The federal tax code contains a loophole so big that in the time you spend reading this article, it will have saved wealthy families and their heirs an average of about $400,000. Over the course of a day, the average total savings is more than $100 million.

Families without sizable estates may be unfamiliar with the provision, but it’s been on the books for more than 90 years and has helped the wealthy pass on billions in dollars to their descendents tax-free.

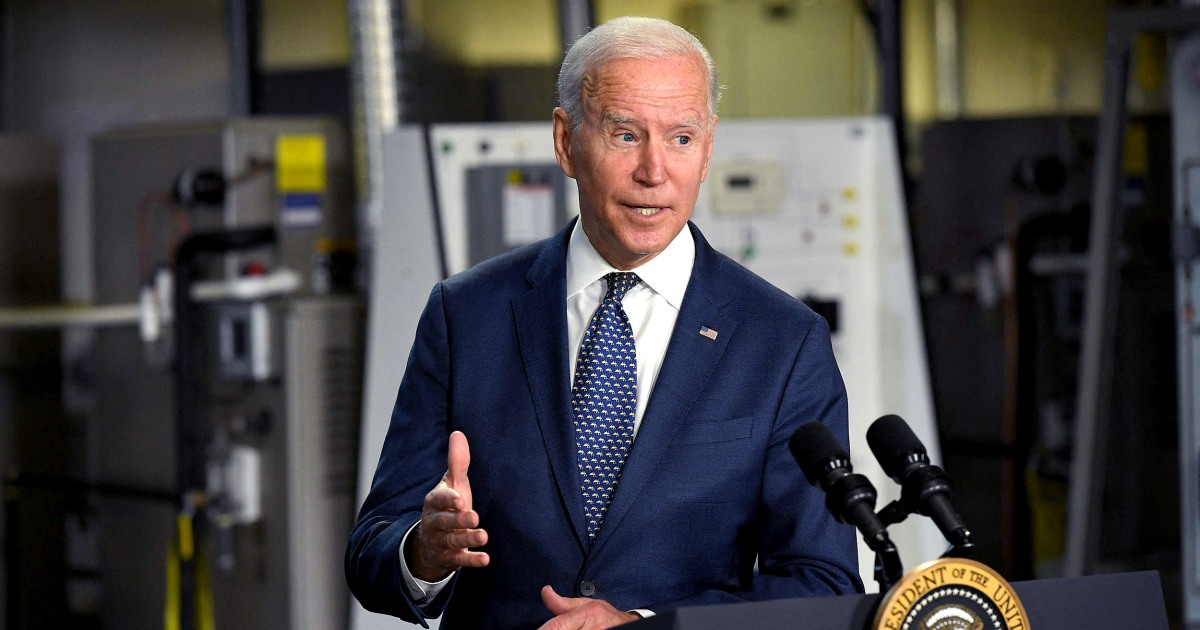

It’s known as the stepped-up basis rule, or, as President Joe Biden called it this month, the “trust fund loophole,” and Biden’s American Families Plan aims to put an end to it for many people who inherit big estates.

Biden, who advocated removing the provision while on the campaign trail, continued attacking it this month in an address he made in support of his plan.

“We need to make a choice to eliminate the loophole,” Biden said. “[If] a person passes away and leaves stock to their son or daughter, [they] don’t have to pay anything on that multimillion-dollar gain when they sell that stock.”

Biden would use the money as one source of funding for his plan, which proposes nationwide preschools, free community college, a national paid-leave program and an extension of tax cuts for low- and middle-income Americans.

Biden’s plans to increase taxes on the wealthy have been met with mixed reactions.

Rep. Kevin Brady of Texas, the highest-ranking Republican on the House Ways and Means Committee, likened eliminating the stepped-up basis to a “middle-class death tax” and said the proposal punishes family-owned farms and businesses.

“It discourages family-owned businesses from investing their money back into their business or farm,” Brady said.

However, the U.S. Senate publishes a yearly report that includes an estimate of the impact of the stepped-up basis on Americans, and according to that report the top earners benefit the most from this part of the tax code.

Brady said the proposal would also cost upward of 80,000 jobs a year for the next decade, citing a report from the Family Business Estate Tax Coalition, a collection of trade associations representing a variety of industries.

Estates of more than $11.7 million do not benefit from the stepped-up basis and are subject to the estate tax, which taxes about 40 percent of an estate’s worth. The tax used to start at $5.6 million, but the Trump administration doubled the threshold at the end of 2017, opening the door for many affluent families to escape it. Now, fewer than 2,000 estates are potentially subject to the estate tax, according to a memo from the Congressional Joint Committee on Taxation.

The stepped-up basis provision is a benefit for heirs of estates smaller than $11.7 million. Normally, the heir to a house or a stock portfolio would have to pay a capital gains tax on the amount those assets increased in value since they were first purchased. But under the stepped-up basis provision, the increase in value is not taxed upon the death of the original owner. The moment the asset switches hands to a new generation, the appreciated value is permanently forgiven by the government.

By government estimates, the stepped-up basis provision left more than $40 billion of potential tax dollars in the pockets of wealthy heirs in 2020 alone, a figure that has steadily climbed since 2017. Five-year estimates show no sign of a reduction in that number.

Source: | This article originally belongs to Nbcnews.com