MARTIN Lewis has revealed how Brits can clear thousands of pounds of debt racked up on credit and debit cards.

The MoneySavingExpert founder explained how applying for balance transfers is a good idea – even if it hurst your credit score.

If you have credit or store card debts debts that are gaining interest you can move the money you owe onto the new card.

That means you can focus on repaying the debt, rather than the amount added in interest, and it can help you get back in the black faster.

“If you have got credit card debts and you need to sort them sooner is safer,” he told The Martin Lewis Money Show Live.

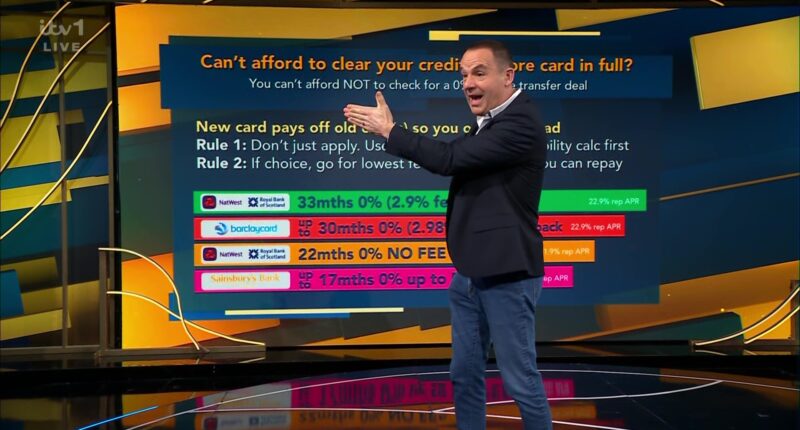

“If you can’t afford to clear your credit or store cards in full you can’t afford not to check for a 0% balance transfer.

“It’s a new credit card that pays off your old credit card.”

MoneySavingExpert has a comparison tool to help you decide which balance transfer card will work for you.

It’s worth noting that only people with the best credit ratings will be accepted for the top deals though.

Even if you do get accepted, you may also be offered a smaller 0% period and be charged a bigger transfer fee.

Most read in Money

You should never miss the minimum monthly repayment or you might lose the 0% interest-free period, meaning it will cost you more.

After the interest-fee period you will be charged 21.9% per year, so make sure to pay off your debts by then or consider switching the remaining balance to another card.

You shouldn’t spend or withdraw the cash as you’ll be charged and it could affect your credit rating.

Consumers usually have to transfer their debts within the first three months of opening the card to get the interest-free deal – so make sure you check the terms and conditions.