Walking around the market town of Haslemere in Surrey, you soon get the impression that prosperity is much to the fore. The town, which bills itself as the gateway to the Surrey Hills and South Downs, is a kaleidoscope of local shops, big brand stores, restaurants and pubs.

Empty units are few and far between. There is a real cafe society feel to the high street with Hemingways of Haslemere doing a roaring trade in smashed avocado on toast with a twist of chilli and a dollop of mango chutney on top. The Christmas market, I am told, is a sight to behold.

Crime does not seem an issue in Haslemere, although a plaque on the town council building in memory of Police Inspector William Donaldson (murdered in 1855) suggests it was not always thus.

Yet the more you walk its high street, the more you realise that something is not quite right. For all its wealth and vibrancy, for all its upmarket Space NK and Aga stores, Haslemere’s high street does not have a bank, post office or cash machine.

As most residents and retailers will tell you with little prompting – and they did so last Tuesday – it’s an outrage, an absolute outrage. It defies logic. If Haslemere, the embodiment of conservative Middle England, can no longer support a bank, it begs the question: ‘Where can?’

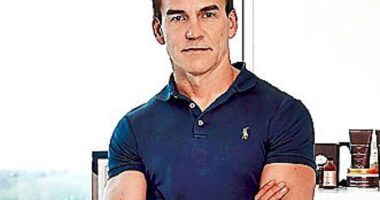

On his watch: Chancellor Jeremy Hunt with wife Lucia Guo, has failed to stop the exodus of banks in Haslemere – part of his own constituency in Surrey

All rather annoying – and embarrassing – I imagine for MP Jeremy Hunt, Chancellor of the Exchequer, whose South West Surrey constituency encompasses Haslemere.

In recent months, he has locked swords with the banks over poor saving rates and has had his say on debanking in the wake of NatWest’s decision to close Nigel Farage’s Coutts account.

He has also overseen new Treasury rules designed to ensure that the vast majority of consumers and small businesses will have ready access to cash services. Yet they will not stop banks shutting branches in towns like Haslemere.

Today, both the old HSBC and Lloyds branches lie empty, scarring the town’s main thoroughfares. Someone has scrawled ‘No nukes’ on the HSBC building, which has been empty for six years and is up for sale. ‘No bank’ would have been more appropriate.

Lloyds was the last bank to shut up shop in November 2021 and its premises now look rather forlorn.

Although the NatWest branch has gone, at least the premises have been converted into a fine Indian cuisine restaurant (Dilli) that since opening last month has received some rave reviews.

The old Barclays branch, which shut eight years ago, has been home to Mediterranean fusion restaurant Moma since 2021.

Even the town’s post office and its cash machine have disappeared – they went in May – although there is a post office on the other side of the town beyond the railway station – a good 20-minute walk away.

As a result, there are now no cash machines on Haslemere’s main high street – as well as no bank branches. But there are cash machines at a nearby Tesco store and petrol station.

The NoteMachine ATM at the train station was not working last week – dead as a doornail. Not an unusual occurrence, according to locals.

Understandably, the desertion of the town by the big banks has gone down badly with locals – residents and small business owners.

‘It’s not good enough,’ says Nicky Raynor, 59, a retired teaching assistant. ‘If Haslemere isn’t deserving of a bank, I can’t see how any town is.

‘Before Lloyds pulled the plug on its branch, there would often be a queue of people waiting for it to open in the morning. That’s a fact as my 92-year-old dad Dennis would often be among them.’

Sarah Patrick, manager of charity shop The Tantum Trust, doesn’t hold back either. She says: ‘Every town deserves a bank.

‘They are part of the engine that drives communities like Haslemere forwards. Take them out of the equation and communities start to malfunction.’

Emily Adsett, manager of the Haslemere Bookshop – awash with hardbacks, best-sellers and a floor devoted to second-hand books – says it is crazy that the town is without a bank or post office. She says: ‘Banking cash is now a big inconvenience. It involves a trip to the post office at Wey Hill, just short of a mile away.

‘That means one of us out of the shop for a while when we should be concentrating our efforts on our trade – serving customers.’

It’s not all calamitous news on the banking front. A new-style banking hub, providing a one-stop shop for customers of all the big banks, could be open before the year is out. It was promised late last year, but so far hasn’t come to fruition.

‘The delay in opening the hub is driving me and my members nuts,’ says Craig McGowan, president of the Haslemere & District Chamber of Trade & Commerce. ‘Many of the businesses we represent need to deposit cash takings, while the town’s main high street desperately needs an ATM that shoppers, especially the elderly, can use to withdraw cash. We feel as if we are being shunned by the big banks.’

Such hubs – also known as shared branches – can only be introduced in towns after the last bank (Nationwide Building Society included) has pulled out.

They are paid for by the banks and Nationwide, and run by the Post Office. They allow bank customers – business and personal – to carry out basic banking services such as depositing and withdrawing cash.

But staff from the major banks are also available on specific days to help customers with more complicated financial matters.

So far, seven hubs have got off the ground nationwide, although 73 are scheduled to come on stream over the coming months (see right).

They include four hubs announced last week: in Dartmouth, Devon; Great Harwood, Lancashire; and Ramsbottom and Westhoughton, both in Greater Manchester.

The Haslemere hub was first requested by the town council. It was then given the green light by the cash machine network Link which – with parameters laid down by the banks – decides which towns merit them.

However, Cash Access UK, the organisation that was set up to oversee the physical installation of hubs, struggled to nail down suitable premises.

Following my visit, I was told that the hub would now be located in the empty Lloyds branch, maybe with an outside cash machine.

Why the delay, nobody knows. But it could be up and running by the end of the year.

The only sign of progress at the premises last week was a notice from Waverley Borough Council alerting passers-by to an application for two flats on the former bank’s first and second floors.

Peter Jones, who owns the Sports Locker shop within a short sprint of the former Lloyds branch, says that the hub would be ‘great news’ for his business and others like it. Yet he still doesn’t understand why all the banks have fled such an affluent town.

He says: ‘There are lots of elderly people here who welcome the personal service a bank branch offers.

‘Surely, one bank could have seen that as an opportunity to grow their customer base. Sadly that didn’t happen, but maybe locals will come to love the hub.’

Last week, I sought a comment from Hunt on the withdrawal of the banks from Haslemere – and the proposed hub.

Eventually, after I left a voice message at his constituency office in Hindhead, Hunt said: ‘I have been pushing for a bank of some sort for Haslemere for many months.

‘I am pleased a new banking hub is progressing well and on track to open by the end of the year.’

Maybe Mr Hunt could use its launch to remind the banks of their responsibilities to all our communities and all our high streets.

#bcaTable .footerText {font-size:10px; margin:10px 10px 10px 10px;}