MILLIONS of households are in for an energy price shock come April with some parts of the country worse affected than others.

The government’s Energy Price Guarantee (EPG) promises to keep average bills at £2,500 a year,

It was extended until July in chancellor Jeremy Hunt’s Budget.

But millions of households are still set to see change to energy bills in April.

Energy standing charges rise, at the same time as vital government support for bills is withdrawn.

The overall result is that many will see an unwelcome and expected jump in costs – and it could be the most vulnerable households that are worst hit, energy charities say.

All homes have been receiving energy rebate payments worth between £66/67 a month since October.

However, from April this support is being withdrawn in a blow to many struggling families.

At the same time, standing charges will also be rising, although unit rates will drop.

Standing charges are put on your bill even if you don’t use any energy, as they represent the cost of supplying your home.

Most read in Money

It means that changing your energy use won’t affect this part of your bill, unlike the unit rate.

The typical household standing charge will jump to £299.59 from its current level of £273.17, according to charity National Energy Action (NEA).

However, there are big regional variations with rural areas typically paying more.

And if you have been carefully monitoring your energy usage in the hope of bringing costs down – your standing charge will likely make up a bigger percentage of your bill and these latest rises could be all the more painful.

Matt Copeland, head of policy at National Energy Action says: “The standing charge has been increasing for years.

“It’s unfair and affects the most vulnerable disproportionately as it accounts for a bigger percentage of their bill.

“Low-income households should not face such high unavoidable costs when they are already struggling to stay warm and safe in their homes.”

How will your standing charge change?

Exact costs depend on how you pay for your energy and your supplier.

The average standing charge for gas by direct debit is rising from 28.49p a day to 29.11p a day across the country, according to data from Money Saving Expert (MSE).

Unit rates will drop slightly from 10.31p per kwh to 10.31p, and from 34.04p per kwh to 33.21p for electricity.

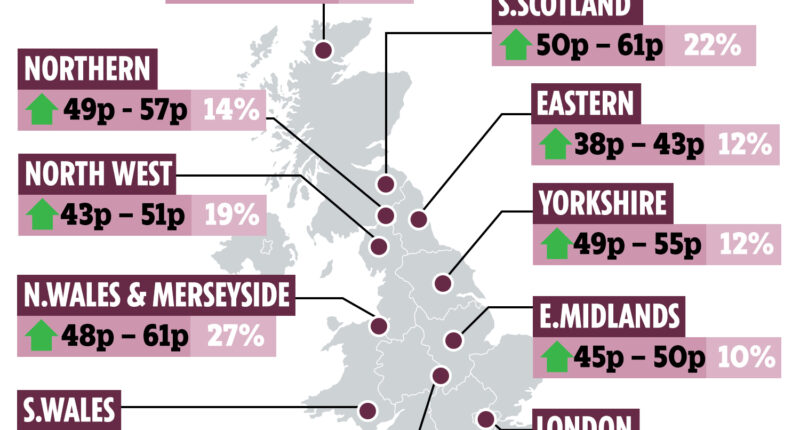

However, electricity standing charges vary by region.

People living in North Wales and Mersey paying by direct debit will see these costs rise by as much as 27% – going from 48.6p to 61.82p, MSE’s data showed.

Southern Scotland is also set for a big jump from 50.66p to 61.67p.

On the other hand, homeowners in London will pay the least for electricity at a rate of 38.18p – even after a 15% rise.

The changes combined with the end of the energy rebates will see the number of UK households in fuel poverty increase from 6.7 million to a new high of 7.5 million from 1 April, according to NEA’s figures.

Customers on prepayment metres face even higher standing charges.

Gas will inch up from 37.51p per day, on average, to 37.80p and for electricity from 51.41p per day to 58.08p.

Unit rates will however drop from 10.82p per kwh for gas to 10.55p, and from 33p per kwh to 32.05p.

Between July 2023 and March 2024, the government has said it will compensate prepayment customers for their higher costs.

In the Budget the Chancellor promised to bring prepayment costs in to line with direct debits so that 4million customers will no longer pay more.

However, they will still pay extra for the three months to July, the NEA said.

The charity found that from April the dual fuel prepayment standing charge will average £350 a year.

A spokesperson from energy regulator Ofgem said: “Ofgem is committed to ensuring that consumers pay a fair price for their energy.

“The increase in standing charges in April is driven by long term changes to transmission charges under our Targeted Charging Review.

“As part of that review, we identified that the package of changes is expected to deliver £300m of overall savings for domestic consumers.”

What help can I get from April?

The ray of hope for households is that wholesale prices have been coming down, according to Brian Byrnes, head of personal finance, at savings app Moneybox.

He said: “The immediate impact of Russia’s war in Ukraine on energy prices has faded somewhat, coupled with a reasonably mild winter has led to Europe having larger than expected energy reserves.

“As such wholesale prices have been coming down and while there is a lag to this being felt in energy bills, the hope is we will all notice our bills come down significantly over the summer.”

The changing prices could mean it is soon worth double checking you are on the best tariff for your circumstances.

Gareth Kloet, energy spokesperson at Go.Compare, said: “Unfortunately there isn’t a lot you can do about the standard charges levied in your region, but you can, as the market opens up again and energy prices start to become more competitive, look to make sure you are on the lowest tariffs available.”

Fixed tariffs are expected to return as energy prices drop and suppliers compete for customers again.

Ovo Energy is the first firm to launch a fixed deal, offering existing customers a deal that’s £225 less than the current £2,5000 price cap on bills.

The Household Support Fund is one avenue for households struggling with costs.

This cash support is handed out by local councils across England – each has its own own eligibility criteria, but it is usually reserved for those on a low income or benefits.

Contact your local council to find out if you could qualify.

It is also worth contacting your energy provider. Some firms offer customers grants to those who are struggling with bills – check out what you can get in our guide.

The amount you can get depends on who you are with.

Prepayment customers can also get emergency credit worth £10 – though this does have to be paid back eventually.

Again, customers on a prepayment meter can get one-off vouchers to top up.

The Fuel Bank Foundation charity can also offer one-off vouchers for prepayment metre customers to up and this help is usually offered through local organisations such as food banks and Citizens Advice.