Earlier today, we found out that the unemployment rate in the U.K. ticked higher from 4.2% to 4.3% – the highest since late 2021 – in July even as the labor participation rate slipped from 79.1% to 78.9%.

There were also 0.9K jobless claimants for the month, which is way lower than the 29K figure we saw in June. Full-time employment also increased by 24.42K after a sharp drop in the previous month.

But what really got the investors’ attention was wage growth in the U.K., which remained at a record high of 7.8% y/y in the three months to July.

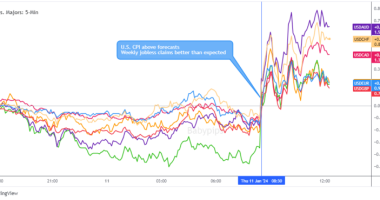

The idea of the BOE implementing even tighter monetary policy (despite its chill vibe from the previous week) bumped up GBP across the board during the release.

But the British pound soon turned lower against the Australian dollar, likely due to the latter receiving support from mild optimism in the Chinese markets.

GBP/AUD, which has been trading below a trend line resistance since last week, got rejected at the 1.9490 level before revisiting its weekly lows near 1.9440.

Let’s see if GBP/AUD will extend a short-term downtrend despite a relatively hawkish U.K. jobs release.

The Event Guide for the U.K.’s Jobs Data suggests that GBP tends to return to its intraweek trends soon after the report’s release.

If this is the case this week, then we may see renewed selling pressure in the next trading sessions.

Look out for clear breakout candlestick patterns below this week’s lows if you’re thinking of selling GBP against AUD.

If GBP/AUD finds support at 1.9440, then you can also consider selling at the first signs of another rejection at the trend line or previous high resistance.

The 1.9390 inflection point may serve as initial profit target but you can also aim for lower areas of interest if GBP/AUD sees fresh bearish catalysts.

However you want to trade GBP/AUD’s rejection at the trend line today, make sure you’re using your best risk management plans so you get to trade for another day!