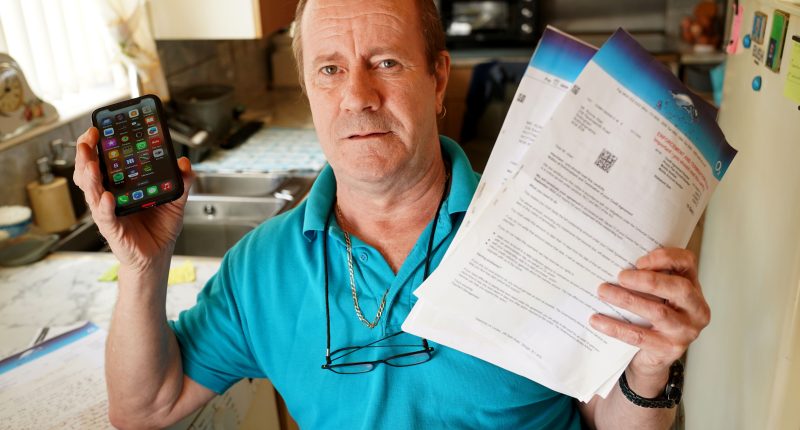

RETIRED electrician Ron Allan was delighted when he got a call from O2 offering to cut his mobile tariff from £17 to £10 a month.

It would shave £84 off his annual costs at a time when lots of his other bills were soaring.

But the 61-year-old from Nottingham grew suspicious when the caller kept probing for personal details and eventually hung up.

But little did he know that he had already revealed just enough for the scammer to steal his identity and take out an expensive iPhone contract in his name.

A month later, in September, Ron received a letter from O2 demanding he pay £1,022 within 14 days or his case would be passed to a debt collector.

“I was terrified there would be bailiffs knocking at the door,” he says.

READ MORE ON MOBILE PHONES

Ron is one of hundreds of thousands of customers targeted by identity thieves each year — with more than 277,000 cases reported last year alone, according to crime prevention body Cifas.

It says this type of fraud reached “unprecedented levels” in 2022 and that crooks are increasingly going after mobile users as well as bank customers.

Victims sometimes struggle to prove that they weren’t responsible for taking out mobile contracts or loans.

Plus their credit score is likely to take a hit as monthly repayments won’t be made by the fraudster and this will leave a mark on the victim’s file.

Most read in Money

Ron says: “I went round and round in circles with O2 trying to get this sorted but they weren’t interested, they just passed me from one person to another.”

‘I was crying from sheer frustration’

Post-grad student Chris Michael had a similar battle on his hands when a bill dropped on his doorstep from O2 demanding £2,570 for two smartphones he had never ordered.

Stunned Chris, 27, reported it straight away as he has never had a contract with O2, but like Ron he couldn’t get anyone to put things right.

O2 staff couldn’t tell him what had happened because he did not know the security details for the account since it had been opened by fraudsters.

Chris, who studies management, says: “I didn’t have the money to repay the debt and I was so worried — I thought my credit score would plummet.

“At one point I was crying out of sheer frustration and the stress of the situation — I couldn’t see a way of getting it resolved as no one was listening.

“I ended up closing down my bank accounts and reopening them because I was scared they’d keep finding ways to take my cash or borrow — I didn’t know where it would end.”

Since then Chris has also had a Virgin Media broadband installer show up at his home address, which he believes might be linked to the fraud as it is now part of the same business as O2.

But he says the case handler assigned to him by O2 said they couldn’t transfer him directly to Virgin’s fraud department.

Instead, he’d have to redial, and feared that once again he’d have to face security questions he couldn’t answer just to find out if crooks had set up an account in his name.

Some experts warn that telecoms firms are not doing enough to prevent this type of fraud and that their ID checks are much weaker than banks and lenders.

Jake Moore, an expert at cyber security firm ESET, says: “Taking out a phone contract is designed to be as quick and easy as possible, which often means it’s less secure.

“Without extra ID checks, telecoms firms are making their customers more vulnerable to scammers.”

Mobile UK, the trade body that represents phone firms, says telecom firms are part of a task force working with the Home Office to protect customers and added: “Our members use detailed ID and credit checks and behaviour analysis tools to block suspected fraud.”

Criminals can piece together information about you from what they find on the internet, from stealing documents from your bins or post from communal hallways to hacking into email accounts.

Others like the scammer who phoned Ron will use a clever ruse to get victims to over-share.

Mr Moore says: “Be extremely wary of what personal information you share on email or on social media.

“Never trust that a cold caller is who they say they are as criminals can make calls and texts appear to come from your bank or other firms.

“Hang up and call that company back using the number from your bills and key the digits in yourself to ensure that it’s not a scammer.”

O2 confirmed Ron and Chris’s accounts had been opened fraudulently and have now been closed.

It believes that Ron must have shared a code at some point with the fraudster to allow this to happen.

In Chris’s case, O2 says the crooks had significant personal details including a bank card.

Read More on The Sun

The firm says it would never call and ask for personal details or one-time pass codes over the phone.

An O2 spokesperson said: “We’re doing everything we can to stop fraudulent activity.”

What to do if you’re a victim

IF you think someone has stolen your identity, phone your bank and mobile firm to check for anything suspicious and to make sure your money is safe.

Change your passwords on bank and utility accounts and consider ordering new cards.

Report what happened to Action Fraud and get a crime reference number so that there is a record of what happened.

Check your credit reports by signing up free to ClearScore, Credit Karma and MoneySavingExpert. com’s Credit Club.

Look out for any credit searches or applications you don’t recognise.

Sarah Coles, personal finance expert at Hargreaves Lansdown, says: “If it shows loans or mobile accounts have been taken out in your name, contact the credit agency and explain.

“Once confirmed as fraud, the lender will take it off your report.

“Providing a crime reference number helps to show it wasn’t you who took them out.”

You can ask credit agencies to add a note to your file while any fraudulent accounts are still being investigated.

You can also get a password added which lenders will ask for if anyone tries to apply for more credit in your name.

To do this you’ll need to contact Experian, Transunion or Equifax directly, not via other websites.