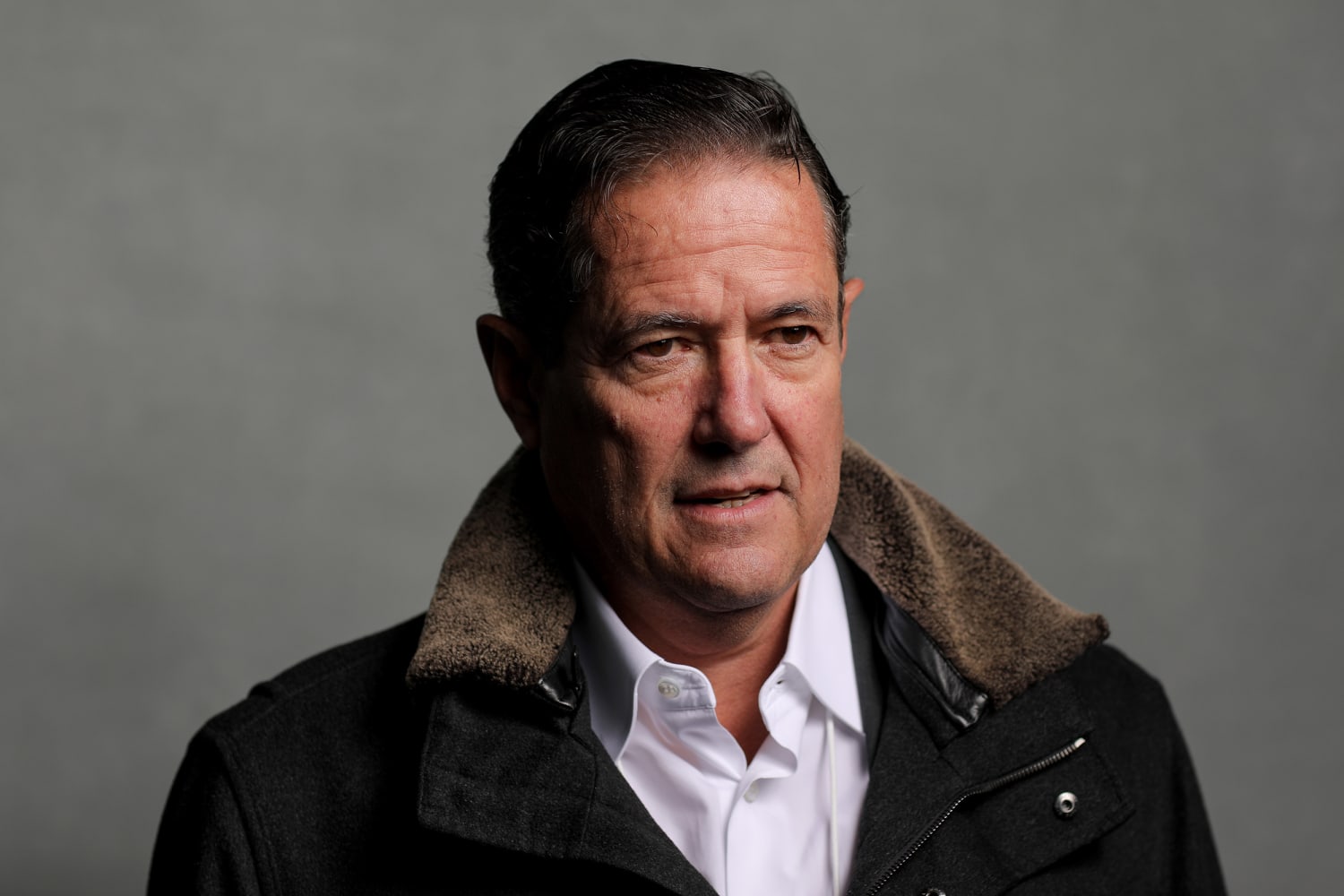

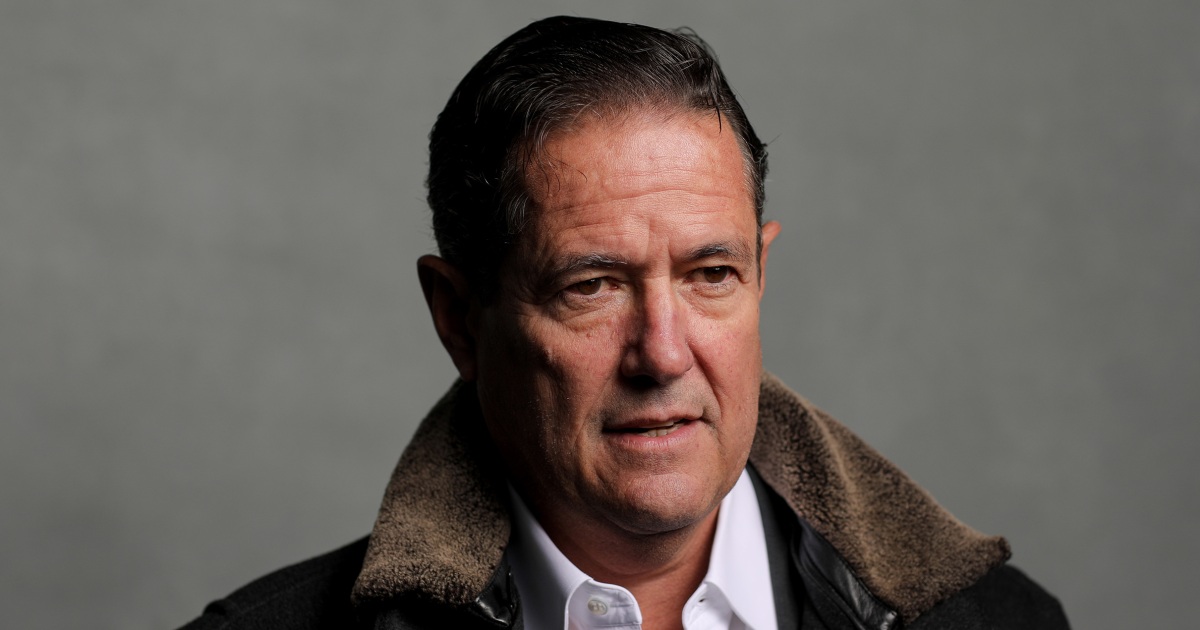

JPMorgan Chase claimed its former executive Jes Staley repeatedly “thwarted” its efforts to cut ties with convicted sex offender Jeffrey Epstein during Staley’s tenure at the bank, according to court documents filed this week.

The Wall Street giant sued Staley in March, saying he should be held liable for any financial damages the bank might have to pay from two lawsuits that alleged the bank enabled Epstein’s sex-trafficking operation.

JPMorgan has denied liability.

Staley, who worked at the bank for more than 30 years, asked a federal judge in April to dismiss the lawsuit, saying the bank was using him as a “public relations shield.”

In response, the bank this week alleged that Staley knew of Epstein’s sex-trafficking enterprise and engaged in “sexual activity with young women procured by Epstein,” but “acted to protect himself and Epstein (who could have exposed Staley’s misconduct),” court documents said.

Staley “persisted for years in protecting Epstein in the face of attempts by JPMC personnel to end the company’s relationship with Epstein on reputational grounds, made misrepresentations in the process, and continued to do so to the end of his JPMC tenure,” the bank stated in the court filing.

An Epstein victim has alleged that she was sexually abused by Staley while he was working at the bank, court documents said.

JPMorgan Chase said this week that it “did not know nor could it have reasonably known of” the woman’s allegations.

Staley’s attorneys did not immediately respond to a request for comment.

The former bank executive has previously called the accusations “baseless,” but has expressed regret for his relationship with Epstein.

Epstein was convicted of procuring a child for prostitution in 2008. He died in 2019 by suicide at a Manhattan correctional center where he was being held on federal sex-trafficking charges.

JPMorgan Chase was sued by the U.S. Virgin Islands and a woman identified as “Jane Doe 1” last year, claiming the bank turned a “blind eye” toward Epstein’s conduct.

