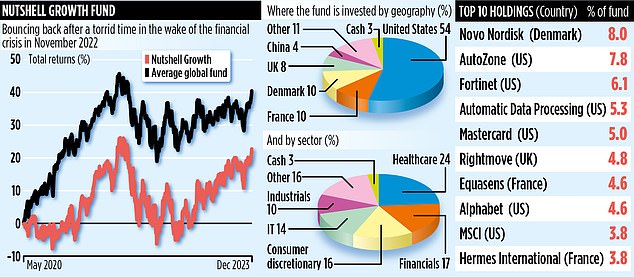

Global investment fund Nutshell Growth has enjoyed a reasonable start to life since its launch during lockdown in May 2020, generating an overall return of 24 per cent.

But it hasn’t been easy with its share price falling sharply in the wake of the financial crisis in November 2022, before bouncing back strongly this year.

The fund remains a minnow with assets under its belt of a tad over £20million, but it has the backing of British billionaire Lord Spencer who is an investor in both the fund and Nutshell Asset Management, the investment company that runs it.

Earlier this month, Spencer confidently predicted that Nutshell Growth would reap investors 2024 returns superior to those registered by Fundsmith Equity, a £23billion global fund that has delivered annual returns since launch in November 2010 of 15.1 per cent.

The Fundsmith fund is managed by Terry Smith – like Michael Spencer, a City icon.

Putting his money where his mouth is, Spencer said he would donate £10,000 to a charity of The Mail on Sunday’s choice if Nutshell Growth triumphed next year.

Mark Ellis, the fund’s investment manager, is not fazed about the challenge put down by Spencer. ‘Competition is good,’ he says.

‘The PR is good and it’s great that Michael likes the investment process that underpins the fund I run.’

Ellis, who spent more than 25 years in the City as a trader before setting up Nutshell Asset Management in 2019, is an individual who loves nothing more than analysing companies and poring over spreadsheets.

He is meticulous in his investment approach, assessing 600 companies on more than 30 different factors, using data going back 20 years. They are drawn from all corners of the world, although most are listed in the United States.

Currently, 37 businesses make it into the fund – familiar names such as US giant Alphabet (owner of Google) and more unfamiliar brands such as French healthcare specialist Equasens.

Ellis uses artificial intelligence to do a lot of the number crunching, for example analysing companies’ profit margins, the ability of listed businesses to preserve shareholder capital in downturns, and how share prices respond to either directors’ dealings or reported results.

He is also happy to bank some profit on individual stocks when their share prices rally – and recalibrates the portfolio twice a month to ensure it is in line with the target stakes he has set. He refers to this as ‘agile rebalancing’.

‘Every stock has to constantly justify its place in the fund,’ he adds.

He also employs AI to assess how bullish and bearish chief executives are about their businesses in calls to analysts and investors.

‘A lot of the work I do is analytical,’ says Ellis.

‘What I am trying to create is an edge. Yes, I could just hold the companies I like and run with them, but I want to deliver a little extra on top for investors.’

Like Spencer, Ellis is a substantial investor in the fund and owns two thirds of Nutshell Asset Management which has around £33million of assets under its wing. ‘I love my job,’ he says. ‘All my family’s investments are tied up in the fund.’

The fund will not touch tobacco stocks. ‘All my mother’s family were smokers and they died in their 60s. So, tobacco companies are a no go as far as I am concerned. Also, the companies are always vulnerable to fines and litigation,’ he says.

Fund charges are on the high side at 1.89 per cent – a result of its small size.