A MARTIN Lewis fan has revealed how the expert’s handy tip helped him wipe a £4,000 council tax bill.

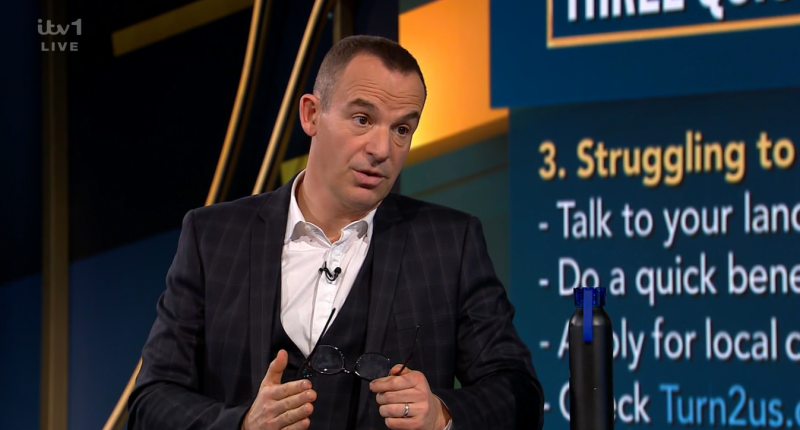

During the latest Martin Lewis Money Show a viewer named only as John shared how he cleared his mum’s bill and she won’t have to pay it again.

John’s wife had tuned into Martin’s Bill Buster special episode last week and listened as he revealed that those with severe mental impairment (SMI) can get a discount on their council tax payments.

The “severely mentally impaired” (SMI) council tax discount is a a mnimum of 25% reduction of a household’s council tax bill.

A person is considered as being severely mentally impaired if they have a severe impairment of intelligence and social functioning, which appears to be permanent.

This can include people suffering from Alzheimer’s disease, Parkinson’s, a stroke and similar illnesses.

READ MORE IN MONEY

Due to the huge number of illnesses or impairments that could qualify, it’s thought that hundreds of thousands are missing out on SMI.

An SMI discount can go all the way up to, in some cases, the entire bill being wiped.

And that’s what happened to John’s mum.

Writing on X, formerly known as Twitter, he said: “Got over £4,000 back for my mum’s council tax because of severe mental impairment and no more council tax from now on.”

Most read in Money

He then thanked Martin for the advice.

According to the consumer champion, SMI discounts is “the one that’s not known about enough”.

He also urged households to check online to see if they may qualify but did urge that discounts may differ from council to council.

Also, the condition must have been diagnosed by a doctor.

He said: “But councils don’t always know about it, council staff.

“So you need to know about it.”

When it comes to SMI discounts, the size depends on who you live with.

Council tax is discounted based on how many qualifying adults live in a house.

Having SMI means you don’t count as a qualifying adult – similar to full-time students and those under 18.

If you have SMI the following applies to you depending on your living situation:

- SMI living alone – house gets 100% council tax discount

- SMI living with an adult carer – 50% council tax discount

- SMI living with one qualifying adult – single person reduction 25% discount

- SMI living with two or more qualifying adults – no discount

It’s important to note that if there are under-18s, full-time students or others with SMI in the house as well, they don’t change the situation.

That’s because they don’t count towards council tax either – so a house where someone with an SMI lives with an under-18 still gets the 100% discount.

Other council tax discounts

If you don’t qualify for the SMI discount, you may for similar reductions instead.

If you are living alone you can get 25% off your council tax bill.

The same applies if there is one adult and one student living together in a property, or if there is one adult and one person classed as severely mentally impaired in the home.

You could be entitled to a larger reduction of up to 50% if you live with someone who doesn’t have to pay council tax, such as a carer or someone who is severely mentally impaired.

And, if you live in an all-student household, you could get a 100% discount.

A full list of circumstances that exempt you from paying council tax can be found on Citizens Advice.

Pensioners may also find themselves eligible for a council tax reduction.

If you receive the Guarantee Credit element of Pension Credit, you could get a 100% discount.

If not, you could still get help if you have a low income and less than £16,000 in savings.

And a pensioner who lives alone will be entitled to a 25% discount too.

If you are on a low income or receiving benefits, you could be eligible for some help towards your council tax.

Whether you are eligible will vary depending on where you live.

And if you find yourself struggling to pay your bill, you may also be able to get a deferral or speak to your council about setting up a payment plan to manage the cost.

But one thing to remember is if you are struggling you should contact your council as early as you can.

How to apply for a reduction

You can apply for a reduction through the Government website.

You’ll need to have your national insurance number, bank statements, a recent payslip or letter from the Jobcentre, and a passport or driving licence to hand.

If there are other adults in the household, you might need the same information for them too.

You can check what council tax bracket your home falls in by entering your postcode on the government website.

Check which local authority you live in to find out how much your council changes for each band, as it varies.

You could also potentially get your house re-banded if you think you’re overpaying on council tax.

To do this, you’ll need to check which band your neighbours are in and work out how much your property was worth in 1991, as this is when council tax bands were decided.

MoneySavingExpert has a free calculator tool to help you do this.

Be warned though – applications are not always successful, and you could even end up being moved to a HIGHER band and paying more.

READ MORE SUN STORIES

A savvy mum revealed how she bagged herself a £600 refund on her council tax.

In the coming months many households will see an increase in their council tax bills, we put together a list of increases with some tips on how to manage to keep your costs down.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories.