The battle for Morrisons is set to be decided in a head-to-head auction between two private equity bidders.

The supermarket’s bosses have asked the Takeover Panel to extend the process until October 18 to allow time for a showdown between Clayton, Dubilier & Rice (CD&R) and rival suitor Fortress.

The dramatic finale to the three-month takeover tussle pits former Tesco boss Sir Terry Leah, who is fronting the pursuit for CD&R, against Joshua A Pack, the chisel-jawed American go-getter behind the Fortress bid.

Auction: Morrisons bosses have asked the Takeover Panel to extend the process until October 18 to allow time for a showdown between Clayton, Dubilier & Rice and rival suitor Fortress

Morrisons directors initially rejected a £5.5billion bid from CD&R before backing two offers from Fortress, the final one in early August worth 272p a share or £6.7billion.

The board then switched horse on August 19 when CD&R increased its bid to 285p a share or £7billion.

But Fortress has remained in the hunt, forcing the Takeover Panel to intervene to end the uncertainty facing Morrisons, its staff and suppliers.

The parties held talks this week to agree on the details of the auction, which typically lasts between one and five days, with the bids put to shareholders next month.

The takeover tussle pits former Tesco boss Sir Terry Leahy (left), who is fronting the pursuit for CD&R, against Joshua A Pack (right), the chisel-jawed American go-getter for Fortress

Shares rose 0.5 per cent, or 1.3p, to 292.4p as investors hoped the auction would draw out higher bids, making Morrisons Britain’s second largest supermarket by value behind Tesco.

It is now valued at £7.02billion compared to the £6.98billion market capitalisation of Sainsbury’s and £19.8billion of Tesco.

Three months ago, before the supermarkets attracted interest, Morrisons was worth just £4.3billion and Sainsbury’s was valued at £6.3billion.

The final stretch of the takeover battle has been accompanied by a war of words. Fortress, backed by the billionaire Koch family and the Singapore sovereign wealth fund, has sought to paint CD&R as short-term investors who will ‘flip’ the business for a quick profit.

Sources close to CD&R hit back saying that, unlike its rival, it has experience in UK retail from its long and successful investment in the discount chain B&M.

Morrisons will today reveal its half-year results, with analysts expecting it to report profits of around £240million.

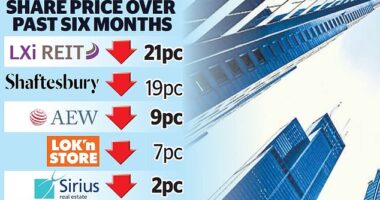

The fight for Morrisons is the most high-profile amid a raft of bids and counter-bids, reflecting private equity’s appetite for UK Plc.

CD&R and Fortress have been forced to make far-reaching pledges to protect the legacy of the supermarket’s founding family, avoid asset sales and protect jobs.

However, critics warned the promises are not legally binding. Morrisons said that given ‘a competitive situation continues to exist’ between Fortress and CD&R it has asked the Takeover Panel to intervene and conduct an auction.

In a statement to the stock market, it went on: ‘In addition to the financial terms of any offer, the Morrisons board continues to place very significant emphasis on the wider responsibilities of ownership of Morrisons.

‘These responsibilities include a recognition of the importance to Morrisons of all stakeholders, including colleagues, customers, pension trustees and suppliers as well as the distinct heritage and history of Morrisons and the legacy of Sir Ken Morrison.’