Inflation concerns have been rising in the US and across Europe since President Biden’s latest stimulus package.

Could this start a flight back to gold and other commodities?

The money supply is expanding, and the oil price is rising; this points to an inflationary environment. While financial markets hate inflation, safe-haven assets such as gold typically do well.

For hundreds of years, precious metals such as gold and silver have been the world’s best inflation hedges. However, they now face competition from bitcoin and other cryptos, not to mention a variety of regulatory stumbling blocks

The US financial markets are in upheaval due to US stimulus, a meme stock frenzy, and an unprecedented increase in derivatives trading.

All this complicates forecasting and makes the future uncertain. Many analysts believe the dizzying surge that began in 2020 is unlikely to continue through 2022.

We have recently had the unusual (difficult to explain) condition of stocks and bonds rising together.

One is no longer a hedge against the other. As a result, there is good reason to expect that demand for gold bullion will continue to grow.

Investors seeking diversification away from stocks and bonds are increasingly re-evaluating gold.

Does gold preserve wealth?

The US abandoned the gold standard in 1971 when the dollar lost its gold backing.

Even though gold no longer serves as the reserve currency of the US (or any other country), it has significance in contemporary society. It remains critical to the world economy.

There is no need to look further than central banks’ balance sheets and other financial institutions, such as the International Monetary Fund, to demonstrate this.

These organisations control nearly one-fifth of the world’s above-ground gold reserves. Additionally, some central banks have increased their current gold stockpiles in recent years, indicating anxiety about the global economy’s long-term prospects. Central banks believe in gold.

Gold’s importance in the modern economy stems from its ability to preserve wealth successfully across thousands of generations.

The same cannot be said of paper currencies. Consider the following example to put things into perspective:

Early in the 1970s, one ounce of gold was worth $35.

Assume you had the option of holding an ounce of gold or merely keeping the $35 in crisp dollar bills at that moment.

They would both purchase the same items for you, such as a new suit or a good bicycle. However, if you had an ounce of gold today and converted it to today’s prices, it would still be sufficient to purchase a brand new suit or bicycle but not for the original $35.

In short, you would have lost a significant portion of your wealth if you had held the $35 in notes rather than the one ounce of gold. The value of gold has climbed while the value of the dollar has deteriorated due to inflation.

The $35 in notes is not what it was, but $35 of gold bought then is worth much more.

Is gold a buy?

Gold has long been seen as a prudent investment to include in a diversified portfolio. It has some of the highest liquidity levels in the commodities markets and frequently appreciates over time, but this rise may take some time.

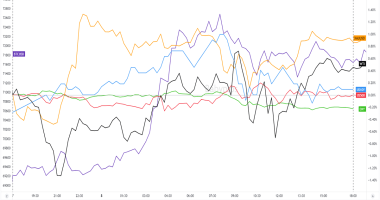

Since the COVID-19 epidemic began, the price of gold has increased significantly, further establishing its utility as a hedge against the S&P 500.

In 2020, when the stock markets fell, gold reached new highs not seen since 2012, with many analysts forecasting additional increases in the following months and years. It has its moments.

During periods of financial uncertainty, investors view gold as a safe-haven and can be a valuable tool for diversifying portfolios and reducing risk exposure. However, as with any investment, there is no certainty of profit and capital can be lost.

Is gold a sell?

Gold’s price can change considerably, down as well as up, over a short period and can take an extended amount of time to rise and make new highs.

Significant falls can be difficult for investors to deal with, and many investors lose confidence in those times. Investing in gold should be for the long haul.

Another thing to consider is competition from cryptocurrencies. Cryptocurrencies such as Bitcoin are growing in popularity among investors, with many abandoning gold in favour of modern, digital commodities.

Bitcoin is sometimes called digital gold. As interest in cryptocurrency continues to expand, confidence and sentiment in precious metals such as gold and silver would erode, potentially resulting in years of depressed pricing.

Gold is a long-term investment; cryptocurrencies may provide more immediate returns, are more suited as a trading vehicle, and aid portfolio diversification.

As more is learned about them and they gain wider acceptance as an investment choice, cryptocurrency may be dubbed the next investment safe-haven, a title previously held by gold.

Should I invest in gold?

As with other investments, investing in gold carries risks. While its price has historically increased, this does not ensure it will continue to do so in the future.

Indeed there have been long periods of underperformance and price falls. It is critical to recognise the risks involved.

If you are searching for short-term gains, gold may not be the best investment. However, if you are looking for a long-term investment and want to diversify your portfolio, gold may be worth considering.