Demand and prices are soaring for minerals essential to the construction of low-carbon infrastructure

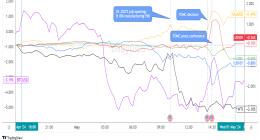

The commodities boom ignited by China’s post-Covid recovery, and stoked by the global move to green energy, broke price records last week even as fears about inflation stalked the markets. But it also risks triggering a rush on metals and minerals that could derail climate action.

Iron ore reached the apex of a super-rally that drove prices to $237.57 a tonne in New York on Wednesday. The record followed a surge in demand from China’s steel-making regions, now recovering after the pandemic, which has pushed prices up from less than $94 this time last year.