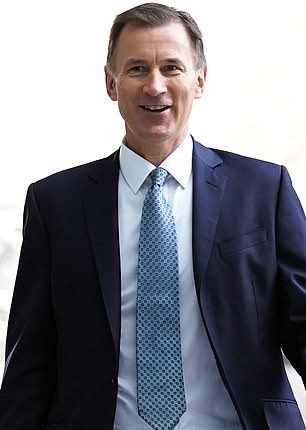

Looking for investment: Jeremy Hunt

There is no secret, certainly not to Jeremy Hunt, that we need businesses to invest more in Britain.

Minds in government were focused on this by some frank remarks by Pascal Soriot, the boss of drugs giant AstraZeneca, on his decision to set up a new manufacturing plant in Ireland rather than the UK.

Soriot has basked in corporate superstar status since he saw off a cynical hostile takeover bid by Pfizer of the US almost a decade ago. Had he taken the greedy way out, the UK would have lost a flagship asset and the world would probably have been deprived of a Covid vaccine.

So when Soriot said the UK’s hopes of becoming a superpower in life sciences are being hurt by our tax system, Hunt would have been horribly stung.

The Chancellor has singled out life sciences as an area in which he believes the UK can excel, along with green industries, digital technology, the creative sector and advanced manufacturing.

Hence the mountain of rhetoric in the Autumn Statement about supporting business, larded with claims his ‘full-expensing’ measure is equivalent to an £11billion tax break, plus the boast that the UK has the lowest corporation tax in the G7.

True, but Ireland is not in the G7. It is a short hop away, with a headline corporation tax rate of 12.5 per cent, compared with 25 per cent in the UK after a hike Hunt chose not to reverse.

At least, though, he gave his backing to a review by Tory peer Lord Harrington into attracting more foreign investment. The most eye-catching of Harrington’s proposals is a concierge service, where potential foreign investors are provided with a Jeeves-style fixer, who can steer them through the cats’-cradle of grants, planning rules and the like.

One potential difficulty is finding the fixers in the first place. Previous attempts to hire recently retired senior civil servants have apparently fallen foul of Whitehall drives to reduce the use of outside ‘consultants’, which sounds like vintage Sir Humphrey.

The real test is whether the Government and the Civil Service will put real welly into making it all happen. Britain is actually in a good position on foreign direct investment, with the highest stock in Europe and inflows of nearly £80billion last year.

But business investment overall, including by UK companies, is persistently lower than our peer group. We rely on foreigners to fill the gap. We cannot rest on our laurels. Not when Joe Biden is touting his ludicrously named Inflation Reduction Act, which is offering up to $2 trillion in subsidies to companies from around the world. In the race for investment, there are no prizes for coming second.

The way to respond is not to try to pick winners or to shower wealthy overseas firms with taxpayer-funded subsidies for investments they might well have made anyway. The UK is good at attracting overseas buyers but not so clever at weeding out the predators who are merely masquerading as investors and really want to truffle out cheap assets.

Genuine long-term foreign investors do exist, such as Nissan, which has just announced a £2billion plan to build three electric cars in Sunderland.

Many in my native North East would not thank me for saying so, but this is the fruit of a determined drive by Mrs Thatcher in the 1980s to attract Japanese car makers.

In similar vein, there should be ‘target lists’ of overseas companies to pursue in each of the Chancellor’s five growth areas.

The old notion of leaving it all to the free market to sort out, sometimes associated with Thatcherism, will not work.

Maggie herself could not have been a more energetic saleswoman for Britain.