A lack of data releases didn’t stop the major assets from seeing volatility!

Gold hit new record highs and crude oil prices resumed their climb despite some easing in the Middle East tensions. Another jump in U.S. bond yields also pushed USD/JPY deeper into intervention territory and bitcoin (BTC/USD) revisited its highs near 72,500.

Here’s what you missed from yesterday’s trading:

Headlines:

- Japan Average Cash Earnings for February: 1.8% y/y (1.4% y/y forecast; 2.0% y/y previous)

- Japan Current Account Surplus for February: ¥2.64T (¥2.61T forecast; ¥438B previous)

- Japan Eco Watchers Survey for March: 49.8 (51.5 forecast; 51.3 previous)

- Switzerland Unemployment Rate for March: 2.4% (2.6% forecast; 2.4% previous)

- Euro Area Sentix Investor Confidence Index for April: -5.9 vs. -10.5 previous

- Germany manufacturing production for February: 2.1% m/m (0.3% m/m forecast; 1.3% m/m previous)

- Germany foreign trade balance for February: €21.4B (€25.1B forecast; €27.5B previous)

- In a speech, SNB Chairman Thomas Jordan says the central bank sees no need for a central bank digital currency (CBDC)

- NZIER’s business confidence index dropped from -2 to -25 in Q1 2024 and noted that “Weaker demand and uncertainty over the new Government’s plans for spending and cutbacks” contribute to businesses’ caution towards hiring and investment

- U.K.’s BRC retail sales monitor accelerated from 1.0% y/y to 3.2% y/y in March thanks in part to Easter-related purchases

- Australia’s Westpac consumer sentiment worsened from -1.8% to -2.4% in April as consumers continued to worry about inflation, high interest rates, and slowing economic growth

- Australia’s NAB business confidence ticked slightly higher from 0 to 1 in March as price pressures eased

Broad Market Price Action:

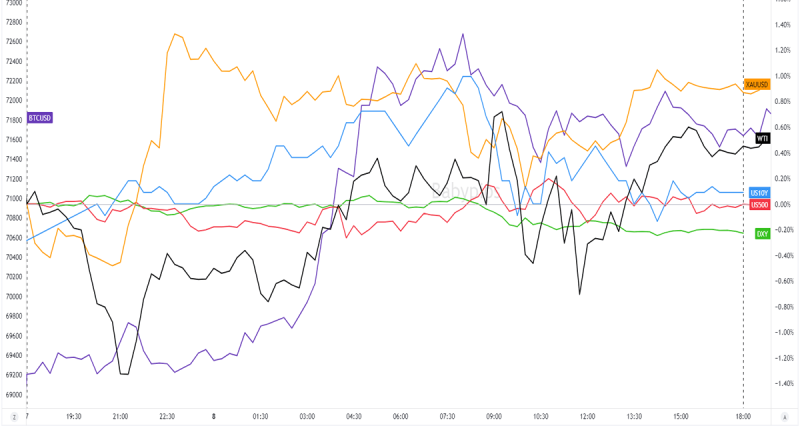

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

No top-tier data releases? No problem!

Gold and crude oil prices started the week strong as they mostly shrugged off talks of a potential cease-fire in Gaza ahead of the Eid al-Fitr holiday.

Meanwhile, U.S. Treasury yields inched higher as more traders priced in the Fed possibly cutting its interest rates by less than three times this year following Friday’s strong U.S. jobs data release.

The major assets eventually pulled back most of their Asian session moves by the London and U.S. sessions. However, bitcoin, spot gold, and crude oil prices saw another push higher near the end of the U.S. session possibly on overall USD weakness.

FX Market Behavior: U.S. Dollar vs. Majors

Unlike U.S. bond yield traders, USD players mostly shrugged off Friday’s strong NFP data.

One possible reason is that the Fed’s hawkishness may be priced in for now but some USD traders may also be taking profits ahead of this week’s U.S. CPI reports.

USD saw intraday downtrends against “riskier” bets like EUR, GBP, AUD, CAD, and NZD but also tempered its losses against fellow safe havens like CHF and JPY. USD-selling even picked up at the start of the U.S. session and the Greenback made and ended the day near new intraday lows.

The dollar ended the day lower across the board except against CHF. The Swiss franc may have gained from some risk aversion while JPY saw limited losses as USD/JPY made new three-decade highs that upped the odds of a currency intervention.

Upcoming Potential Catalysts on the Economic Calendar:

- Japan’s preliminary machine tool orders at 6:00 am GMT

- France’s trade balance at 6:45 am GMT

- Japan’s PPI reports at 11:50 pm GMT

- RBNZ’s monetary policy decision at 2:00 am GMT (April 10)

We have another relatively light data calendar today, which could keep traders’ focus on existing broader market trends.

The Reserve Bank of New Zealand (RBNZ) may make things more interesting for FX traders in the early Asian session. The central bank is expected to keep its policies steady in April but RBNZ folks have been known to surprise the markets before. Keep your eyes glued to the tube in case we get another surprise decision!

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!