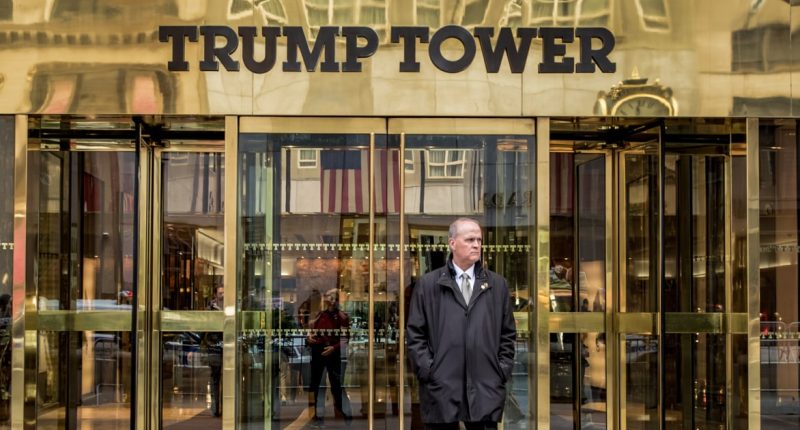

Trump has asked the state Appellate Division, a mid-level appeals court, to let him appeal while posting either a reduced bond, or without posting any sort of security at all. They argue it’s not necessary because he clearly has valuable assets, could pay the entire judgment if he needed to and it would be impossible to secretly sell something like Trump Tower. The appeals court could rule on Trump’s request at any time — including after the deadline has passed. Trump’s attorneys have asked that if the court does rule against him, it gives them time to make their case to the state’s highest court, the Court of Appeals, and ask it to let him proceed without posting security or a bond.

The AG’s office has urged the appeals court to deny Trump’s “extraordinary” request, arguing his difficulty in coming up with the cash shows “there is substantial risk that defendants will attempt to evade enforcement of the judgment (or make enforcement more difficult) following appeal.”

What is a bond?

An appeals bond is similar to the more familiar bail bond in criminal court, where a person has to put up some form of security in order to get a bondsman to post an amount securing the person’s release. If the defendant disappears, the bondsman is on the hook for paying the government and seizes the items used as collateral to make themselves whole.

For appeals bonds, individuals and companies typically put up a mix of cash and securities as collateral for the entire judgment to secure the bond. The purpose of the bond is to make sure the person who won the judgment is able to collect if the defendant loses the appeal, since the legal challenges can take months and sometimes years. If the person appealing is successful, they can get whatever collateral and security they put up returned afterward, but would be out whatever fees they paid the bond company. According to Trump’s court filing, the fee in this case would be about $18 million.

Can’t he just put up cash?

While Trump has said his brand alone is worth over $10 billion and a 2021 financial statement put his net worth a $4.5 billion, the bulk of his assets is real estate, not cash or stock.

In a 2021 statement of financial condition that was entered into evidence in the AG’s case, Trump said he had close to $293.8 million in “cash and cash equivalents.” The AG’s office said that figure included $93 million in assets that weren’t actually liquid.

At his deposition in the case last April, Trump said he had more than that. “We have a lot of cash. I believe we have substantially in excess of $400 million in cash, which is a lot for a developer. Developers usually don’t have cash. They have assets, not cash. We have, I believe, $400-plus and going up very substantially every month,” he said then.

That amount has likely decreased — in part because last week he posted a $91 million bond in the second Carroll defamation case.

Can’t he just use some of his properties as collateral for a bond?

In his court filing Monday, Trump’s attorneys said they’d approached 30 different surety companies, and “very few bonding companies will consider a bond of anything approaching that magnitude.” “The remaining handful will not ‘accept hard assets such as real estate as collateral,’ but ‘will only accept cash or cash equivalents (such as marketable securities),'” his filing said.

In a response Wednesday, the AG’s office said Trump could have used the properties as collateral even without a bond. “If defendants were truly unable to provide an undertaking, they at a minimum should have consented to have their real-estate interests held by Supreme Court to satisfy the judgment or should have otherwise pledged security in real-estate holdings with sufficient value to secure payment of the entire judgment,” the filing said.

James also suggested Trump and his co-defendants were playing games because they could have raised these issues earlier.

Will Trump have to mortgage or sell off properties to come up with the money?

The former president suggested mortgaging or selling off his properties were possibilities in a post on his social media platform Truth Social on Tuesday. “Judge Engoron actually wants me to put up Hundreds of Millions of Dollars for the Right to Appeal his ridiculous decision,” Trump wrote. “I would be forced to mortgage or sell Great Assets, perhaps at Fire Sale prices, and if and when I win the Appeal, they would be gone. Does that make sense?”

