Rising rental costs are putting a major strain on people’s expected retirement income, a report has revealed.

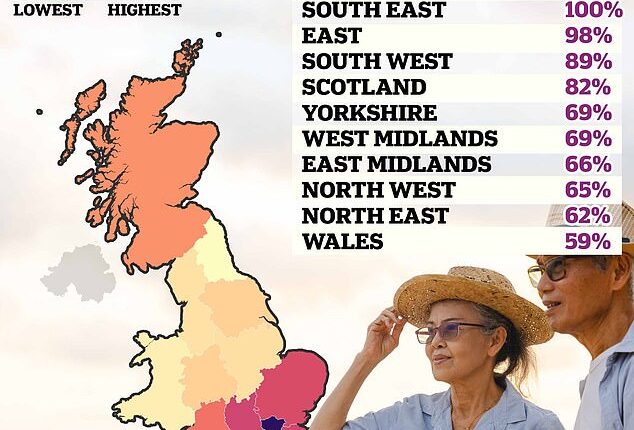

The report by Scottish Widows looked at what percentage of income people around the country can expect to spend on their rent during their retirement.

The places where those in retirement will not typically see their income cover at least their rent includes London and the South East.

It follows separate research by Hamptons that suggested the number of households aged over-65 renting their home will double to more than 1million in the next decade.

The report by Scottish Widows looked at the percentage of income that those in retirement spend on rent

It claimed numbers would more than double from 402,963 last year to 1,003,382 by 2033.

The places where those renting in retirement can expect to spend at least 80 per cent of their income on their monthly rental payments include the East of England, the South West and Scotland – at 98 per cent, 89 per cent and 82 per cent respectively.

In these areas, a lack of supply and high demand has helped to push rents out of reach for many people, including those in retirement.

By contrast, the region where those in retirement can expect to spend the smallest percentage of their income on rent is the North East at 59 per cent.

There are four regions where people in retirement can expect to spend between 62 per cent and 69 per cent of their income on rent.

These are Wales – where they will spend 62 per cent of their income on rent -, the North West at 65 per cent, the East Midlands at 66 per cent, and the West Midlands at 69 per cent.

A lack of supply and high demand has helped to push rents out of reach for many people, including those in retirement

Pete Glancy, of Scottish Widows, said: ‘Escalating rental costs pose a significant challenge, particularly for those on lower retirement incomes.

‘It could become exceedingly difficult for them to achieve even a minimum standard of retirement.

‘As a result, many may find themselves relying on housing benefits or being forced to downsize to smaller and more affordable accommodation in order to mitigate the burden of rental costs.

‘This has severe consequences for ‘Generation Rent’, who will have to save substantially more for retirement.’

It comes after the Office of National Statistics revealed that the number of households renting has more than doubled in the past two decades.

Approximately five million households in England and Wales are privately renting, which is up from 3.9 million as recently as 2011.

Mr Glancy added: ‘On the other hand, homeowners have the extra option of releasing equity from their home later in retirement.’

The Scottish Widows’ Retirement Report went on to say that while many people are making good preparations for retirement, a substantial minority are being left behind.

Enjoying a basic level of comfort in retirement includes being able to pay rent, something that is under pressure as rents nationwide increase.

Retirees who rent and are living in London and the South East are worst affected by rising costs

The average price of renting a home outside of London has reached a record high of £1,231 a month.

The picture is even more alarming for those looking to rent in London, where typical values have also reached a record of £2,567 a month.

The data by Rightmove means average rents have increased by £300 a month outside of London, and £559 a month in London compared to before the pandemic in 2019.

Rightmove explained that there is fierce competition among tenants for properties, with it taking just 17 days to find a tenant a property.

The average asking rent for a typical home outside of London is now 33 per cent higher than at this time in 2019, increasing by more than £300 from £923 a month.

It’s a similar story in the capital, with average asking rents in London reaching a new quarterly record of £2,567, and while the pace of rent growth has slowed slightly, it remains in double-digits for the seventh consecutive quarter.

London rents are now 28 per cent higher – the equivalent of £559 a month – than at this time in 2019.