Internal emails and memos filed as exhibits this week revealed that bank executives were concerned about the financial institution’s relationship with Epstein dating back to 2006.

In October 2006, the bank’s rapid response team issued a memo, saying Epstein had banking, asset and credit accounts with balances that amounted to $32 million.

The memo also said cash withdrawals were “routinely” made in sums of $40,000 to $80,000 multiple times a month, totaling “over $750,000 year to date,” according to the document.

The memo said, “after internal discussions with Jes Staley, Mary Erdoes, Catherine Keating, John Duffy and Mary Casey, it was decided that we will keep Mr. Epstein solely as a banking client and on a ‘reactive’, client service basis,” and “we will not proactively solicit new investment business from him.”

A month later, Ann Borowiec, a JPMorgan Chase executive, emailed Staley with the subject line: “Epstein-please call me.” In the email, Borowiec said she had “concerns on risk mgt with this client” and “we have a bad track record internally on risk … as you know.”

“Is Jeffrey going to stay involved here? How are we managing risk here? Please call,” Borowiec asked Staley in the email.

In 2013, two bank directors emailed about the private bank risk unit, referring Epstein in 2008 to its anti-money laundering program because of “excessive cash activity” and media reports alleging his connection to sex trafficking. Epstein was “marked” as “high risk” at the time.

In another email exchange from 2011 indicates that the bank kept Epstein as a client “due to Jes’s personal relationship” with him despite other bank directors not being in “favor of having retained him as a client.”

One director in the same email correspondence said they also looked into one of Epstein’s assistant’s transactions that included “lots of salon, lingerie shops, drug stores ny palm beach and in st thomas (his places of residence). Plus lots of video like girls gone wild.”

Source: | This article originally belongs to Nbcnews.com