“Nobody has ever heard of anything like this before,” he wrote of the longstanding practice in New York state and federal courts.

James’ office noted “there is nothing unusual about even billion-dollar judgments being fully bonded on appeal,” and urged the appeals court to reject Trump’s argument. “Defendants object to a possible ‘fire sale’ if they were to sell assets to generate cash to use as collateral for a bond or as a deposit — but the alternative would be to shift the risk of executing on defendants’ illiquid assets to OAG,” their filing said.

Bankruptcy protection?

One way Trump could stop the clock — at least temporarily — would be to file for bankruptcy protection. It’s a move Trump allies Alex Jones and Rudy Giuliani used when they were hit with large judgments, but could be a bad look for Trump, the presumptive Republican presidential nominee whose political image was built on the perception of his being a savvy businessman. There’s also the possibility that declaring bankruptcy could trigger defaults with some of his existing bank loans.

Chris Mattei, who represented families of the victims of the mass shooting at Sandy Hook Elementary School in Connecticut in their suit against Jones, said Trump could have some of his smaller individual companies that were found liable declare bankruptcy in order to trigger an automatic stay, but such a stay would only apply to those companies — not Trump personally. He said he was skeptical that Trump would declare bankruptcy himself because of “the PR implications.”

Could Trump put together some sort of hybrid bond?

Mattei suggested Trump might “be able to cobble together sufficient funds” to cover the amount through “a combination of a traditional bond company bond for a partial amount” and the rest “through his personal assets and loans or donations or gifts from others.” But, he added, “I don’t know what the likelihood is” of that happening.

In its filing Wednesday, the AG said Trump is using a “false premise” with his claims that he can’t get a bond for the entire amount, and suggested he could use several smaller bonds from different sureties — bond companies. “[A]ppealing parties may bond large judgments by dividing the bond amount among multiple sureties, thereby limiting any individual surety’s risk to a smaller sum, such as $100 or $200 million apiece,” the AG wrote.

Asked Wednesday in an interview on Fox News about whether there was any effort to get money from countries like Saudi Arabia or Russia to help secure a bond, Trump attorney Alina Habba replied, “There’s rules and regulations that are public. I can’t speak about strategy. That requires certain things, and we have to follow those rules.”

What if Trump doesn’t do anything?

If he doesn’t take any action, James would be free to immediately start moving to seize Trump’s assets, and would not need a further court order to do so in New York, where he’s estimated to have hundreds of millions of dollars in assets. His properties in New York City include Trump Tower and 40 Wall Street, a property near James’ office that she’s suggested she might go after. Financial disclosures Trump filed last year as part of his presidential campaign requirements also indicate he has several bank accounts located in New York.

“We are prepared to make sure that the judgment is paid to New Yorkers, and yes, I look at 40 Wall Street each and every day,” James told ABC News in an interview last month.

Without Trump getting an extension “the AG will be authorized to collect” on the judgment, Mattei said. “She could freeze accounts, encumber his real property in New York, and significantly impede Trump’s ability to access his New York-based assets,” he said, adding she could also move to force sales of properties.

If James wanted to seize Trump’s assets from outside the state, she would need to go to court in that state to enforce that order there, the lawyer added.

Is any of this just gamesmanship?

In the Carroll case, Trump’s attorneys made repeated pleas for extra time to come up with a bond, but court filings show that Trump had actually already signed the bond agreement the day before their final request to a judge for more time.

The AG’s filing suggested that Trump’s claims might be overblown in this case because the affirmations Trump used to claim that getting a bond was a “practical impossibility” were unreliable. One was from Gary Giulietti, a top executive at the Lockton Companies, which he described as “the largest privately held insurance brokerage firm in the world.” Giulietti said he’d been involved in attempts to get the bond.

The AG’s office noted that Trump’s filing did not mention that Giuletti, a longtime friend of Trump’s, had testified in the trial and that the judge found his testimony “to lack credibility.” The other affirmation was from Alan Garten, the general counsel for the Trump Organization who the AG said the judge had determined “was personally involved in the fraudulent and illegal conduct” in the case.

Garten told NBC News that the AG’s statement is “reckless and completely untrue” and that Engoron had “found no such thing.”

In their filing, Trump’s attorneys maintained that having to post a full bond could wreak havoc on the Trump Organization. “The judgment seeks to destroy a successful business that employs many hardworking New Yorkers,” their filing said. “The Court should stay the judgment pending appeal, and put the brakes on the Attorney General’s overzealous litigation crusade.”

Source: | This article originally belongs to Nbcnews.com