WASHINGTON — Supreme Court Justice Amy Coney Barrett on Friday rejected a second challenge to President Joe Biden’s student loan forgiveness plan, keeping the court out of the fight over the program that’s raging in the lower courts.

The decision has little practical effect, as an appeals court ruling had already put implementation of the policy on hold. The brief notation on the Supreme Court’s docket did not give a reason for why the application was rejected, which is not unusual.

On Oct. 20, Barrett rejected a similar request.

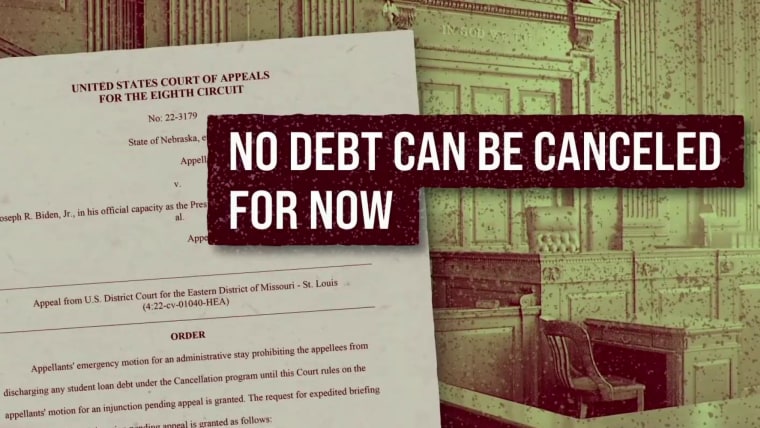

The program, which allows eligible borrowers to cancel up to $20,000 of debt, remains on hold at least temporarily after it was blocked on Oct. 21 by an appeals court in a separate case. The administration has continued to encourage people to apply despite the various court cases.

The latest case was brought by the Pacific Legal Foundation, a conservative legal group representing two Indiana-based lawyers Frank Garrison and Noel Johnson, who say that the plan was not authorized by Congress and is an abuse of presidential power. Garrison works for the Pacific Legal Foundation while Johnson works for another conservative group, the Public Interest Legal Foundation.

The challengers argue that the administration’s plan — announced by Biden in August and set to take effect this fall — violates the Constitution and federal law, partly because it circumvents Congress, which they said has the power to create laws related to student loan forgiveness.

A major obstacle facing challengers is to show they have legal standing to sue by illustrating how they are harmed by the program.

The challengers argue they will be worse off because of the cancellation of student debt. Garrison and Johnson say they could have their loans relieved through the Public Service Loan Forgiveness program, which cancels debt for people who are employed by a federal, state, local or tribal government or a not-for-profit organization. But as a result of the administration’s student loan forgiveness plan, they and potentially millions of others in similar positions could be subject to state income tax liability in Indiana and at least five other states, the lawsuit says.

After the initial lawsuit was filed, the Education Department said that people who do not wish to have their loans forgiven could opt out, which raises additional questions about whether Garrison and Johnson have legal standing.

The challengers’ lawyers and other critics of the program say the Biden administration is guilty of cynically amending the terms of the plan in order to prevent courts from reaching the legal merits.

Biden’s student debt relief program would provide up to $10,000 in debt cancellation for those earning less than $125,000 a year and couples who file taxes jointly and earn less than $250,000 annually. Pell Grant recipients, who comprise the majority of borrowers, would be eligible for an additional $10,000 in debt relief. The overall program is anticipated to help more than 40 million borrowers, the administration has said.

The nonpartisan Congressional Budget Office estimated in September that Biden’s plan would cost $400 billion, while the Education Department said the price tag would be closer to $379 billion.

Source: | This article originally belongs to Nbcnews.com