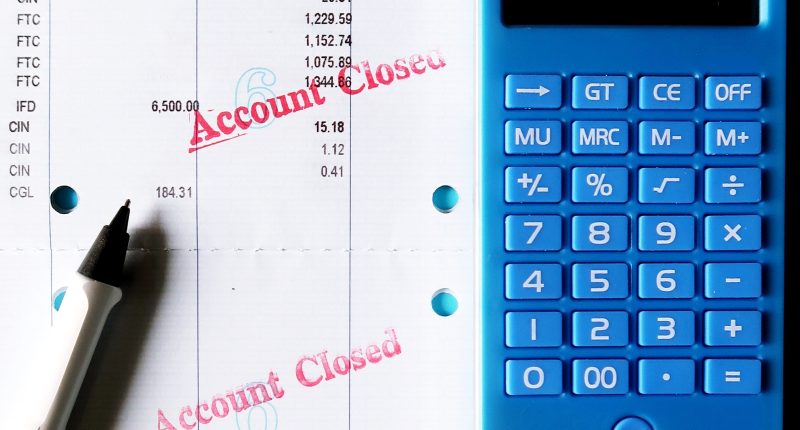

A MAJOR high street bank is axing a service experts call a “lifeline” and it will affect around 100,000 customers.

Virgin Money will soon be telling around 5% of its two million savings account holders that they will no longer be able to use their passbooks to pay in or withdraw cash in person.

Although passbooks may seem mystical to younger generations, older account holders often consider them essential.

Passbooks were the original way account holders used to keep track of their savings.

The books would physically hold all details of all transactions in an account so you can see them all at a glance.

They also come in particularly useful if you are trying to limit compulsive spending as there are a lot more steps to take with each transaction.

Read more on banking

But with the move to digital banking, many banks such as Santander and Barclays have decided to scrap passbook savings accounts which are no longer available to new customers.

Passbook accounts are far more expensive for banks to maintain than alternative electronic systems.

Virgin Money told The Sun: “Passbooks are a small part of our overall savings book. In total, we’ve got two million savings accounts and passbook accounts make up around 5% of that total.

“As there are now more secure and convenient ways for customers to manage their money (including offline/in store options), passbook accounts have not been available to open for a number of years and, due to the relatively small volumes of them, we’re in the process of removing them from our range.”

Most read in Money

The bank hopes to have concluded the process by the second half of 2024.

Should you change accounts if you have a Passbook savings account?

Consumer expert Martyn James has said passbooks are a “lifeline” but as banks are moving online, account holders eventually have to move too.

He said: “I fear that chasing accounts that offer passbooks will ultimately become a lost cause.

“Ultimately, if a bank has branches, it’s not a huge hassle to issue passbooks to those who want them.

“To not do so suggests that they are looking ahead to a world where everything is online, like it or not.”

Myron Jobson, senior personal finance analyst at Interactive Investor says this may be a good time to make a move to a savings account with better interest rates.

“As ever, it pays to shop around for the best savings deal. The top savings deals continue to drop like flies, on the expectation that interest rates will fall quicker than initial predictions.

“As such, those who have been waiting to nab a top savings deal might want to get a move on as the very best deals may not be around for much longer.”

What to do if you have a Passbooks savings account with Virgin

Virgin has said impacted customers will be modified directly about when their accounts will be subject to these changes.

The bank has said customers do not need to move their savings online or use a cash machine card.

The vast majority of customers can keep the account they have and simply operate it as a statement-based account instead of using a passbook, but all the features remain the same.

Virgin will be offering alternative savings accounts to the small majority of costumes who have accounts where this is not possible.

These will include online and offline options.

If you are interested in passbook savings accounts some smaller building societies have pledged to still keep them available such as Leeds building society and Newcastle building society.

READ MORE SUN STORIES

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

You can also join our new Sun Money Facebook group to share stories and tips and engage with the consumer team and other group members.